Bitcoin Updates Today: Cardone Blends Real Estate and Bitcoin in a Strategic Move to Navigate Market Fluctuations

- Cardone Capital increased Bitcoin holdings to 888 coins while acquiring a $235M Florida multifamily property. - The hybrid strategy combines real estate stability with crypto growth, reinvesting $10M annual property income into Bitcoin. - Grant Cardone emphasized using real estate profits to hedge volatility, with 935 new Bitcoin purchases funded by cash flows. - Institutional Bitcoin adoption grows as Harvard allocates $443M to crypto ETFs, mirroring Cardone's diversified approach. - The model contrasts

Cardone Capital, a real estate investment firm, Announces

Grant Cardone, a prominent figure in real estate, has led Cardone Capital to substantially boost its Bitcoin reserves, now holding 888 coins as part of a strategy that merges property investments with digital assets. This move highlights a rising inclination among investors to broaden their portfolios in response to economic uncertainty and market swings.

The company’s Bitcoin investment plan has recently

Market conditions have remained unpredictable. Bitcoin

Unlike companies focused solely on crypto treasuries,

Analysts have noted mixed market signals. While short-term price swings continue, driven by macroeconomic factors and profit-taking,

This blended investment model is also appealing to international investors looking for diversification. In Hong Kong, affluent families are increasingly interested in mainland China’s electric vehicle, AI, and biotech industries, with some viewing real estate as an entry point

Cardone Capital’s strategy mirrors a wider shift in how assets are allocated. As AI investments reshape the financials of major tech firms and traditional sectors adjust,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s Team and Wall Street Join Forces to Revamp Mortgages, Cryptocurrency, and Around-the-Clock Trading

- Trump's administration collaborates with Wall Street leaders to address rising mortgage rates and inflation through policy reforms and market strategies. - Treasury and Commerce officials emphasize leveraging financial expertise to stabilize housing costs and implement broader economic measures including immigration policies. - Galaxy Digital's crypto growth and Nasdaq's 24/7 trading plans highlight evolving financial innovation amid regulatory challenges and investor reentry into digital assets. - Exten

Hyperliquid News Today: Crypto Volatility with Leverage: Major Players Gain, Bears Suffer Losses

- A "smart money" address (0xbbc0) earned $2.5M profit via 5x leveraged STRK tokens, buying 29.5M at $6.7M. - Same address opened 10x leveraged HYPE position with $2.98M, showing speculative crypto confidence. - Another whale reduced 5x HYPE position to $48.41M but faces $2.02M unrealized loss as of Nov 14. - STRK/HYPE trades highlight leveraged crypto volatility, with HyperLiquid seeing $5M deposits for similar positions.

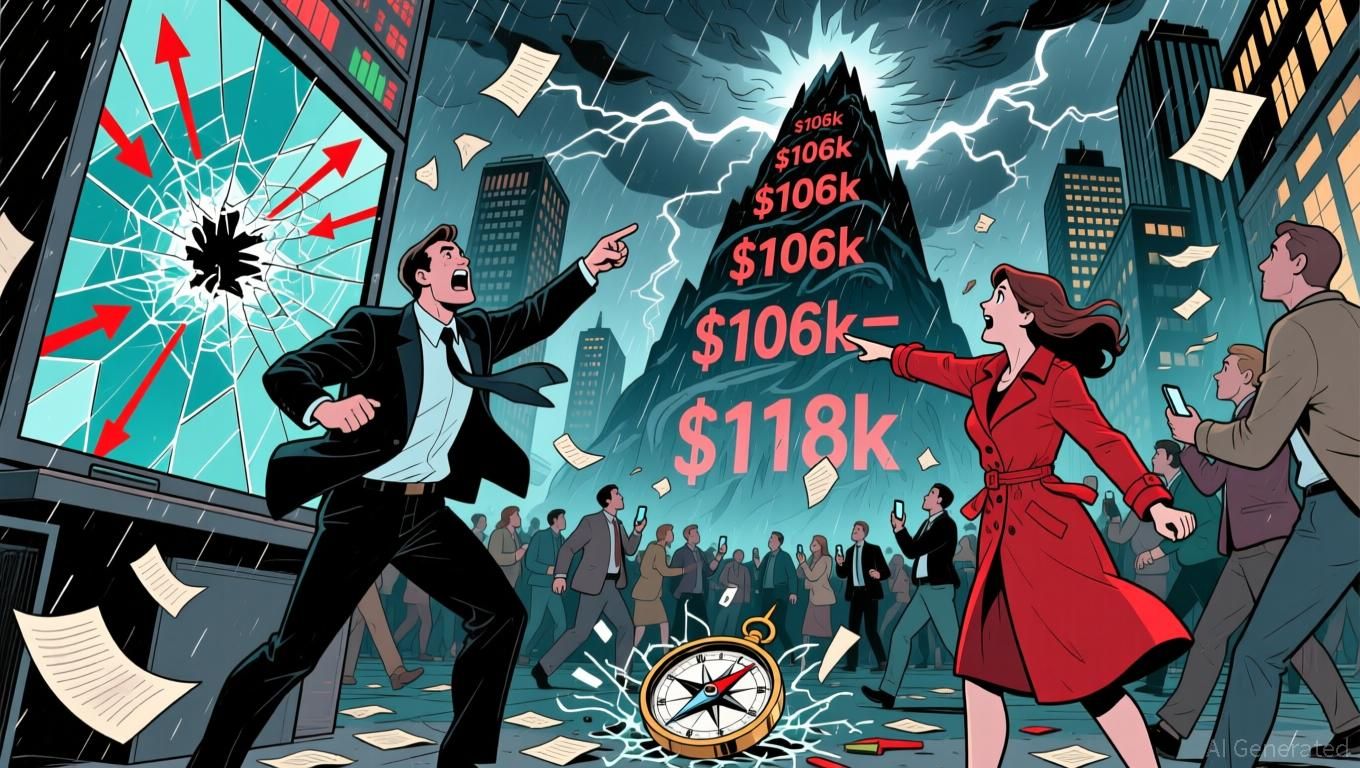

Bitcoin News Today: Spot ETFs See $2.3B Outflow as Bitcoin Faces Potential Fresh Lows

- Cryptocurrency markets plunged in late 2025 as Bitcoin (BTC) and Ethereum (ETH) hit six-month lows amid $2.3B ETF outflows. - Analysts warn BTC could test new price floors, with consolidation resistance between $106,000-$118,000 hindering recovery. - XRP's ETF saw record inflows contrasting BTC/ETH trends, but smaller coins struggle to offset top-tier liquidity drains. - Market capitalization fell to $3.57T with 80/100 cryptos declining, raising concerns about deeper corrections amid weak investor sentim

Hyperliquid News Today: ZEC Surges 25%, Triggering $17 Million in Liquidations and Underscoring Crypto Market Volatility

- A top trader lost $3.28M as Zcash's 25% surge triggered massive short liquidations in 12 hours. - Hyperliquid faced $4.9M losses from a Popcat meme coin trade, with a trader using $3M to open $20M leveraged positions. - Crypto markets show heightened volatility, with cascading liquidations exposing DeFi platforms' risk management gaps. - Regulators scrutinize leveraged trading risks as HYPE token demand declines and futures open interest drops to $1.56B.