eSIM usage is increasing due to its compatibility with devices and the convenience it offers travelers

The Evolution and Uptake of eSIM Technology

Although eSIM technology has existed for about ten years, its global usage remains relatively low, with adoption rates just surpassing 5% this year from around 3% the previous year.

Despite these modest numbers, industry experts, startups specializing in eSIM, and investors remain optimistic about its future, especially due to its growing relevance in travel.

Expanding Device Support

A major driver behind eSIM’s gradual rise is the increasing number of smartphones equipped with eSIM functionality.

The earliest smartphones to feature eSIM, such as the Pixel 2 and iPhone XR, debuted in 2017 and 2018. Apple made a significant move in 2022 by eliminating the physical SIM slot for its U.S. iPhones, opting for eSIM-only models, and Google followed with the Pixel 10 this year.

In 2024, Apple introduced the eSIM-only iPhone Air and expanded eSIM-only options for the iPhone 17 series to over 11 countries. These models offer a slight boost in battery life compared to their physical SIM counterparts.

According to Counterpoint, only 23% of smartphones shipped in 2024 supported eSIM, with the U.S. leading at 41% of new devices featuring this capability.

Historically, eSIM was limited to flagship devices, but this is changing. GSMA reports that over 60 new eSIM-enabled smartphones were launched in just the first half of 2025.

China is poised to play a pivotal role in eSIM’s expansion. Following the release of Apple’s eSIM-only phone and some initial challenges, Chinese telecom operators began supporting eSIM in October. GSMA analyst Pablo Iacopino anticipates that domestic brands like Huawei, Xiaomi, Oppo, and Vivo will increasingly release devices with native eSIM support.

These manufacturers dominate price-sensitive markets in Asia and Africa, and are expected to gradually introduce eSIM across various price segments to meet local demand.

Iacopino predicts that as Chinese mobile operators roll out eSIM services, local brands will likely expand eSIM support to mid-range and budget smartphones, initially offering both physical SIM and eSIM options before transitioning to eSIM-only models.

Currently, even among devices that support eSIM, user activation remains low but is on the rise. Steffen Sorrell of Kaleido Intelligence notes that eSIM activation reached 30% in 2024, with projections climbing to 75% by 2030.

Travel: A Key Driver for eSIM Growth

For travelers, eSIM offers a seamless way to stay connected abroad. GSMA’s research indicates that 51% of eSIM users rely on it for travel, and its integration with secure hardware makes it a safer option.

This trend has fueled growth for startups like Airalo, Holafly, eSIM.me, Nomad, and Truely. Even Nord, a Lithuanian security company, launched its own eSIM service, Saily. These companies have seen their user bases expand, largely due to the travel sector.

GSMA highlights that frequent travelers are increasingly choosing devices with eSIM support, and many continue using eSIM after their trips.

According to Iacopino, many people try eSIM for the first time while traveling and, if satisfied, request their home carriers to switch them from physical SIMs to eSIMs.

Airalo, a leading eSIM provider, has been active for over six years. CEO Bahadir Ozdemir shared that 85% of respondents in a recent app survey were first-time eSIM users.

Ozdemir estimates that eSIMs now account for about 15% of travel connectivity, and this share is increasing as users prefer the convenience over traditional SIM cards.

He also noted that while many telecom operators offer eSIMs, discovering and activating them can be challenging, which is where apps like Airalo simplify the process. Network providers are also targeting travelers, as seen with Vodafone’s partnership with UEFA to offer special eSIMs for football fans attending matches across Europe.

Investor Momentum and Market Expansion

Startups focused on travel-related eSIM services have experienced rapid growth. Truely, for example, has served over 70,000 travelers in two years and doubled its orders this year. The company, which secured a $2 million funding extension in June, is also exploring partnerships with fintech and travel platforms, as well as government collaborations.

NordVPN’s Saily app reached over a million users within months of its March 2024 launch, and the company introduced a $60/month Ultra plan with worldwide coverage.

Holafly has sold more than 15 million eSIMs since 2018, generating over $500 million in revenue, with $200 million earned in 2024 alone.

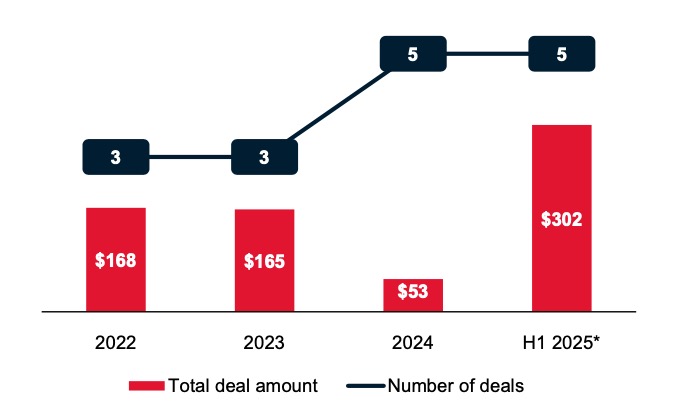

Airalo’s $220 million funding round, led by CVC in July, made it a unicorn and marked the largest eSIM investment in recent years. French startup Kolet also raised $10 million in Series A funding, attracting notable investors from Expedia and Apple.

Scott Shiao of Goodwater Capital believes that, for now, investment will focus on travel-oriented eSIM startups, but domestic opportunities may emerge in the future.

Martell Hardenberg of Antler points out that while travel eSIM adoption is growing, most users are still early adopters, leaving significant room for expansion.

Hardenberg suggests that bundling additional services for global travelers and digital nomads could create more attractive offerings beyond just travel SIM cards.

Sorrell from Kaleido Intelligence predicts that as the market matures, investors will prioritize long-term sustainability, customer loyalty, coverage quality, and marketing partnerships, anticipating eventual market consolidation.

Barriers to Widespread Adoption

Several challenges hinder broader eSIM adoption, including lack of awareness, trust, and user-friendliness. Many consumers are still unfamiliar with eSIM technology.

Ozdemir from Airalo compares the situation to established brands like Spotify or Netflix, which can easily promote their apps because people already understand music and TV streaming, whereas eSIM still requires significant consumer education.

To address this, Airalo collaborates with influencers to raise awareness about eSIM connectivity and direct users to their platform.

Truely CEO Eric Dadoun believes that as more devices become eSIM-only, consumers will inevitably learn about the technology. However, companies in the sector must continue educating users, especially in markets where eSIM-only devices are not yet the norm.

One practical hurdle is the activation process: users typically receive a QR code via email to install their eSIM, which often requires a second device to display the code. This can be inconvenient, particularly for travelers needing connectivity at airports.

Iacopino from GSMA acknowledges that this process can be cumbersome, and both eSIM providers and hardware manufacturers will need to streamline the user experience as adoption grows.

Sorrell from Kaleido Intelligence adds that some network operators are slow to adopt eSIM due to legacy systems, and a fully digital onboarding process is necessary to eliminate the need for in-store visits.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bloomberg: Power Theft Exceeds $1 Billion as Malaysia Bitcoin Mining Rigs Overwhelm

Malaysia has uncovered approximately 14,000 illegal cryptocurrency mining sites in the past five years, causing the state-owned power company losses of over $1.1 billion. In response, the local government established a special committee in November 2025 to consider a total ban on mining,

ProShares Withdraws 3x Leveraged Crypto and Tech ETF Plans After SEC Raises Concerns

PENGU Price Rally Explained: Is a Bigger Breakout on the Horizon?

SHIB Jumps 21% to $0.000009463: Analysts Eye Possible Zero Cut