- SOL: Firedancer upgrade and Shopify payments boost adoption and strengthen December growth potential.

- XRP: Banking partnerships and steady performance support strong momentum heading into December.

- LINK: CCIP growth and RWA demand position Chainlink for major December expansion.

A strong shift in market sentiment now shines a bright light on three major crypto projects. Many traders look toward December with fresh energy and a renewed focus on real utility. Solana, XRP, and Chainlink continue to attract interest from users, developers, and large institutions. Each project shows clear progress, growing demand, and stronger fundamentals. Many investors now view these three networks as strong contenders for a sharp December climb.

Solana (SOL)

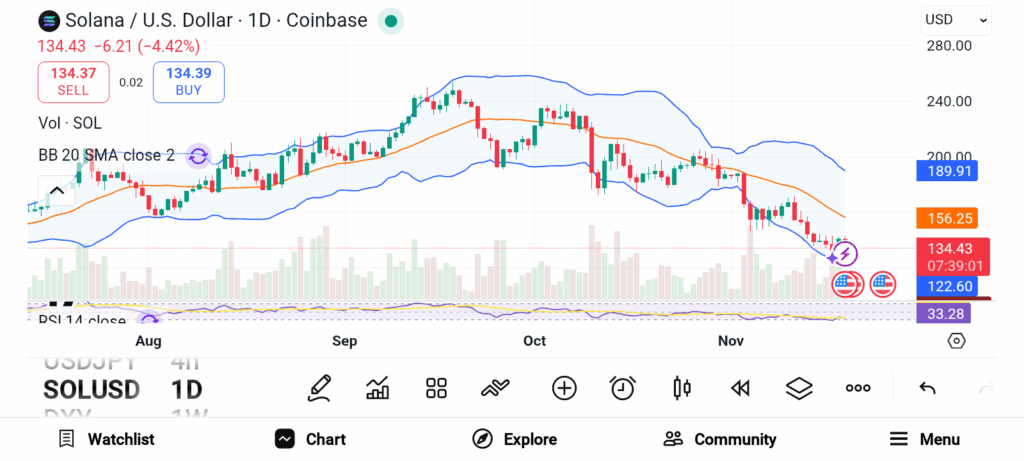

Source: Trading View

Source: Trading View

SOL recovered from heavy doubt and now shows fast growth again. The Solana Network runs at high speed with very low fees, giving developers a smooth path for building consumer-focused apps. Many teams working on NFT platforms and DePIN projects choose Solana because performance remains consistent during heavy traffic. A major upgrade called Firedancer adds a fresh validator client that boosts reliability across the network.

This upgrade brings more confidence for both builders and traders. Solana Pay also grows in popularity, drawing attention from retail partners. A recent Shopify integration highlights real payment use cases that many merchants can benefit from. Strong demand plus real adoption continues to support a positive outlook for December.

Ripple (XRP)

Source: Trading View

Source: Trading View

Ripple’s XRP spent years under serious regulatory pressure before showing major strength this year. The token recorded strong gains and now stands among the top performers of 2025. Many traders view XRP as a steady mover backed by a clear mission in global payments. A potential Ripple ETF now draws interest from large financial groups.

RippleNet expands partnerships with major banks, helping cross-border transfers move faster and at a lower cost. The XRP Ledger supports quick settlement for remittances and large transfers. This strong foundation gives XRP a unique position among top cryptos. A stable and growing role in global finance helps set the stage for a promising December.

Chainlink (LINK)

Source: Trading View

Source: Trading View

Chainlink plays a crucial role in blockchain infrastructure. The network connects real-world data to smart contracts across many chains. Developers rely on the oracle network for accurate price feeds, insurance triggers, game logic, RWA data, and automated settlement. More attention now shifts toward the Chainlink Cross Chain Interoperability Protocol.

CCIP supports smooth messaging and transfers across different networks. The protocol gains adoption in both traditional finance and DeFi platforms. Many analysts expect Chainlink to grow as RWA tokenization expands. The network stands at the center of this trend, helping bring real assets onto blockchains in a secure and reliable way. Growing utility supports a strong outlook for December.

Solana shows strong momentum from technical upgrades and retail adoption. XRP grows through banking partnerships and steady performance. Chainlink strengthens infrastructure for RWA and cross-chain activity. These three networks now stand in a strong position for a December surge.