COCA Announces 10% APY Holiday Boost on Stablecoins

December 2, 2025 — COCA, a leading stablecoin banking app, is introducing a special holiday promotion for its users. From December 5 to December 31, 2025, COCA Card holders can earn a 10% annual percentage yield (APY) on their stablecoin balances, an increase from the usual 6%. Promotion Details: 10% APY on All Supported Stablecoins

December 2, 2025 — COCA, a leading stablecoin banking app, is introducing a special holiday promotion for its users. From December 5 to December 31, 2025, COCA Card holders can earn a 10% annual percentage yield (APY) on their stablecoin balances, an increase from the usual 6%.

Promotion Details: 10% APY on All Supported Stablecoins

During the promotional period, the 10% APY applies to all stablecoins supported on the COCA Card, including:

- USDC

- USDT

- EURC

- EURS

Users may hold a single stablecoin or a combination, and all balances remain fully liquid. There are no lockups, staking requirements, or tier upgrades necessary.

Eligibility Requirements

To qualify for the holiday APY boost, users must meet the following conditions:

- Minimum Balance: Maintain a COCA Card balance of $500 or more in stablecoins throughout December.

- Transaction Activity: Complete at least five eligible card transactions during the month. Transactions can include online purchases, in-store spending, travel bookings, or subscriptions.

The APY boost is automatically applied once these requirements are met.

Payout and Timing

- The holiday APY boost is calculated based on the minimum December card balance.

- Payouts will be credited directly to the COCA Card by January 10, 2026.

- Users may receive the boost in USDC or EURC, and funds remain fully liquid, available for spending, swapping, withdrawal, or saving immediately.

Purpose and Benefits of the Promotion

This promotion underscores COCA’s mission to unlock real-world utility for stablecoins. Beyond the APY boost, COCA users benefit from:

- Up to 8% cashback on everyday purchases

- 50% cashback on Netflix, Spotify, ChatGPT, and Amazon Prime subscriptions

- Up to 50% off global hotel bookings

- Zero-fee swaps across 15+ blockchains

- A globally accepted Visa card used by over 1 million people

The holiday APY boost provides users with an additional opportunity to grow their stablecoins while retaining full control and liquidity.

Campaign Dates

- Start: December 5, 2025

- End: December 31, 2025

Why Stablecoin Yield Matters

Stablecoins are increasingly integrated into everyday spending. With COCA, users’ funds are not just stored; they can:

- Grow with passive income

- Power daily purchases

- Unlock cashback rewards

- Remain fully under user control through MPC self-custody

The December APY boost further enhances the financial utility of stablecoins.

About COCA

COCA is a digital platform designed to provide practical utility for stablecoins. The COCA Card allows users to earn yield, access cashback and discounts, and conduct zero-fee swaps across multiple blockchains. The platform is used by a growing global user base, supporting secure, liquid, and fully controlled digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

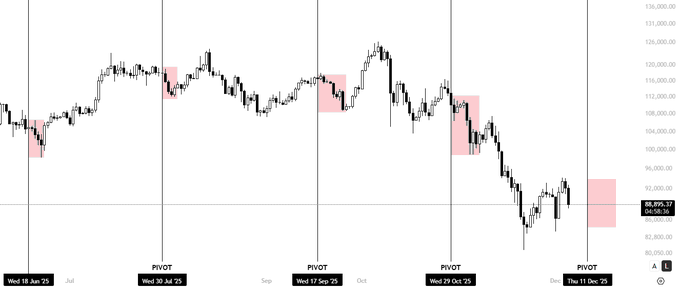

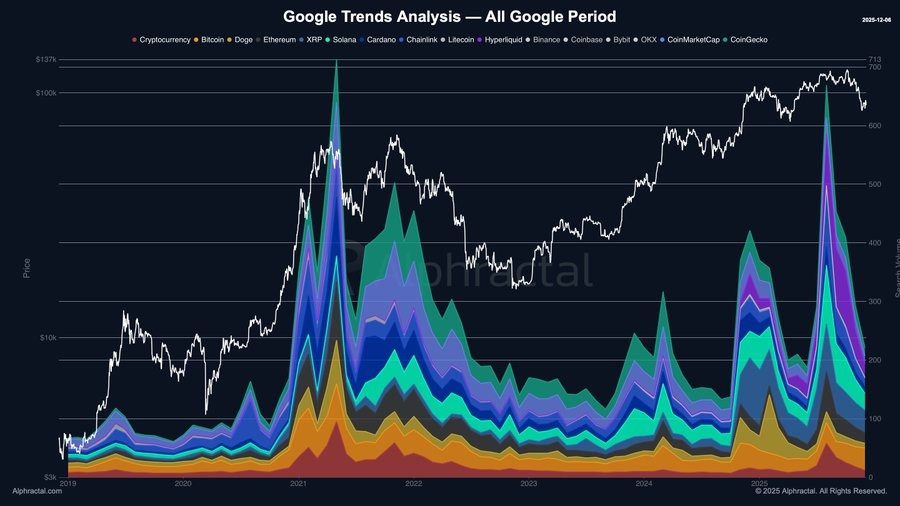

Bitcoin Leverage Liquidations and Systemic Risks in Cryptocurrency Markets: Analyzing the Causes and Impacts of 2025 Market Turbulence

- 2025 Bitcoin's November crash erased $800B in value as high-leverage liquidations amplified volatility, exposing systemic risks in crypto markets. - Trump's proposed China tariffs and synthetic stablecoin de-pegging triggered cascading liquidations, with $19B wiped in one day during October's crisis. - 392,000 traders lost $960M in 24 hours as fragmented order books and concentrated ownership worsened liquidity crunches during November's collapse. - Regulators highlight 11/28 jurisdictions with finalized

Why Bitcoin Price Is Down Today: The Unexpected Market Move No One Saw Coming

Crypto Market Panic Grows as Fear Index Hits Extreme Lows, Is Bitcoin Entering a Bear Market?

Algorand (ALGO) Gains 1.76% Over the Past Week Despite Market Fluctuations

- Algorand (ALGO) rose 1.76% weekly to $0.1326 but fell 60.33% annually amid broader crypto market declines. - ApeX Protocol's Dec 12 delisting of BABY/HOME tokens risks liquidity shocks, indirectly affecting ALGO market sentiment. - Other fintech/entertainment events had no direct impact on ALGO's price or trading dynamics. - Analysts highlight ALGO's long-term potential in DeFi despite bearish 1-month/1-year trends and macroeconomic uncertainties.