HSBC to bring tokenized deposits to US and UAE as stablecoin race heats up

Global megabank HSBC is doubling down on tokenization over stablecoins as global banks rush to keep pace in the stablecoin race.

HSBC Holdings will start offering tokenized deposits to its corporate clients in the US and the United Arab Emirates in the first half of 2026, according to a Bloomberg report on Tuesday.

The Tokenized Deposit Service (TDS) by HSBC enables clients to send money domestically and abroad in seconds around the clock, said Manish Kohli, HSBC’s global head of payments solutions.

“The topic of tokenization, stablecoins, digital money and digital currencies has obviously gathered so much momentum. We are making big bets in this space,” Kohli said.

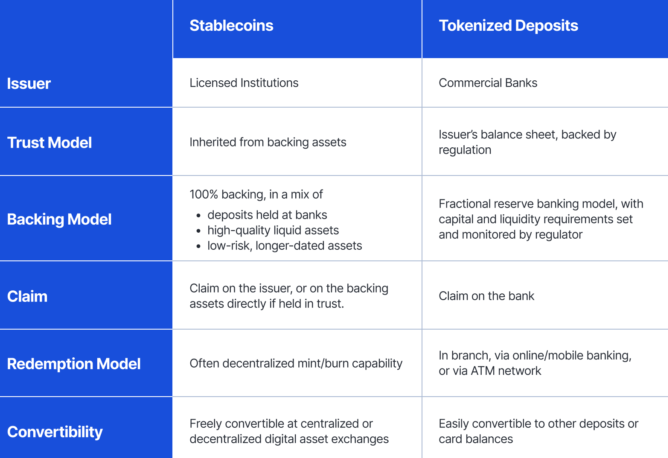

Tokenized deposits versus stablecoins

Tokenized deposits are digital representations of bank deposits issued on a blockchain by regulated banks, allowing for instant 24/7 transfers and programmable payments.

Unlike stablecoins, which are often linked to fiat currencies like the US dollar and backed by assets like government debt, deposit tokens are created using the issuer’s balance sheet.

While stablecoin issuers like Circle are not allowed to pay yields on stablecoin holdings by users, tokenized deposits offer interest payouts among their key features.

According to Kohli, HSBC plans to expand the use cases of tokenized deposits in programmable payments and autonomous treasuries, or systems that deploy automation and AI to independently manage cash and liquidity risk.

“Nearly every large company that we have a conversation with, we are seeing a big theme around treasury transformation,” the HSBC executive said.

HSBC stablecoin launch not ruled out

The product’s expansion in the US and UAE is the latest by HSBC, following its debut of the offering in Hong Kong in May, with Ant International becoming the first client to utilize the TDS solution.

The bank has since expanded the offering in multiple markets, including Singapore, the United Kingdom and Luxembourg.

HSBC’s choice to move forward with tokenized deposits comes amid major banks like JPMorgan doubling down on the technology.

Related: How TradFi banks are advancing new stablecoin models

On Nov. 12, JPMorgan rolled out the JPM Coin, a deposit token representing US dollar deposits at the bank. The company opposed the token to traditional stablecoins, with JPMorgan’s blockchain executive Naveen Mallela highlighting that deposit tokens operate within traditional banking frameworks.

While pushing tokenized deposits, HSBC does not rule out the potential issuance of a stablecoin.

“It’s something that we would continue to evaluate,” Kohli said, adding: “There are a few things that need to happen, which is the legal framework needs to be clearer.”

Magazine: Saylor denies Bitcoin sell-off, XRP ETF debut tops chart: Hodler’s Digest, Nov. 9 – 15

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock CEO Larry Fink reveals sovereign wealth funds are buying Bitcoin for the long term

Two Casascius coins with $2,000 Bitcoin move after 13 years of dormancy

ICP Value Jumps 30% Following Key Network Improvements: Exploring How Protocol Advancements Are Transforming Long-Term Value Outlook for Web3 Infrastructure

- Internet Computer (ICP) surged 30% to $4.71 in November 2025, driven by protocol upgrades and AI-powered smart contracts. - Flux/Stellarator upgrades enhanced storage and sharding, while Chain Fusion enabled cross-chain interoperability with Bitcoin , Ethereum , and Solana . - Institutional adoption and hybrid cloud partnerships boosted DeFi TVL to $237 billion, though dApp engagement dropped 22.4% amid regulatory scrutiny. - Security milestones like Niobium/Magnetosphere fortified governance, yet challe

Crypto Market Loses $400B in Just One Month

The total crypto market cap fell by $400 billion in a month, raising concerns among investors amid rising volatility.Bearish Sentiment Grows Among InvestorsWhat’s Next for the Crypto Market Cap?