Fed Faces Rate Decision Challenges: Incomplete Data Deepens Policy Disagreements

- U.S. government shutdown disrupted key economic data, delaying Fed's rate decision amid inflation and employment uncertainty. - Fed officials split: Collins and Bostic oppose December rate cuts due to persistent inflation, contrasting with Miran's growth-focused stance. - Market uncertainty rises as CME FedWatch shows 68% chance of 25-basis-point cut, with financial stocks reflecting volatility. - Shutdown reduced Q4 GDP by 1.5pp, while delayed data risks flawed policy decisions and impacts consumer borr

The U.S. economy is approaching a crucial crossroads next week as it deals with the consequences of a two-month government shutdown and growing disagreements within the Federal Reserve regarding interest rate decisions. With the first non-farm payrolls report since the shutdown about to be published, both policymakers and investors are uncertain if the Fed will proceed with a third rate reduction at its December session.

Both the White House and Congressional leaders have admitted that the jobs and consumer price index (CPI) figures for October might never be fully published,

Within the Fed, internal disagreements are becoming more pronounced. Boston Fed President Susan Collins and Atlanta Fed President Raphael Bostic have publicly spoken against a rate cut in December, pointing to persistent inflation and a robust economy. Collins highlighted the difficulties of setting policy when reliable data is lacking,

Market volatility has increased as the Fed’s lack of consensus leaves investors uncertain. The CME FedWatch Tool

The wider economic effects of the shutdown continue to be felt.

As the Fed maneuvers through these challenges, its December meeting will be a crucial test of its ability to manage inflation while supporting economic stability. The results of this meeting could influence the direction for 2026, especially as Fed Chair Jerome Powell’s term is set to end in May 2026

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

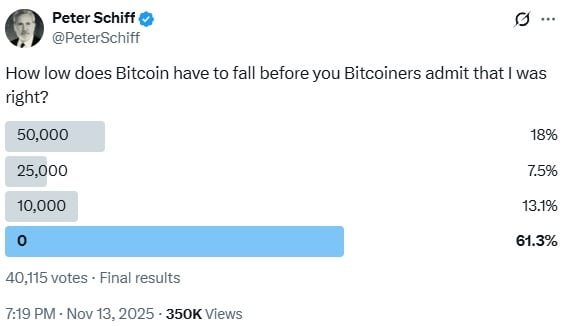

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.