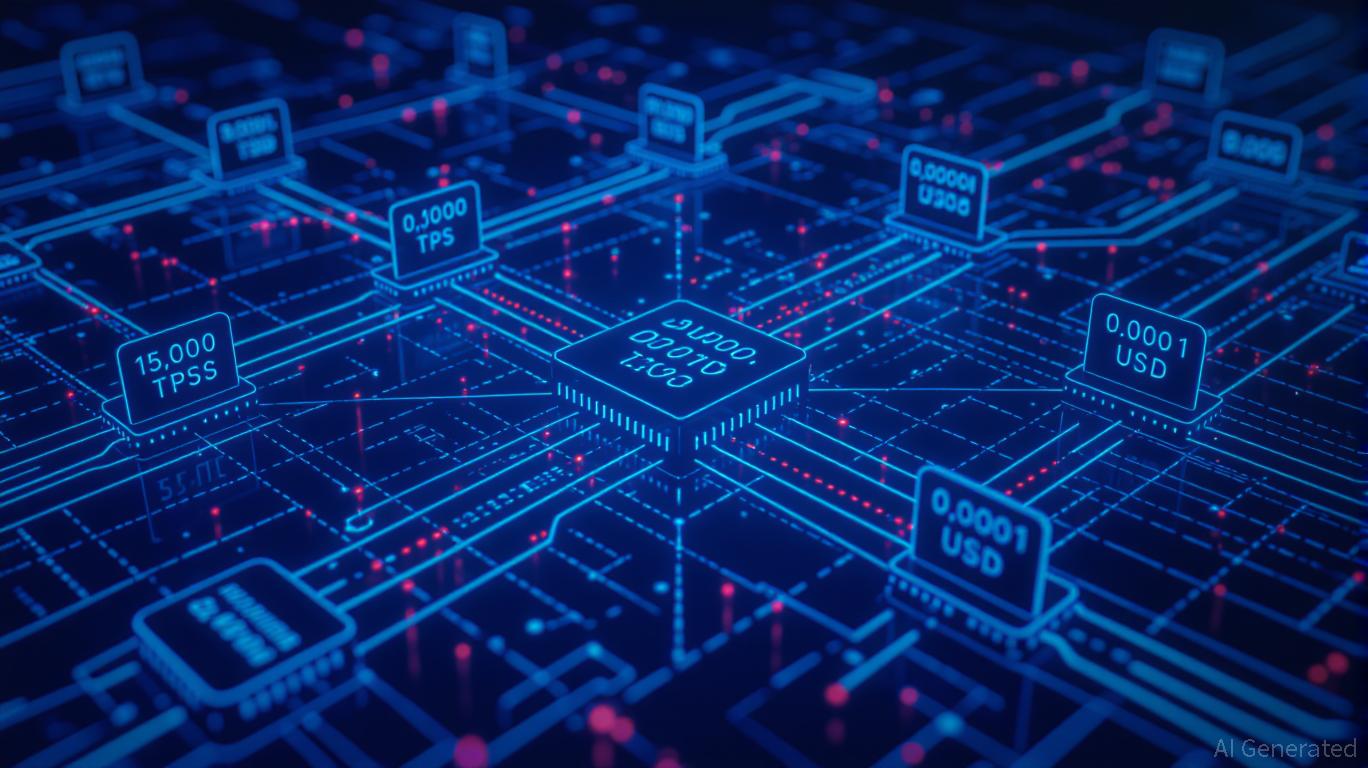

ZK Atlas Enhancement and Its Influence on Layer 2 Scaling

- The ZK Atlas Upgrade (Oct 2025) revolutionized Layer 2 scalability with 15,000+ TPS and $0.0001/tx costs via innovations like Atlas Sequencer and Airbender prover. - Vitalik Buterin's GKR protocol reduced ZK verification costs 10-15x, slashing Ethereum gas fees by 90% and boosting DeFi competitiveness. - ZK ecosystem TVL hit $3.5B by 2025, with $15B in Bitcoin ETF investments and 60.7% CAGR projected for ZK Layer 2 market growth to $90B by 2031. - Institutional adoption accelerated as stablecoins capture

Key Features of the

ZK

Atlas Upgrade

The ZK Atlas Upgrade brought forth three major breakthroughs: the Atlas Sequencer, Airbender prover, and ZKsync OS. Together, these innovations allow ZK protocols to

Importantly, the upgrade also incorporated Vitalik Buterin’s innovation with the GKR protocol, which

Developer Activity and Ecosystem Growth

The ZK Atlas Upgrade has sparked a notable increase in developer participation and ecosystem expansion. Bitget’s research shows that the total value locked (TVL) in ZK rollups—including zkSync,

Metrics on developer engagement further demonstrate the upgrade’s influence. ZKsync Era’s daily and weekly active wallet counts have soared, surpassing many Layer 1 networks. The ZK ecosystem has also

Institutional Adoption and Market Trends

The ZK Atlas Upgrade has propelled institutional involvement, especially within DeFi and stablecoin markets. Stablecoins now represent 30% of all on-chain crypto transaction volume,

Institutional funding has also grown, with spot Bitcoin ETFs channeling $15 billion into ZK-related ventures in 2025. This momentum is projected to persist, with estimates suggesting a 61% increase in institutional crypto allocations by 2026,

Challenges and Risks

Despite its advantages, the ZK Atlas Upgrade is not without obstacles. Regulatory oversight remains a pressing issue, particularly for privacy-oriented coins like Zcash. Furthermore, the technical demands of ZK technology—which require expertise in cryptography and distributed systems—may hinder adoption among smaller development teams.

Future Outlook and Investment Potential

The ZK Atlas Upgrade has established a foundation for scalable and affordable blockchain systems. With Ethereum’s “Lean Ethereum” initiative and the industry’s broader move toward Layer 2, ZK protocols are poised to lead the next wave of crypto growth. Investors should keep an eye on TVL trends, TPS gains, and institutional capital flows.

Nonetheless, prudence is necessary. Although the long-term perspective is optimistic, short-term market swings and regulatory ambiguity could affect returns. Spreading investments across various ZK projects (such as zkSync and StarkNet) and managing privacy coin exposure may help address these risks.

Conclusion

The ZK Atlas Upgrade marks a pivotal point for blockchain scalability. By tackling throughput, expenses, and interoperability, it has opened up new opportunities for DeFi, institutional finance, and international payments. For investors, the upgrade’s success will depend on ongoing developer involvement, regulatory progress, and sustained institutional interest. As the ZK ecosystem evolves, it presents a strong case for long-term investment in the post-upgrade landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Increasing Economic Strain of Alzheimer’s Disease and Its Effects on Healthcare Systems and Long-Term Care Industries

- Alzheimer's disease's global economic burden is projected to surge from $1.6 trillion in 2023 to $14.5 trillion by 2050, straining healthcare systems and public infrastructure. - The Alzheimer's therapeutics market is growing at 23.4% CAGR, driven by disease-modifying therapies and tech innovations like AI-driven care platforms. - Strategic investments in dementia infrastructure include $3.9B U.S. NIH funding and startups like Isaac Health securing $10.5M for in-home memory clinics. - Public-private part

Building Robust Investment Portfolios: Insights Gained from Economic Crises and Policy Actions

Hyperliquid (HYPE) Price Rally: The Role of DeFi Advancements and Investor Sentiment in Driving Recent Market Fluctuations

- Hyperliquid (HYPE) surged to $59.39 in 2025 before retreating, driven by DeFi innovations and volatile market sentiment. - Technical advancements like HyperBFT consensus and USDH stablecoin attracted 73% of decentralized trading volume, while institutional partnerships stabilized the ecosystem. - Despite short-term volatility near $36, bullish RSI patterns and $3 trillion trading volume suggest potential for a $59 rebound, though sustained momentum above $43 is critical. - Analysts project HYPE could rea

The Driving Forces Behind Economic Growth in Webster, NY

- Webster , NY, transformed a 300-acre Xerox brownfield into a high-tech industrial hub via a $9.8M FAST NY grant, boosting industrial and real estate growth. - Public-private partnerships enabled infrastructure upgrades, attracting $650M fairlife® dairy projects and 250 high-paying jobs by 2025. - Industrial vacancy rates dropped to 2%, while residential values rose 10.1% annually, highlighting synergies between infrastructure and economic development. - The model underscores secondary markets' potential