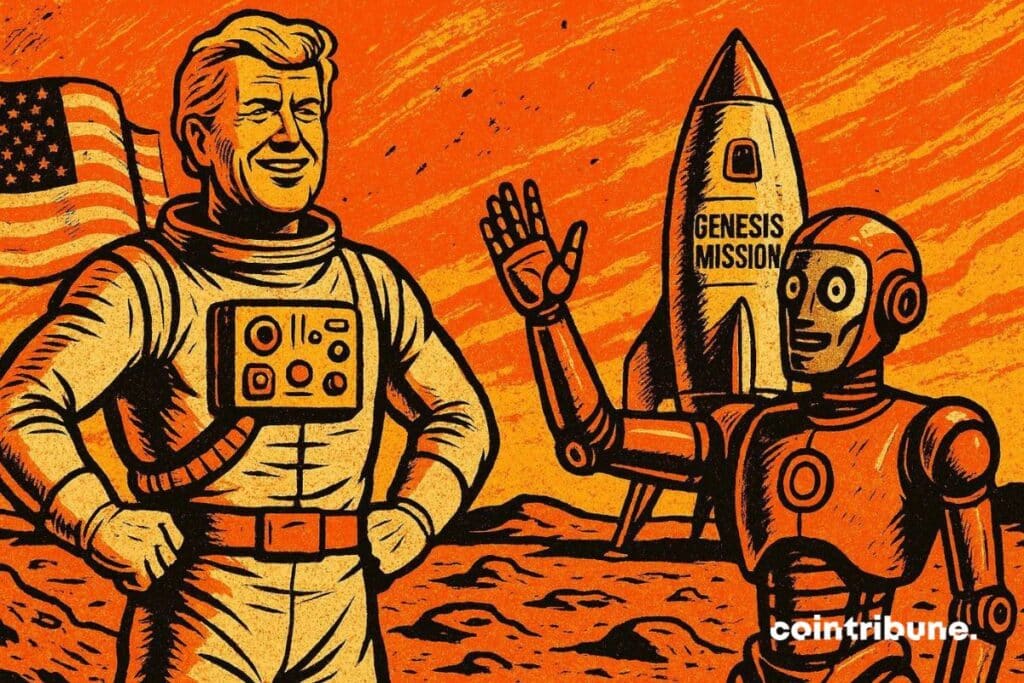

Trump Signs "Genesis Mission" Order to Boost AI Innovation in the United States

On November 24, 2025, Donald Trump signed an executive order launching the “Genesis Mission“, an ambitious federal project to accelerate research in artificial intelligence (AI). Compared to the Apollo program, this initiative aims to position the United States as the global leader in technological innovation. What are its objectives, key players, and implications for the future?

In brief

- Donald Trump signs the “Genesis Mission” executive order to accelerate AI research in the United States.

- The Genesis Mission relies on public-private partnerships with companies such as Nvidia, AMD, and AWS.

- The initiative could indirectly benefit AI-related cryptocurrencies, while creating new challenges for Bitcoin.

The “Genesis Mission“: a federal revolution for AI by Trump

The “Genesis Mission” is a federal initiative aiming to centralize American scientific resources to stimulate advances in artificial intelligence (AI). Led by the Department of Energy, the decree signed by Donald Trump foresees the creation of a digital platform integrating:

- supercomputers;

- federal data sets;

- research infrastructures.

The objective is clear: accelerate discoveries in strategic fields such as energy, national security, and semiconductors.

To achieve this, the Trump administration relies on partnerships with tech giants. Nvidia, AMD, and AWS have already announced massive investments, such as Amazon’s $50 billion commitment for AI-dedicated data centers. This public-private collaboration recalls great federal programs of the past, like the Manhattan Project or the space race.

The platform, named “American Science and Security Platform“, must demonstrate operational capability within nine months. It will allow researchers to access advanced modeling tools and unprecedented computing resources. All this while ensuring the protection of sensitive data.

AI and crypto: a winning duo for the US economy?

The alliance between AI and blockchain could become a pillar of technological innovation in the United States. Indeed, the “Genesis Mission” decree signed by Donald Trump emphasizes areas where blockchain can play a key role. Notably, data security and process automation. Smart contracts, for example, could optimize energy resource management, while decentralized ledgers would ensure research traceability.

For the crypto sector, this synergy represents an opportunity. Projects integrating AI tools, such as Fetch.ai or SingularityNET, could benefit from increased visibility and federal support. Growing AI adoption in government infrastructures could also encourage more favorable regulation for cryptocurrencies, strengthening their legitimacy. However, this dynamic will depend on the crypto players’ ability to meet federal requirements, especially regarding cybersecurity and compliance.

The dangers of the “Genesis Mission”: is Trump turning his back on bitcoin?

The “ Genesis Mission ” could propel AI cryptos to the forefront, relegating bitcoin to a secondary role. Projects combining blockchain and artificial intelligence align better with federal priorities than BTC, which is often seen as a simple store of value. Massive investments in AI, like those by AWS, could marginalize the crypto queen, less integrated into government initiatives.

However, bitcoin retains major assets: its status as a safe haven asset and increasing adoption by institutions (ETFs, state reserves) could limit its decline. Lastly, this initiative raises questions about the centralization of infrastructures, contrary to the decentralized ethos of cryptos, and about the environmental impact of data centers.

Donald Trump’s “Genesis Mission” could redefine technological and economic balances in the United States. While it offers unprecedented opportunities for AI cryptos, it also poses challenges in terms of regulation and environmental impact… A ticking time bomb for the climate . In your opinion, will this strategy manage to reconcile innovation and decentralized principles?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ChainOpera AI Token Plummets Unexpectedly: Is This a Warning Sign for Crypto Investors Focused on AI?

- ChainOpera AI's 96% value collapse in late 2025 exposed critical risks in centralized, opaque AI-driven crypto projects. - 87.9% token concentration in ten wallets enabled manipulation, while untested AI algorithms and lack of audits eroded trust. - Regulatory ambiguity from delayed U.S. CLARITY Act and EU AI Act created fragmented frameworks, deterring institutional participation. - Post-crash trends prioritize decentralized governance, auditable smart contracts, and compliance with AML/KYC protocols fo

Modern Monetary Theory and the Transformation of Cryptocurrency Valuation Models in 2025

- Modern Monetary Theory (MMT) reshaped crypto valuation in 2025, transitioning digital assets from speculative tools to institutional liquidity instruments amid low-yield environments. - Central banks and 52% of hedge funds adopted MMT-aligned CBDCs and regulated stablecoins, with BlackRock's IBIT ETF managing $50B as crypto gained portfolio diversification status. - Regulatory divergence (e.g., U.S. CLARITY Act vs. New York BitLicense) created volatility, exemplified by the Momentum (MMT) token's 1,300%

Financial Wellness Emerging as a Key Investment Trend: Psychological and Structural Factors Shaping Sustainable Wealth Over Time

- 2025 investment trends prioritize financial wellness driven by behavioral economics and systemic factors like inflation and AI-driven tools. - Budgeting apps (YNAB, Mint) and automation platforms (Digit, Acorns) address debt management and savings discipline amid $1.17T U.S. credit card debt. - ETFs like iShares IYG and Global X FINX target financial wellness infrastructure, while Vanguard's inflation-protected ETFs cater to capital preservation needs. - Systemic shifts force "cascading waterfall" financ

Investing for Tomorrow: Eco-Friendly Energy Systems and the Growth of Green Cities

- Global climate-conscious energy infrastructure is accelerating, driven by tech innovation and urban decarbonization needs, with cities accounting for 70% of carbon emissions. - Smart grids and AI are transforming energy systems: grids optimize distribution (e.g., Amsterdam/Singapore), while AI cuts building energy use by 30% via automation and analytics. - Renewable energy investments hit $2.2T in 2025, led by solar (cheapest electricity source), but emerging markets face funding gaps despite hosting 40%