EU Transfers Crypto Oversight to European Authority

- EU shifts crypto regulation oversight to ESMA.

- Centralized regulation for improved market integrity.

- Impact on exchanges and service providers expected.

The European Union plans to shift crypto regulation oversight to the European Securities and Markets Authority (ESMA). This move builds on the existing Markets in Crypto-Assets Regulation (MiCA), centralizing supervision and enhancing market integrity.

The move centralizes crypto regulation within the European Union, aiming for heightened market oversight and consistency. Market participants are likely to respond to more unified regulatory requirements across member states.

The EU’s decision to transfer oversight to ESMA falls within the framework established by the Markets in Crypto-Assets Regulation (MiCA) . ESMA will now play an enhanced role in the supervision of crypto markets, coordinating efforts with the European Commission and national regulators.

ESMA’s new role will involve supervision of large cross-border exchanges and setting market integrity standards. Transparency, disclosure, and market abuse prevention are expected to be focal points. This move follows global trends of centralizing crypto regulations under one primary authority.

Key market players will need to adjust to ESMA’s standards , potentially affecting highly traded cryptocurrencies like BTC and ETH. The enforcement of market integrity standards suggests potential shifts in liquidity and trading practices.

Given ESMA’s expertise in financial market regulation, this shift is poised to enhance transparency and bolster investor protection.

Historically, the MiCA framework indicated some supervisory responsibilities for ESMA, but assigning direct oversight to ESMA clarifies the EU’s strategic approach to crypto markets. With ESMA’s experience in financial market regulation, transparency and investor protection are anticipated benefits.

The long-term effects may see a more cohesive regulatory environment for crypto within the EU, influencing global standards and practices. This realignment aims to bolster market confidence and protect investors through comprehensive oversight and regulatory clarity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

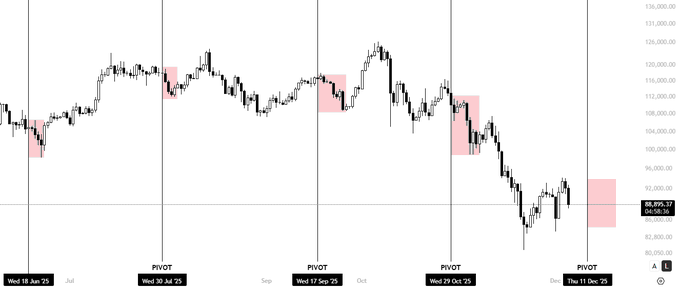

Bitcoin Leverage Liquidations and Systemic Risks in Cryptocurrency Markets: Analyzing the Causes and Impacts of 2025 Market Turbulence

- 2025 Bitcoin's November crash erased $800B in value as high-leverage liquidations amplified volatility, exposing systemic risks in crypto markets. - Trump's proposed China tariffs and synthetic stablecoin de-pegging triggered cascading liquidations, with $19B wiped in one day during October's crisis. - 392,000 traders lost $960M in 24 hours as fragmented order books and concentrated ownership worsened liquidity crunches during November's collapse. - Regulators highlight 11/28 jurisdictions with finalized

Why Bitcoin Price Is Down Today: The Unexpected Market Move No One Saw Coming

Crypto Market Panic Grows as Fear Index Hits Extreme Lows, Is Bitcoin Entering a Bear Market?

Algorand (ALGO) Gains 1.76% Over the Past Week Despite Market Fluctuations

- Algorand (ALGO) rose 1.76% weekly to $0.1326 but fell 60.33% annually amid broader crypto market declines. - ApeX Protocol's Dec 12 delisting of BABY/HOME tokens risks liquidity shocks, indirectly affecting ALGO market sentiment. - Other fintech/entertainment events had no direct impact on ALGO's price or trading dynamics. - Analysts highlight ALGO's long-term potential in DeFi despite bearish 1-month/1-year trends and macroeconomic uncertainties.