Bitcoin traders hit peak unrealized pain as ETFs start to turn positive

Bitcoin may be nearing a make-or-break point as short-term traders sit on the steepest unrealized losses of the current bull cycle.

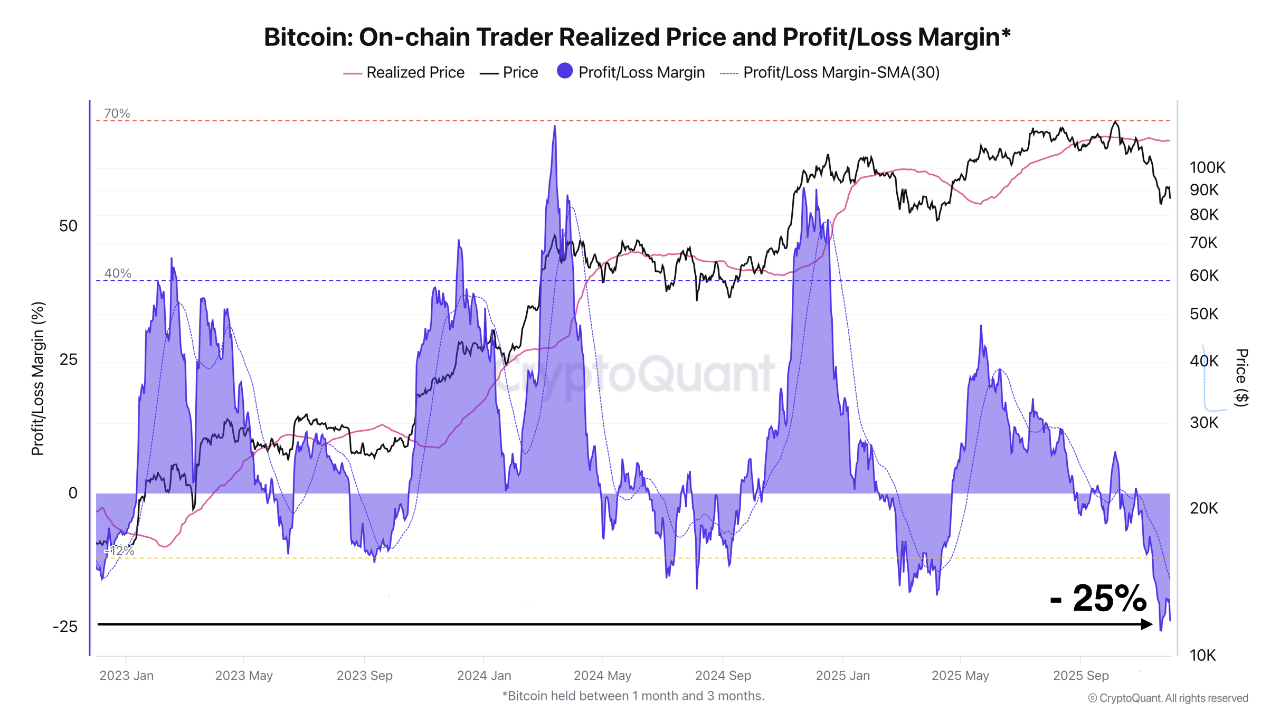

Short-term Bitcoin (BTC) traders who have held BTC between one to three months have been sitting on losses ranging from 20% to 25% for over two weeks, marking the highest pain point of the current market cycle, according to CryptoQuant analyst Darkfrost.

“Once a large portion of them has capitulated, as we have seen in recent weeks, that is usually when the opportunity to accumulate becomes interesting,” he wrote in a Monday note.

This cohort will remain underwater until BTC trades back above its realized price of about $113,692, Darkfrost added.

Some of the largest financial institutions remain optimistic about Bitcoin’s trajectory in 2026, despite the current correction.

On Monday, asset management giant Grayscale said that Bitcoin’s current drawdown points to a local bottom ahead of a recovery in 2026 — a development that will invalidate the four-year cycle theory, according to the company.

Related: Cathie Wood still bullish on $1.5M Bitcoin price target: Finance Redefined

Bitcoin ETF only accounted for up to 3% of selling pressure: ETF analyst

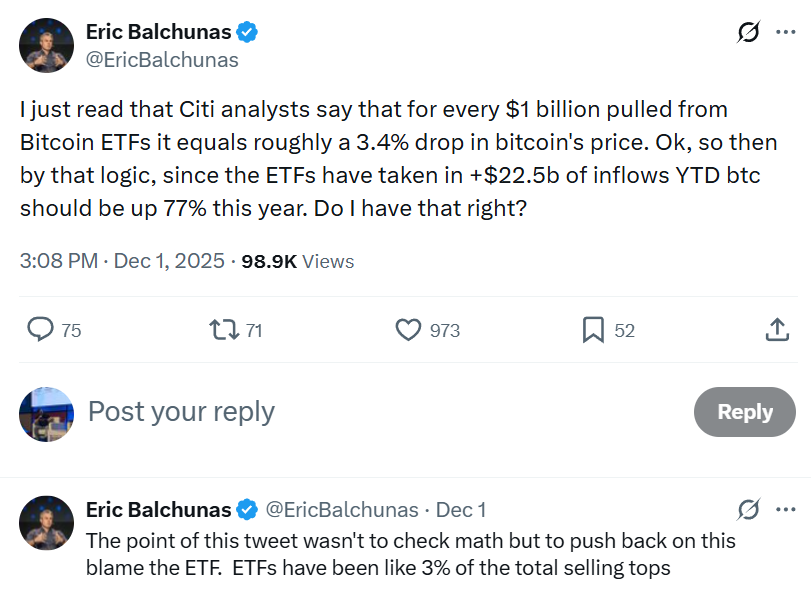

Despite previous concerns about the large-scale sales from spot Bitcoin exchange-traded fund (ETF) holders, these funds were only a fraction of the selling pressure behind Bitcoin’s price decline.

“I just read that Citi analysts say that for every $1 billion pulled from Bitcoin ETFs it equals roughly a 3.4% drop in Bitcoin's price. Ok, so then by that logic, since the ETFs have taken in +$22.5b of inflows YTD BTC should be up 77% this year,” wrote Bloomberg ETF analyst Eric Balchunas, in a Monday X post.

“ETFs have been like 3% of the total selling tops.”

Related: Bank of America backs 1%–4% crypto allocation, opens door to Bitcoin ETFs

Meanwhile, Bitcoin ETFs have started to recover from the $3.48 billion of cumulative outflows recorded during November, marking their second-worst month on record.

The Bitcoin ETFs recorded $58 million worth of net positive inflows on Tuesday, staging their fifth consecutive day of positive inflows, according to Farside Investors data.

Those modest inflows could continue as Bitcoin trades back above the roughly $89,600 flow-weighted cost basis for ETF buyers, meaning the average holder is no longer sitting on paper losses.

Looking at the other US crypto funds, spot Ether (ETH) ETFs saw $9.9 million in outflows on Tuesday, while the Solana (SOL) ETFs recorded $13.5 million of net negative outflows, according to Farside Investors.

Magazine: Mysterious Mr Nakamoto author — Finding Satoshi would hurt Bitcoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After viewing your Spotify Wrapped 2025, take a look at these similar alternatives

Privacy Coins and Market Fluctuations: Uncovering the Factors Behind ZEC's Latest Price Jump

- Zcash (ZEC) surged 700% in late 2025 driven by institutional backing and network upgrades like the Zashi wallet. - Regulatory pressures and market fragmentation intensified as exchanges delisted privacy coins and liquidity shifted to decentralized platforms. - ZEC's volatility reflects macroeconomic tailwinds and speculative demand, but its long-term viability hinges on balancing privacy with regulatory compliance. - Institutional adoption of privacy coins accelerated in 2025, yet fragmented markets and

Why Dash (DASH) Is Soaring as Institutions Embrace It and Privacy Concerns Fuel Demand

- Dash (DASH) surged 150% in June 2025, driven by institutional adoption and privacy-focused demand. - Institutional ownership reached 90.64% after AGF Management's $7.79M investment and DoorDash's $450M partnership. - Dash Platform 2.0 enhanced scalability while PrivateSend usage grew 25% YoY amid rising privacy needs. - Regulatory challenges persist under EU MiCA and SEC scrutiny, prompting multi-jurisdictional compliance strategies. - DeFi integration and Latin American adoption expanded DASH's utility

ZK Atlas Upgrade: Pioneering the Future of Blockchain Infrastructure for Enhanced DeFi Scalability

- ZKsync's 2025 Atlas Upgrade revolutionizes DeFi scalability via zero-knowledge rollups, boosting transaction throughput to 43,000 TPS and slashing costs to $0.0001 per transfer. - Modular architecture with Atlas Sequencer and Airbender Prover enables real-time execution, while zkSync OS supports EVM/WASM compatibility and cross-chain liquidity unification. - Post-upgrade DeFi metrics show 300% transaction volume growth and $0.28–$1.32 ZK token price projections, positioning ZKsync as a key Layer 2 infras