A black swan to start the year? Bitcoin drops in the first week of December

Author: 1912212.eth, Foresight News

Original Title: A Poor Start to December, Why Did Bitcoin Drop Again?

After BTC slowly rose from $86,000 to $93,000, the market had yet to pause. At 8 a.m. on December 1st, East 8th District time, BTC plummeted 3.7% within an hour, dropping from $90,000 to below $87,000. ETH also fell from $3,000 to around $2,800, and altcoins suffered another widespread decline.

According to Coinglass data, $434 million was liquidated across the network in the past 4 hours, with $423 million from long positions.

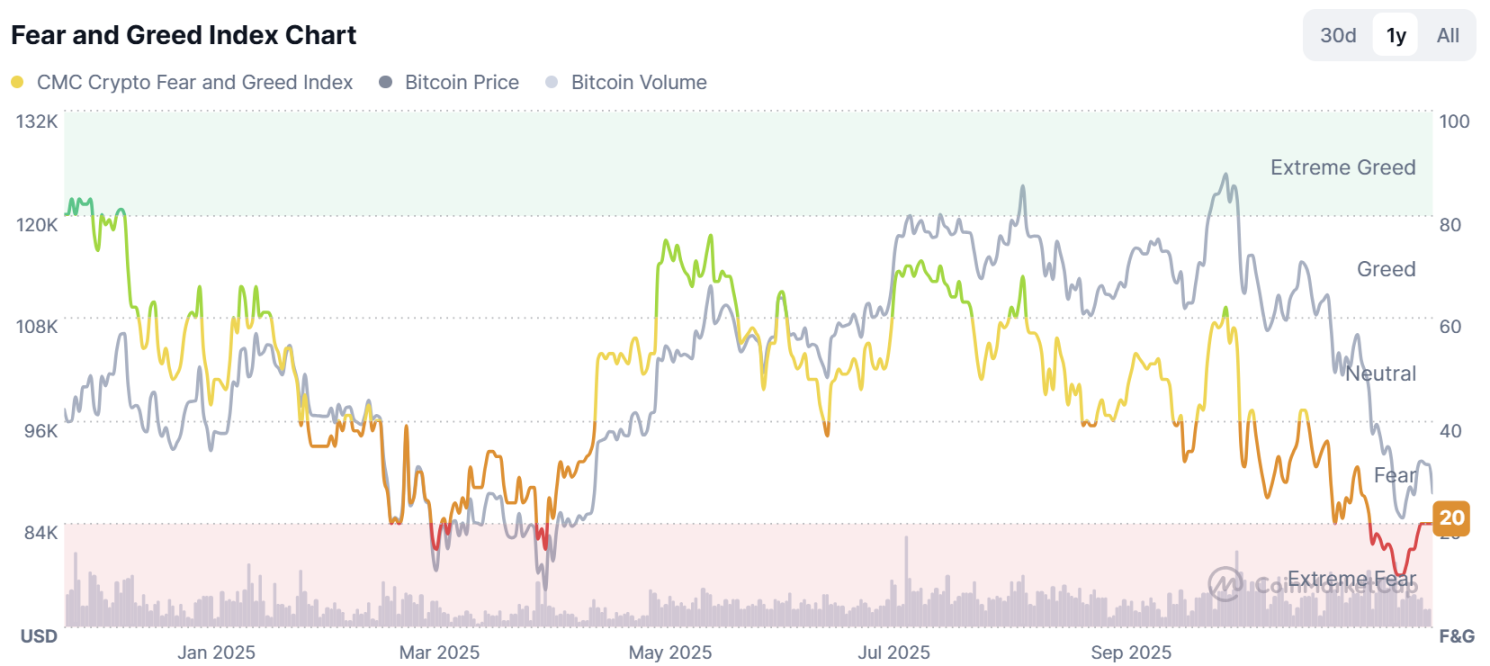

Market sentiment has once again fallen into a state of extreme fear. This time, the timing of the sell-off was extremely precise. In the last hour of November, the market was forcefully hammered into a large bearish candlestick with an ultra-long upper shadow, completely destroying the last bit of confidence among the bulls. With the monthly candle closing bearish, the technical side directly declared a "bull market structure breakdown," and all weekly and monthly bullish arrangements may have collapsed.

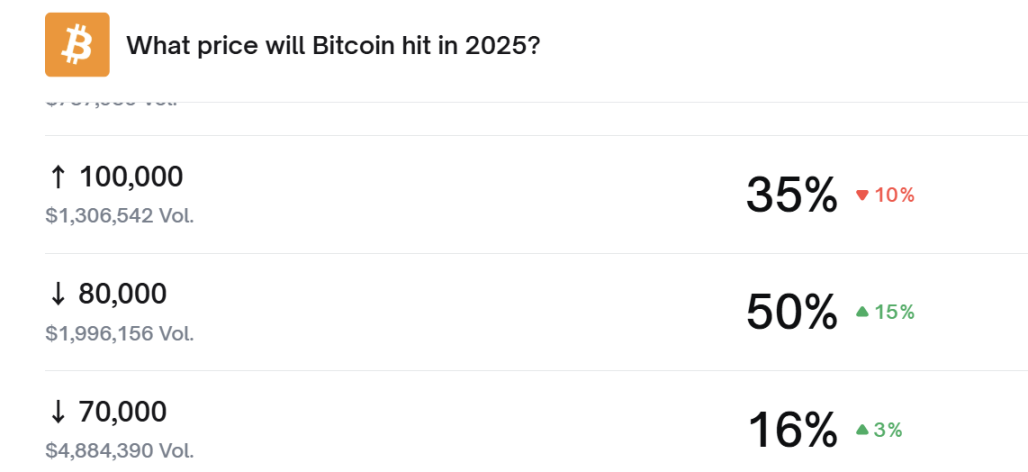

On Polymarket, the probability of BTC rebounding to $100,000 in 2025 dropped to 35%, while the probability of it falling to $80,000 rose by 15% to 50%.

The real trigger this time was actually not the Federal Reserve, not Trump’s policies, nor China’s increasingly strict regulation.

On November 29, the People’s Bank of China held a meeting of the coordination mechanism for cracking down on virtual currency trading and speculation. Officials from the Ministry of Public Security, the Cyberspace Administration of China, the Central Financial Office, the Supreme People’s Court, the Supreme People’s Procuratorate, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Justice, the People’s Bank of China, the State Administration for Market Regulation, the National Financial Regulatory Administration, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange attended the meeting. The meeting emphasized that virtual currencies do not have the same legal status as legal tender, do not have legal compensation, and should not and cannot be used as currency in the market. Virtual currency-related business activities are illegal financial activities. Stablecoins are a form of virtual currency and currently cannot effectively meet requirements such as customer identification and anti-money laundering, and are at risk of being used for illegal activities such as money laundering, fundraising fraud, and illegal cross-border fund transfers.

The meeting required all units to adhere to Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era as guidance, fully implement the spirit of the 20th National Congress of the Communist Party of China and the plenary sessions of the 20th Central Committee, make risk prevention and control the eternal theme of financial work, continue to uphold the prohibitive policy on virtual currencies, and continue to crack down on illegal financial activities related to virtual currencies. All units should deepen coordination and cooperation, improve regulatory policies and legal bases, focus on key links such as information flow and capital flow, strengthen information sharing, further enhance monitoring capabilities, severely crack down on illegal and criminal activities, protect the safety of people’s property, and maintain the stability of economic and financial order.

The severity of this crackdown, the breadth of the departments involved, and the classification of stablecoins as a form of virtual currency with warnings about risks such as money laundering and fraud, have undoubtedly poured cold water on already fragile market confidence.

The 94 policy in 2017 and the 519 policy in 2021 both caused significant pullbacks in the crypto market in a short period of time.

The market never lacks stories, and this time the story is called "the last batch of Chinese funds forced to exit." After the story is told, it marks the beginning of a long winter.

However, some opinions also point out that since the 1011 crash, capital inflows and macro uncertainty have had a serious negative impact on the crypto market.

Rob Hadick, General Partner at Dragonfly, stated that this deleveraging event, triggered by low liquidity, poor risk management, and weak oracle or leverage mechanisms, caused significant losses and brought great uncertainty.

Boris Revsin, General Partner and Managing Director at Tribe Capital, shared the same view, calling this a "leverage washout" that created a chain reaction throughout the market. At the same time, the macro environment has also become less friendly: short-term rate cut expectations have faded, inflation remains stubborn, the job market is weakening, geopolitical risks are rising, and consumer pressure is increasing.

Anirudh Pai, Partner at Robot Ventures, emphasized concerns about a slowdown in the US economy. Key growth indicators—including the Citi Economic Surprise Index and the 1-year inflation swap (a derivative used to hedge inflation risk)—have already started to weaken. Pai noted that this pattern has appeared before previous recession fears, driving broader risk aversion sentiment.

Dan Matuszewski, co-founder of CMS Holdings, said that apart from tokens supported by buyback mechanisms, there is almost no "incremental capital inflow" in the crypto market, except for DAT (Digital Asset Treasury) companies. As new demand dries up and ETF inflows no longer provide effective support, prices are falling even faster.

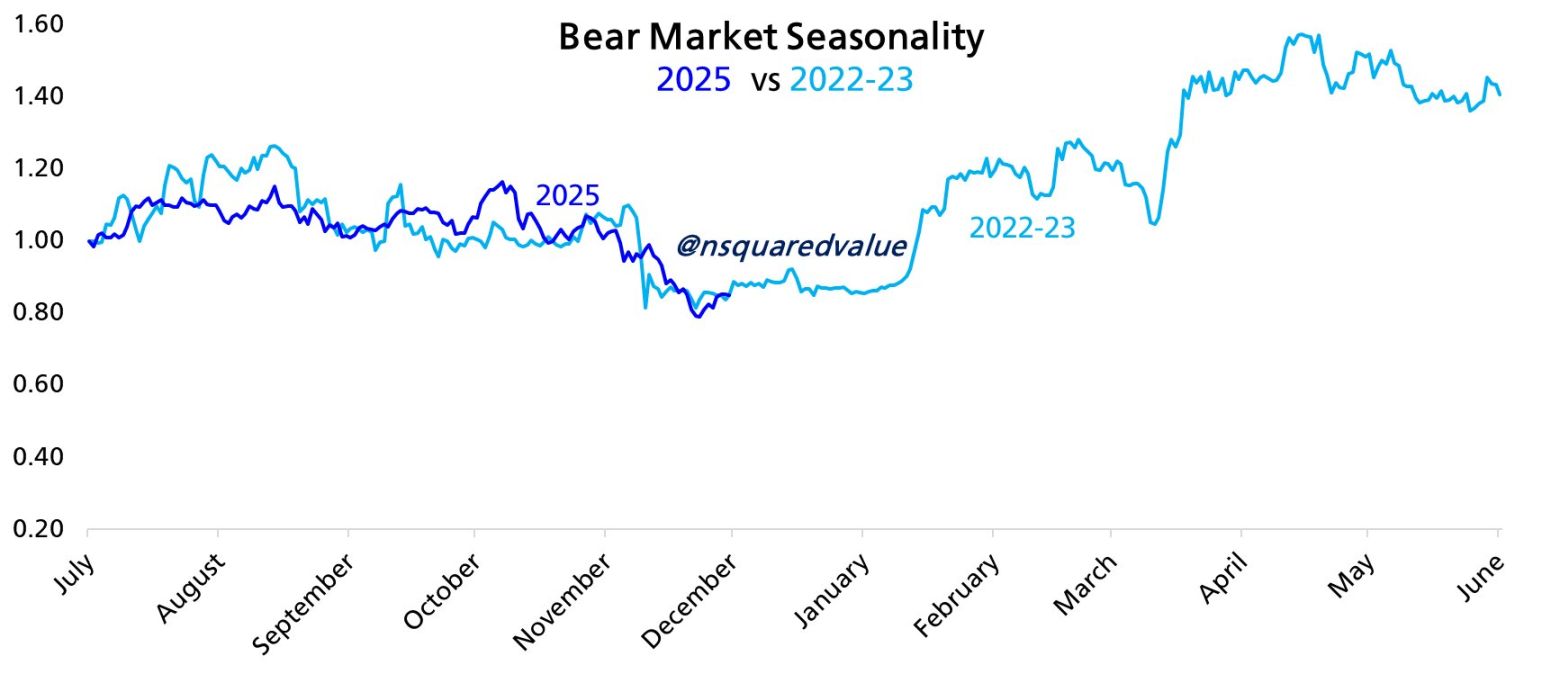

Analyst Timothy Peterson stated that the current bitcoin trend is highly similar to the 2022 bear market. From both daily and monthly charts, the daily correlation between this year and 2022 is 80%, and the monthly correlation is as high as 98%. If history repeats itself, a true recovery in bitcoin prices may not occur until the first quarter of next year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.