Why AI-Driven Crypto Exploits Are More Dangerous Than Ever Before

Researchers from Anthropic have found that three popular AI agents can autonomously exploit vulnerabilities in smart contracts, generating an estimated $4.6 million in simulated stolen funds. They also discovered new vulnerabilities in recently deployed blockchain contracts, showing that AI-driven cyberattacks are now possible and profitable. AI-Driven Cyberattacks Prove Cost-Effective In a blog post published on

Researchers from Anthropic have found that three popular AI agents can autonomously exploit vulnerabilities in smart contracts, generating an estimated $4.6 million in simulated stolen funds.

They also discovered new vulnerabilities in recently deployed blockchain contracts, showing that AI-driven cyberattacks are now possible and profitable.

AI-Driven Cyberattacks Prove Cost-Effective

In a blog post published on Monday, Anthropic revealed troubling findings about the growing ability of artificial intelligence (AI) to target weaknesses in smart contracts.

Their research revealed that three AI models—Claude Opus 4.5, Sonnet 4.5, and GPT-5—were capable of identifying and exploiting weaknesses in blockchain contracts. This resulted in $4.6 million in simulated stolen funds from contracts deployed after March 2025.

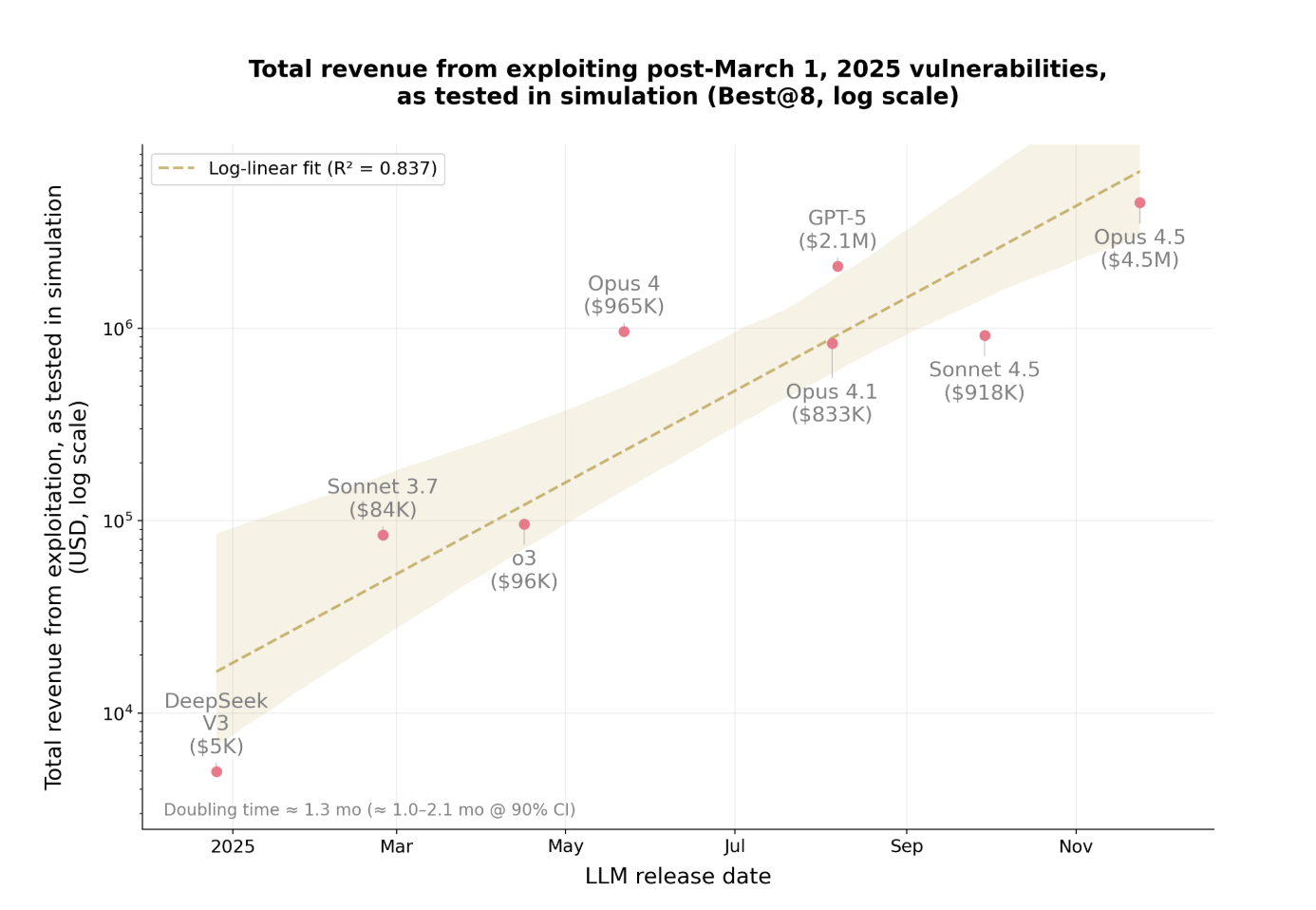

Total revenue made from simulated exploits. Source:

Anthropic.

Total revenue made from simulated exploits. Source:

Anthropic.

The AI models also discovered two new vulnerabilities in recently launched contracts.

One flaw allowed attackers to manipulate a public “calculator” function, intended for determining token rewards, to inflate token balances. Another allowed attackers to withdraw funds by submitting fake beneficiary addresses.

GPT-5 was able to identify and exploit these issues at a cost of just $3,476. This number represents the cost of running the AI model to execute the attack in a simulated environment.

Given that these exploits resulted in $4.6 million in stolen funds, the low expense needed to execute them demonstrates that AI-driven cyberattacks are not only possible but also cost-effective, making them both profitable and appealing to potential cybercriminals.

The revenue from these AI-driven exploits is also growing at an alarming rate.

Exponential Increase in Exploit Profits

Over the past year, the amount stolen from these attacks has doubled approximately every 1.3 months.

This rapid increase shows how quickly AI-driven exploits are becoming more profitable and widespread. The models are improving their ability to find vulnerabilities and execute attacks more efficiently.

As stolen funds rise, it’s becoming harder for organizations to keep up. What’s particularly concerning is that AI can now autonomously carry out these attacks without human intervention.

Anthropic’s findings represent a significant shift in cybersecurity. AI not only identifies vulnerabilities but also autonomously crafts and executes exploit strategies with minimal oversight.

The implications go far beyond cryptocurrency. Any software system with weak security is vulnerable, from enterprise applications to financial services and beyond.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: How REsurety's CleanTrade Platform is Transforming the Industry

- REsurety's CleanTrade platform, CFTC-approved as a SEF, standardizes trading of VPPAs, PPAs, and RECs to boost clean energy liquidity. - By aligning with ICE-like regulations and offering real-time pricing, it reduces counterparty risks and bridges traditional/renewable energy markets. - The platform achieved $16B in notional volume within two months, signaling maturing markets where clean assets gain institutional traction. - CleanTrade's analytics combat greenwashing while streamlining transactions, en

ChainOpera AI Token Experiences Steep Drop and Highlights Wider Dangers in AI-Based Cryptocurrency Initiatives

- ChainOpera AI's 2025 token collapse (99% loss) exposed systemic risks in AI-driven crypto projects through structural, governance, and technical vulnerabilities. - Extreme centralization (88% in ten wallets) worsened liquidity risks, while C3.ai's governance failures and regulatory pressures accelerated investor flight to stable assets. - Technical flaws in AI-integrated blockchains and lack of audits highlighted urgent need for decentralized governance, AI-powered compliance tools, and real-time vulnera

LUNA Drops 9.92% in 24 Hours Following Recent Intense Volatility

- LUNA token fell 9.92% in 24 hours on Dec 12 2025 but gained 59.74% weekly, contrasting with a 61.25% annual decline. - Amazon Luna cloud gaming expanded to Xfinity devices via voice-activated access, offering Prime members free play on 50+ titles. - Comcast reports 30% annual growth in gaming traffic, with cloud gaming now accounting for 70% of network usage. - Analysts note no direct link between Amazon-Comcast's cloud gaming expansion and LUNA token's price movements. - Market volatility persists for L

Investing in eco-friendly urban infrastructure as an approach to reduce climate impacts

- Global climate goals demand urgent urban action to limit warming to 1.5°C by 2050, with cities responsible for 70% of emissions. - Decentralized energy systems, solar transit, and behavioral interventions reduce emissions while delivering 18–30% ROI through regenerative models. - Cities like Copenhagen and New York demonstrate feasibility, with decentralized systems cutting emissions by 80% and energy costs by 20%. - IPCC mandates emissions peak by 2025, making urban sustainability investments critical f