BlackRock Registers Staked Ethereum Trust ETF, Expanding Yield Opportunities for Investors

Quick Breakdown:

- BlackRock, the $13.5 trillion asset manager, has registered for a new staked Ethereum ETF.

- This move follows the successful launch of its flagship Ethereum ETF in July 2024, which attracted $13.1 billion in inflows.

- The new product aims to provide a steady yield alongside price exposure, targeting yield-focused investors whom traditional Ethereum ETFs often overlook.

BlackRock expands Ethereum ETF offering with staking

According to Eric Balchunas, Senior ETF Analyst for Bloomberg, BlackRock has taken the first official step toward launching a new staked Ethereum exchange-traded fund (ETF) by registering the product name in Delaware. This move indicates the asset manager’s intention to build on the success of its original iShares Ethereum Trust ETF (ETHA), which debuted in July 2024 and has since drawn $13.1 billion in investor inflows.

Unlike ETHA, which currently does not stake its holdings due to operational and regulatory complications, the proposed staked Ethereum ETF would incorporate staking rewards, potentially providing investors with a more attractive total return.

BlackRock is planning to file for a Staked Ethereum ETF, as per the Delaware name registration. ’33 Act. Filing coming soon. pic.twitter.com/NmAsQhcq5D

— Eric Balchunas (@EricBalchunas) November 19, 2025

To bring this new fund to market, BlackRock still needs to file additional paperwork with the U.S. Securities and Exchange Commission (SEC) to obtain regulatory approval. The SEC has become more receptive to crypto ETFs under recent policies, allowing faster approvals through a generic listing standard. Notably, BlackRock’s staked ETH ETF is registered under the Securities Act of 1933, which imposes stringent transparency and investor protection requirements, ensuring a secure, fully disclosed investment product.

Staked ETH ETFs: Yield-Enhancing opportunity

Integrating staking into an Ethereum ETF introduces an income stream derived from the average annual ETH staking return of about 3.95%, according to Blocknative data. This yield component offers a compelling advantage by transforming the fund into a total-return vehicle combining price appreciation with steady staking rewards. Such a product could appeal to investors seeking consistent income while also providing exposure to Ethereum’s price movements, addressing a key limitation of existing Ethereum ETFs that focus solely on price.

BlackRock’s initiative to offer staking complements recent market developments, including the launch of staked ETH products by REX-Osprey and Grayscale. It signals growing interest in yield-bearing crypto ETF offerings, a growing niche as investor demand for income-focused digital asset products increases.

BlackRock’s initiative to launch a staked Ethereum ETF in the US, which introduces an income stream from staking rewards, underscores its commitment to innovation in digital asset finance. This move complements the firm’s broader global strategy, as further evidenced by the simultaneous debut of its iShares Bitcoin ETP on the London Stock Exchange. This dual expansion into both yield-bearing Ethereum products and new geographic markets for its Bitcoin offering solidifies BlackRock’s dominant position and forward-looking vision in the regulated crypto investment landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tesla engaged in deceptive marketing for Autopilot and Full Self-Driving, judge rules

IBIT-Linked Structured Notes: Wall Street’s $530M Bet on Bitcoin Integration

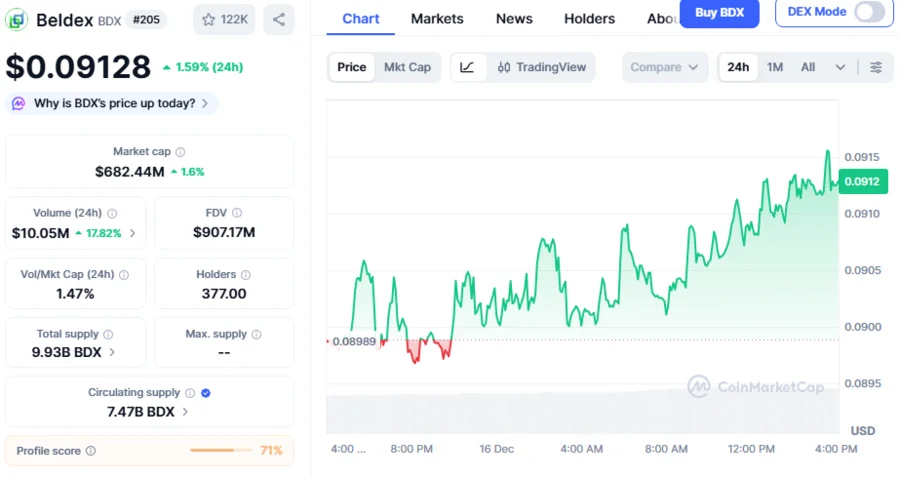

Beldex Price: BDX Token Gains Momentum with Stargate Integration via LayerZero’s OFT Standard

Altcoin Season Index Plummets: A Stark 4-Point Drop to 18 Signals Bitcoin’s Grip