Monad Token Defies Market Rout With Sharp Post-Launch Rally

Monad’s MON token surged more than 35% on launch day, breaking the industry’s usual post-airdrop decline. The move stands out in a harsh November downturn, with MON outperforming even as broader crypto sentiment hits extreme fear.

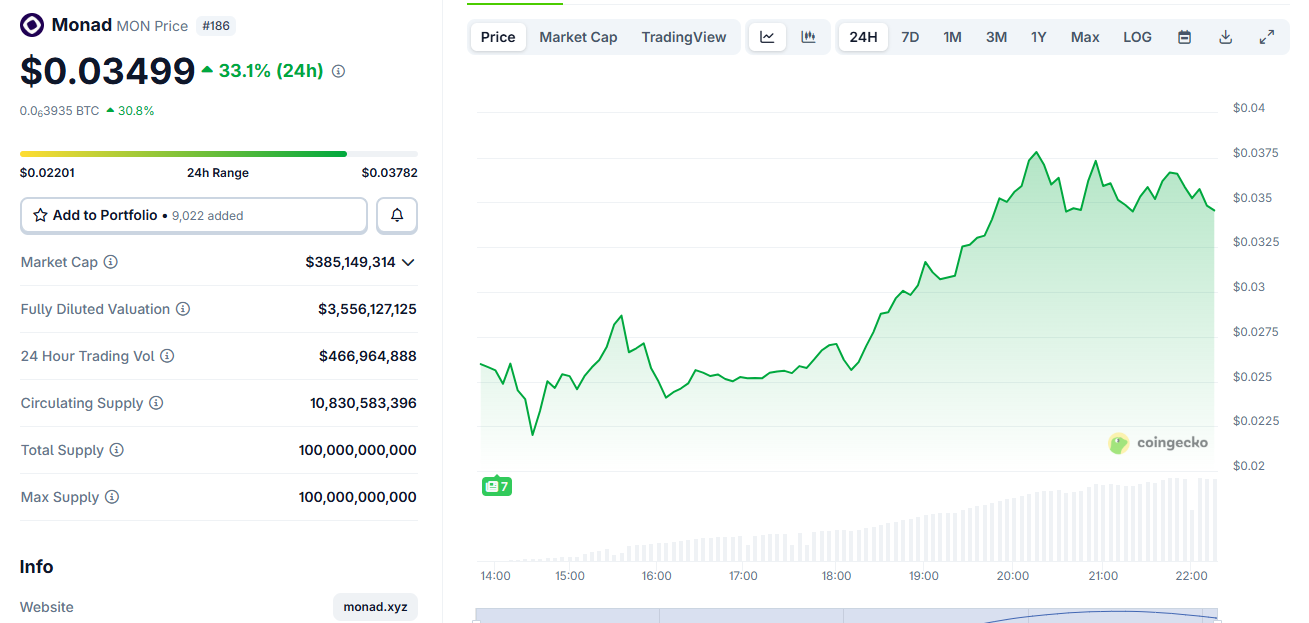

Monad’s MON token surged more than 35% within 24 hours of launch, defying both a cold airdrop market and a deep November sell-off across digital assets.

MON traded around $0.035 on Monday, rising from an early range near $0.025 as liquidity spread across major exchanges.

Monad Shines Bright Amid the Bear Market

The move stands out against a market where most airdrops have struggled. Recent industry research shows nearly 90% of airdropped tokens decline within days, driven by thin liquidity, high FDVs, and aggressive selling from recipients.

MON instead climbed strongly despite more than 10.8 billion tokens entering circulation from airdrop claims and a public token sale.

$MON TGE today.Simplest Monad airdrop play is still liquid staking. Stake and forget while farming points.If Monad does well, one of the $MON LSTs will be Lido of ETH and Jupiter for Solana.Question is which.I look for:– Exclusive to Monad– No TGEd yet– Already…

— Ignas | DeFi November 24, 2025

The token launched on November 24 alongside Monad’s mainnet. Around 76,000 wallets claimed 3.33 billion MON from a 4.73 billion-token airdrop, while 7.5 billion more unlocked from Coinbase’s token sale.

Monad Price Chart. Source:

CoinGecko

Monad Price Chart. Source:

CoinGecko

The airdrop alone was valued near $105 million at early trading prices.

MON’s performance also contrasts with the broader market downturn. Bitcoin fell below $90,000 last week after long-term holders sold more than 815,000 BTC over 30 days.

Total crypto market value has dropped by over $1 trillion since October, and sentiment sits in extreme fear territory.

However, MON’s trading demand remained resilient. Its price recovered from initial selling pressure and climbed steadily through the afternoon session.

Most large exchanges listed the token at launch, including Coinbase, Kraken, Bybit, KuCoin, Bitget, Gate.io, and Upbit, supporting deeper liquidity.

Analysts attribute the move to pent-up interest in Monad’s high-performance L1 design and a launch structure that avoided the steep inflation seen in other airdrops this year.

People really gravedancing on Monad right before a 4 hour 50% up candle at the most obvious support on planet earthMan I love this game

— DonAlt November 24, 2025

The project delivered one of 2025’s largest distributions but kept real circulating supply focused on early users and public sale participants rather than speculative farmers.

MON’s rally comes as a rare outlier in November’s bear cycle. Its early strength now positions the token as one of the few airdrops this year to post immediate gains instead of sharp declines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Spain's sweeping changes to cryptocurrency taxation ignite concerns over mass departures and create regulatory turmoil

- Spain's left-wing Sumar group proposes reclassifying crypto gains as ordinary income, raising top tax rates to 47% and introducing a "crypto traffic light" risk system. - Critics warn the reforms could drive investors offshore, mirroring India's 2022 experience, and create compliance chaos for self-custodied assets and non-EU tokens. - Legal experts challenge enforceability of asset seizure rules for non-local custodied tokens like USDT , while tax agencies highlight existing legislative ambiguities. - C

UAE Establishes International Benchmark for Crypto: Striking a Balance Between Progress and Oversight

- UAE enacts landmark crypto law (Federal Decree No. 6/2025) to regulate DeFi, Web3 protocols, stablecoins, DEXs, and blockchain bridges under central bank oversight. - Entities offering crypto financial services must obtain licenses by September 2026, enforcing AML compliance and systemic risk mitigation through reserve audits and security standards. - Framework balances innovation with stability, supporting UAE's economic diversification goals while attracting institutional investors through regulatory c

XRP News Today: Institutional XRP ETFs Create Rarity, Yet Market Downturn Restricts Price Growth

- Jake Claver highlights ETF-driven depletion of XRP's OTC supply, potentially triggering sharp price surges via liquidity constraints. - SEC's Project Crypto prioritizing disclosure enabled XRP ETF approvals (e.g., Grayscale GXRP), offering institutional access through regulated platforms. - Analysts note ETFs' structural advantages over futures but warn XRP's $2.11 price faces headwinds from broader crypto market weakness (-25% since October). - FeFe's model predicts $47 price target if $10B ETF inflows

Bitcoin Updates: Bullish Technical Signals for Bitcoin Face Off Against Underlying Bearish Threats

- Analysts highlight Bitcoin's proximity to key technical indicators, suggesting a potential rebound to $96,000 amid undervaluation signals like the Puell Multiple (0.86) and a two-year low MVRV Z-Score (1.13). - Structural risks persist, including MSCI index exclusions of crypto treasuries (Jan 2026) and ETF outflows, which could trigger sell-offs and weaken liquidity despite improving bull-bear momentum (-20%) and fair-value gaps ($99,000 target). - Market views diverge: some see a 30% drawdown from $126