COAI's Latest Price Decline: An Overreaction by the Market and a Chance for Undervalued Investment

- COAI Index plunged 88% YTD in Nov 2025 amid AI/crypto AI sector selloff, driven by C3.ai's leadership turmoil, $116.8M losses, and regulatory ambiguity. - C3.ai's Q1 2025 revenue rose 21% to $87.2M, with 84% recurring subscription income, highlighting resilient business fundamentals despite unprofitability. - AI infrastructure stocks like Celestica (CLS) surged 5.78% as analysts raised price targets to $440, contrasting crypto AI's freefall and signaling market overcorrection. - Regulatory clarity on AI/

The Catalysts: Leadership Changes, Legal Challenges, and Regulatory Uncertainty

The sharp drop in the COAI Index was set off by a combination of negative events. C3.ai, a key player in the AI field, has attracted considerable criticism.

Wider market forces have made the situation worse.

The Fundamentals: Resilient Sector and Revenue Expansion

It’s important not to let the panic overshadow the facts. Despite its losses, C3.ai

It’s also worth noting that the COAI Index is not just a reflection of C3.ai’s performance. It encompasses a wider range of AI and crypto AI initiatives, many still in their early stages. The sector’s current obstacles are significant but likely temporary. Once regulatory guidelines are clarified, substantial growth could follow. For now, the market is reacting as if the worst-case scenario is certain, ignoring the possibilities for progress and adaptation.

Analyst Price Targets: Optimism for AI Infrastructure

This is where things get interesting. While COAI is struggling, another player in the AI infrastructure arena—Celestica Inc. (CLS)—is being recognized for its success.

This trend is not isolated.

The Bottom Line: Seize the Dip, Manage the Risk

The sharp decline in COAI’s value is a textbook example of an overblown market response. The sector’s issues are genuine, but not insurmountable. C3.ai’s numbers show underlying strength, and although regulatory clarity is taking time, it is expected. Meanwhile, the AI infrastructure sector is being rewarded for its reliability and growth prospects.

For those comfortable with risk, COAI now presents an attractive entry point. However, caution is advised.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

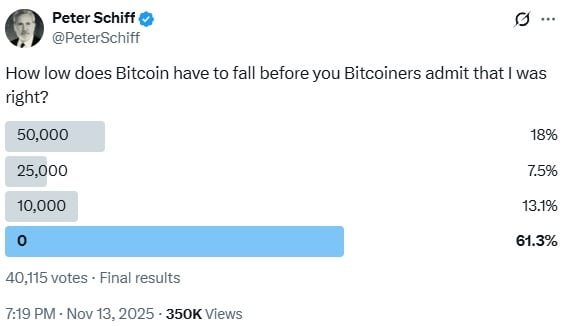

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.