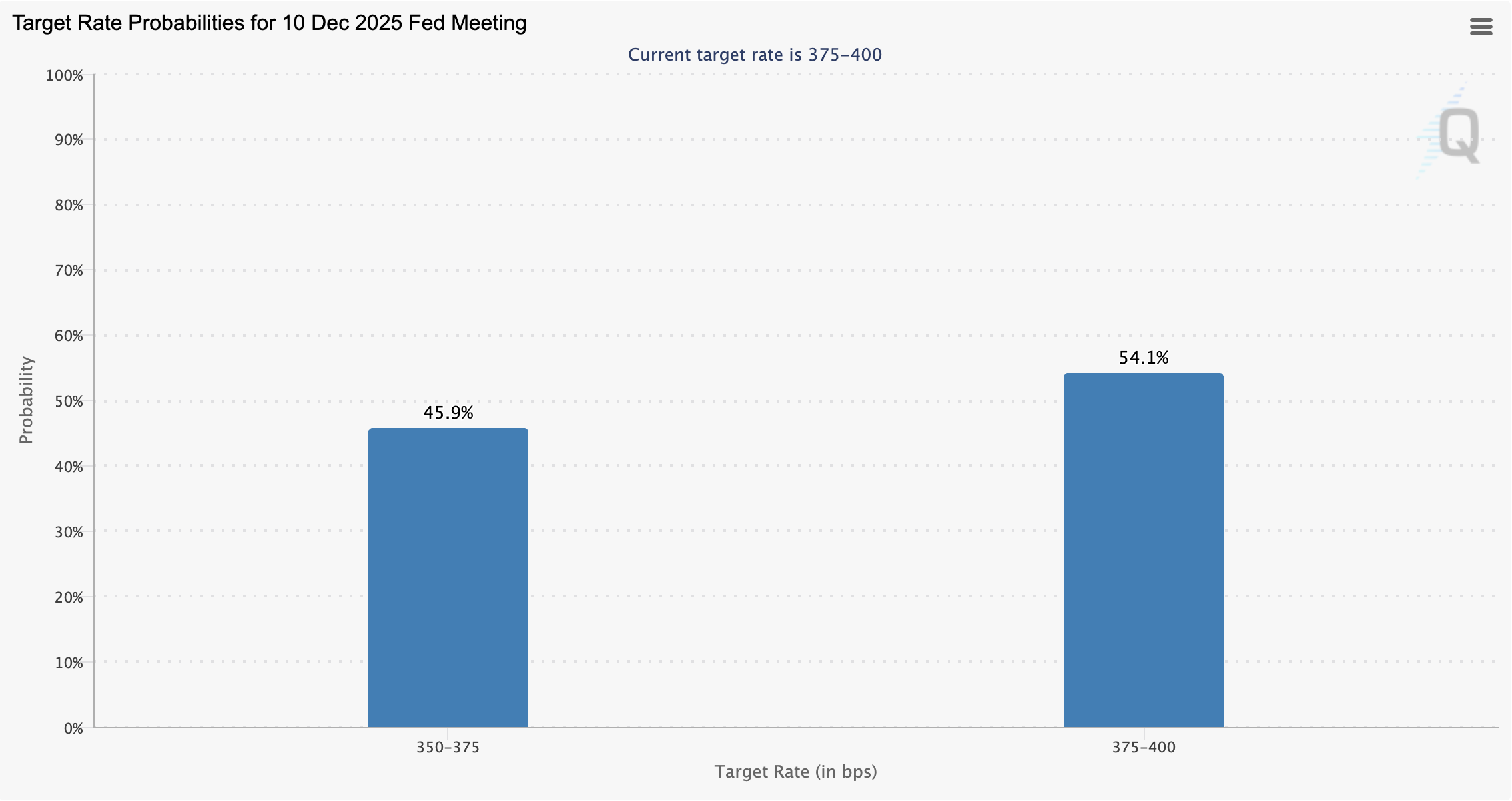

Probability of December interest rate cut falls below 50%

Only 45.9% of investors anticipate an interest rate cut at the next US Federal Open Market Committee (FOMC) meeting in December, amid declining market sentiment and a downturn in the cryptocurrency market.

The odds of a 25 basis point (BPS) interest rate cut in December were nearly 67% on Nov. 7, according to data from the Chicago Mercantile Exchange (CME) Group.

In September, several banking institutions forecast at least two interest rate cuts in 2025, with market analysts at investment banking company Goldman Sachs and banking giant Citigroup each projecting three 25 BPS cuts in 2025.

Interest rate decisions influence crypto prices. Lower interest rates translate into more liquidity flowing into asset markets and propping up prices, while higher rates mean liquidity and prices will be constrained.

The declining odds of a December rate cut are feeding negative market sentiment and may signal that more short-term price pain is coming to the crypto market until the Federal Reserve resumes easing rates.

Related: Stablecoin demand is growing, and it can push down interest rates: Fed’s Miran

Federal Reserve’s Jerome Powell casts doubt on a December rate cut

“There were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it. Policy is not on a preset course,” Federal Reserve Chair Jerome Powell said in October.

As expected, the Federal Reserve slashed rates by 25 BPS in October; however, crypto prices extended their decline following the lowered rates.

The October rate cut was “fully priced in” by investors, who widely anticipated the cut months ahead of time, according to Matt Mena, a market analyst at investment company 21Shares.

Economist and former hedge fund manager Ray Dalio warned that the Federal Reserve is cutting rates into record-high asset prices, relatively low unemployment and low credit spreads, a historic anomaly.

In November, Dalio said the Federal Reserve is likely stimulating the economy into a bubble, adding that this is a feature typical of debt-laden economies headed toward hyperinflation and currency collapse.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: DeFi Faces Liquidity Challenges Amid Bitcoin Falling Under $100K

- Bitcoin's drop below $100K triggered DeFi liquidity crises, with $650M in leveraged positions liquidated as automated stop-losses activated. - Wrapped Bitcoin (WBTC) integrated with Hedera blockchain to reduce MEV and frontrunning, aiming to inject liquidity into DeFi protocols. - Hyperion DeFi reported 60% MoM validator growth and new partnerships, emphasizing staking yields over leveraged positions to avoid market volatility. - Analysts like Tom Lee predict 6-8 weeks for recovery, contingent on stabili

Assessing How Recent Ecosystem Enhancements Influence Trust Wallet Token (TWT) Price Forecasts

- Trust Wallet's Q4 2025 upgrades expanded TWT's utility through FlexGas (gas fee payments) and Trust Premium loyalty incentives, transforming it from governance to transactional token. - TWT surged 129% to $1.6 by October 2025, fueled by Binance CZ's endorsement and institutional validation of its ecosystem-driven value proposition. - The token's growth aligns with multi-token economy trends, emphasizing cross-utility, stability, and transparency through fixed supply models and public audits. - While regu

Astar (ASTR) Price Rally: Cross-Chain Compatibility Fuels Altcoin Value Growth

- Astar (ASTR) surged in late 2025 due to strategic blockchain interoperability advancements and partnerships. - Collaboration with HTX includes TGE Catalyst Grants, listing acceleration, and CEX partnerships to boost DeFi adoption. - Astar 2.0's zkEVM and CCIP integration achieved 150,000 TPS, targeting 300,000 TPS by 2025 with enterprise partnerships. - Interoperability-driven projects like Astar are reshaping altcoin valuations, aligning with growing institutional DeFi demand.

Astar 2.0 Debut and Its Impact on the Blockchain Landscape

- Astar 2.0 emerges as a strong contender in institutional blockchain adoption through Polkadot-based scalability and interoperability innovations. - Institutional confidence grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Astar's 6-second block time, 150k TPS throughput, and Chainlink CCIP integration contrast with Bitcoin/Ethereum's scalability struggles and ETF outflows. - Projected $0.80–$1.20 ASTR price by 2030 hinges on Evolution Phase