Monad Is Still Rallying, But How Long Will It Last?

Monad’s MON token is defying 2025 airdrop trends with strong liquidity and record on-chain activity. Analysts now assess how long the rally can hold.

Monad’s MON token continues to rally after its long-anticipated mainnet launch, defying the steep post-airdrop declines that dominated 2025. The token has climbed more than 70% above its Coinbase sale price while the broader crypto market trades under heavy pressure.

Data from on-chain activity, exchange flows, and token distribution offer a clear explanation for the outperformance — and reveal how long the rally may realistically last.

Strong Day-One Performance Sets the Tone

Monad launched its public mainnet and MON token on November 24 with roughly 10–11% of its 100 billion supply unlocked.

The airdrop and public sale provided liquidity, while more than 50.6% of the supply (team, investors, treasury) remained locked through 2029.

Large Monad Holders Are Still Not Selling Any MON Token. Source:

Nansen

Large Monad Holders Are Still Not Selling Any MON Token. Source:

Nansen

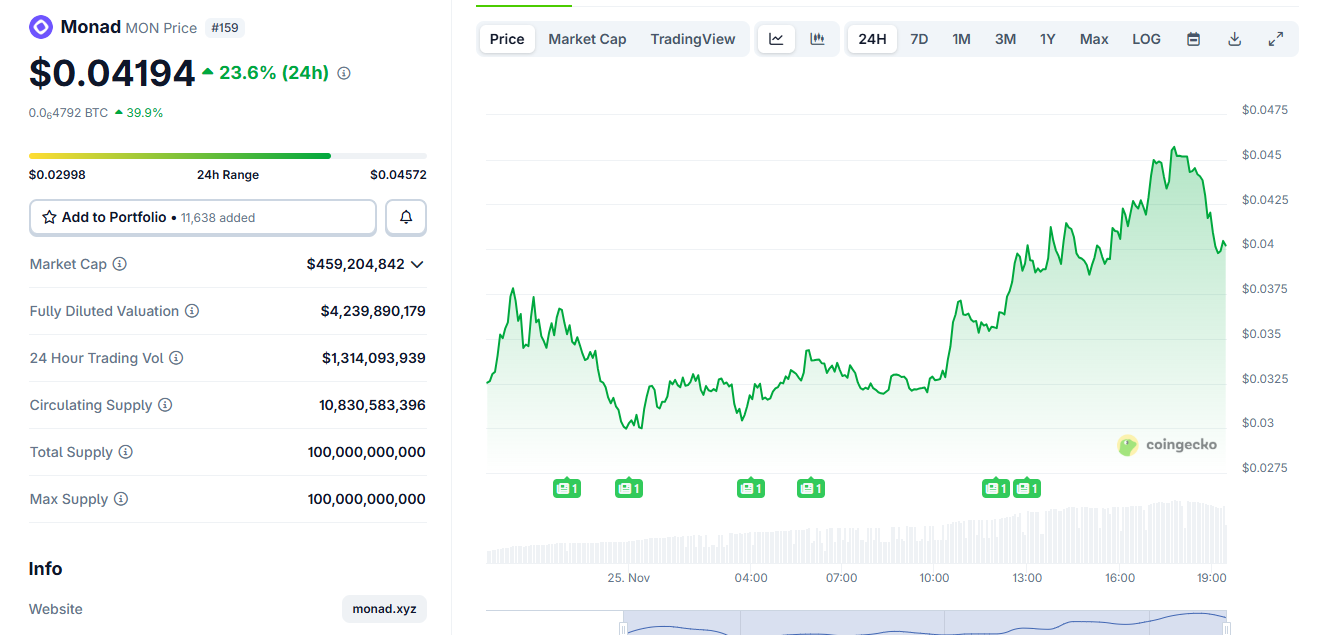

The launch attracted immediate attention. MON dipped about 15% in early trading, hitting $0.02 as airdrop sellers exited.

Buyers quickly absorbed the flow. Within 24 hours, MON traded near $0.03–0.035, and now sits around $0.04, more than 50–70% above its $0.025 public sale price.

This strength stands out in a market where Bitcoin has dropped below $90,000 and total crypto market capitalization has fallen by more than a trillion dollars since October.

Monad Price Chart. Source:

CoinGecko

Monad Price Chart. Source:

CoinGecko

Airdrop and Token Sale Created a Stable Holder Base

Monad distributed roughly 4.73 billion MON in airdrops to 289,000 eligible accounts, with 3.33 billion ultimately claimed. The design targeted DeFi power-users, NFT traders, testnet contributors, and DAO participants rather than quest farmers.

The Coinbase token sale, which raised $269 million from about 85,820 participants, added a second cohort of committed holders. These buyers anchored around the $0.025 sale price and proved less eager to dump at launch.

Because insiders remain locked, early sellers were mostly airdrop recipients. This dynamic helped prevent the heavy cascades that crushed many 2025 airdrops.

my monad airdrop is worth $14,000?what the actual fuck hello wtf pic.twitter.com/zHkEdQQsIT

— Loshmi (@loshmi) November 25, 2025

Heavy Exchange Coverage Shielded MON From Volatility

MON was listed across major exchanges on day one, including Coinbase, Upbit, Bithumb, Kraken, Bybit, Bitget, Crypto.com, and MEXC. Derivatives opened on multiple venues, giving traders hedging options.

Deep order books absorbed airdrop selling. Market makers tightened spreads, and cross-venue liquidity reduced fragmentation. Traders could short, long, or hedge without flooding spot markets.

This broad coverage sharply contrasts with earlier L1 launches that relied on thin liquidity pools and fragmented markets, often triggering immediate 50–80% crashes.

Huge respect to @monad for not paying the Binance cartel listing fee.Probably not a coincidence that the price is going up.No serious project should waste millions of dollars for nothing (study Binance TGEs this cycle).gMonad

— Aylo (@alpha_pls) November 25, 2025

On-Chain Activity Surprised the Market

Monad’s first 24 hours delivered rare on-chain traction for a new L1. Nansen recorded:

- 3.7 million transactions

- 153,000 active addresses

- 18,000 contract deployments

These figures exceed what many blockchains achieve in their first year. They show early real usage from bots, arbitrageurs, developers, and liquidity programs.

.@Monad went live less than 24 hours agoIt already cleared:– 3.7M daily txns– 153K active addresses– 18K contract deploymentsThat’s higher day-one activity than most chains in their first year🧵 👇 pic.twitter.com/ggUwfOyjx7

— Nansen 🧭 (@nansen_ai) November 25, 2025

TVL reached ~$90 million, with Uniswap, Gearbox, Curve, and native dApps launching within hours. DEX volume crossed $70 million, driven by concentrated liquidity pools and farming incentives.

This early activity reinforced the perception that Monad launched as a functioning ecosystem, not as a speculative token awaiting future development.

Monad’s Rare Relative-Strength Play in a Weak Market

MON’s rally stands out because the rest of the market remains fragile. Bitcoin’s slide under $90,000 triggered retail outflows and pushed sentiment indicators into extreme fear.

Traders rotated into MON due to its relative strength. New tokens with credible metrics often attract momentum capital when major assets struggle.

This reflexive flow — strength attracting more capital — added fuel to the rally.

Arthur Hayes Goes All-In

Arthur Hayes weighed in with a sarcastic comment that captured the market mood.

Just what this bull market needs another low float , high FDV useless L1. But obvi I aped. It’s a bull market bitches!$MON to $10 pic.twitter.com/UMSDWWmp5a

— Arthur Hayes (@CryptoHayes) November 25, 2025

He highlighted MON’s low float and high FDV (fully diluted valuation). With only around 10% of supply circulating and FDV near $3–4 billion, MON fits the low-float pattern that dominates early-stage price action.

Yet Hayes admitted he bought anyway. His remark reflects how traders treat early L1 tokens: fundamentally risky, but attractive for short-term speculation.

How Long Can the Monad Rally Last?

The current data and patterns point to three time horizons that shape MON’s outlook.

Short Term: Rally Can Sustain

Monad has absorbed its largest early unlocks. Liquidity remains deep, and on-chain usage is rising. Incentive programs are launching, and trading flows remain strong.

Under these conditions, MON can maintain upward momentum for days or weeks.

Medium Term: Unlock Pressure Builds

Over the next several months, the circulating supply will rise as vesting tranches unlock. Even disciplined insider distribution adds structural sell pressure.

Activity may normalize after early incentives fade. If TVL flattens or starts slipping, the narrative could shift.

Longer Term: Fundamental Execution Matters

MON’s FDV places high expectations on the chain. Sustained growth in TVL, real applications, and developer traction will determine long-run resilience.

Without continued expansion, valuation compression becomes likely as supply expands.

In 2017 $ADA went from $3B → $30B in less than a month$MON just launched at $3BImagine the smell 💜 @monad pic.twitter.com/9LEg9WXNW9

— zac.eth 🧙🏻♂️♦️ (@zacxbt) November 24, 2025

Monad Token Outlook

Monad’s rally stems from a rare combination of strong distribution design, deep exchange liquidity, high early usage, and standout performance during a weak market.

This alignment makes MON one of the few 2025 airdrop tokens to defy the typical post-launch collapse.

The rally can continue in the short term as long as on-chain demand holds and liquidity remains supportive. However, the token’s high FDV and long vesting schedule introduce clear medium-term risks.

For now, MON remains a high-momentum asset driven by early fundamentals and speculative flows.

However, the durability of that momentum will depend on whether Monad converts its powerful first 48 hours into sustained ecosystem growth.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Value Jumps 30% Following Significant Network Update and Changes in Adoption

- ICP's 30% price surge in late 2025 follows major upgrades like Caffeine (AI-powered dev tools) and Chain Fusion (cross-chain interoperability), enhancing scalability and enterprise appeal. - Institutional partnerships with Microsoft and Google Cloud validate ICP's hybrid cloud potential, while Flux/Magnetosphere upgrades aim to match centralized cloud performance through TEEs. - Despite 1.2M active wallets and $1.14B daily transactions, dApp engagement fell 22.4%, highlighting gaps between infrastructure

Prediction Markets Face Legal Challenges as Kalshi’s Value Soars to $11 Billion

- Kalshi's $11B valuation doubles after $1B funding led by CapitalG and Sequoia, signaling institutional confidence in prediction markets. - Regulatory divergence emerges as Polymarket gains CFTC approval while Kalshi faces Nevada gaming law challenges over sports contracts. - Enlivex Therapeutics raises $212M via prediction market-linked strategy, highlighting sector maturation and cross-industry adoption. - Prediction markets increasingly reshape traditional finance, with CFTC licensing enabling broader

Bitcoin Updates: Federal Reserve's Shift to Dovish Stance—Will It Propel Crypto or Heighten Uncertainty?

- The Fed's end of quantitative tightening and potential December rate cut signal a dovish pivot, likely boosting crypto markets by improving liquidity and lowering holding costs for assets like Bitcoin . - Bitcoin's recent price rebound above $90,000 and January 2024 spot ETF approvals have institutionalized crypto exposure, though ETFs trade direct ownership for custody security. - Altcoins may gain from Bitcoin's declining dominance, while regulatory moves like Abu Dhabi's Ripple stablecoin approval hig

As cryptocurrency fraud becomes more sophisticated, Interpol strengthens its unified crackdown

- Interpol labels crypto scam networks a global threat, citing $11B in cross-border fraud since 2023. - Scam compounds use forced labor and blockchain tech to evade detection across 60+ countries. - 2024 operations achieved 2,500 arrests, but networks persist in Southeast Asia and expand globally. - Finland's caller ID tech reduced scam losses by 99.9%, highlighting tech-innovation's role in combating fraud.