Aztec Public Sale: Will Anyone Foot the Bill After 7 Years of Waiting?

A Quick Look at Auction Details and Tokenomics

Original Article Title: "Aztec: Will Anyone Join After 7 Years of Waiting?"

Original Article Author: 1912212.eth, Foresight News

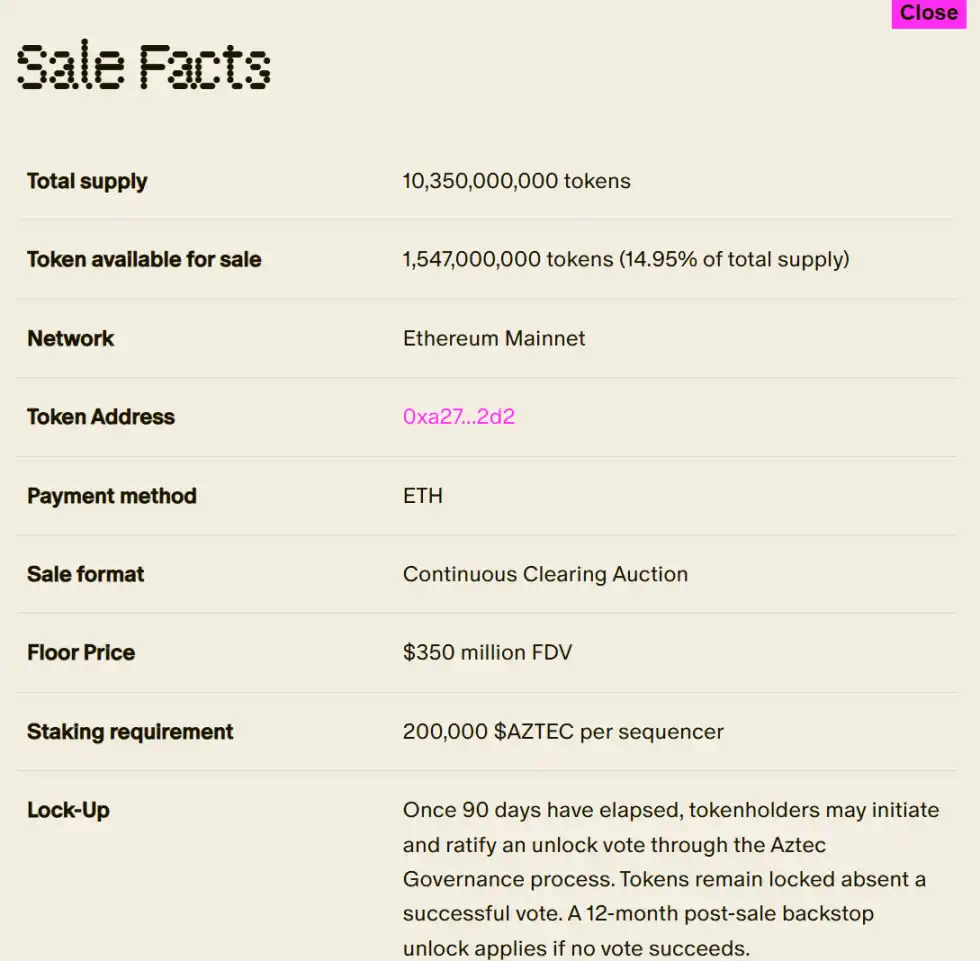

On November 13, the zero-knowledge privacy technology project Aztec announced the launch of the AZTEC token, with a total of 15.47 billion tokens, accounting for 14.95% of the total supply, and accepting ETH as payment. Regarding the mechanism, the project stated that it would prioritize real-time price discovery and fair participation opportunities. The initial price was set at a $3.5 billion FDV, approximately 75% lower than the implied network valuation based on the latest equity financing. Participants could mint Soul-Bound NFTs to confirm their participation status.

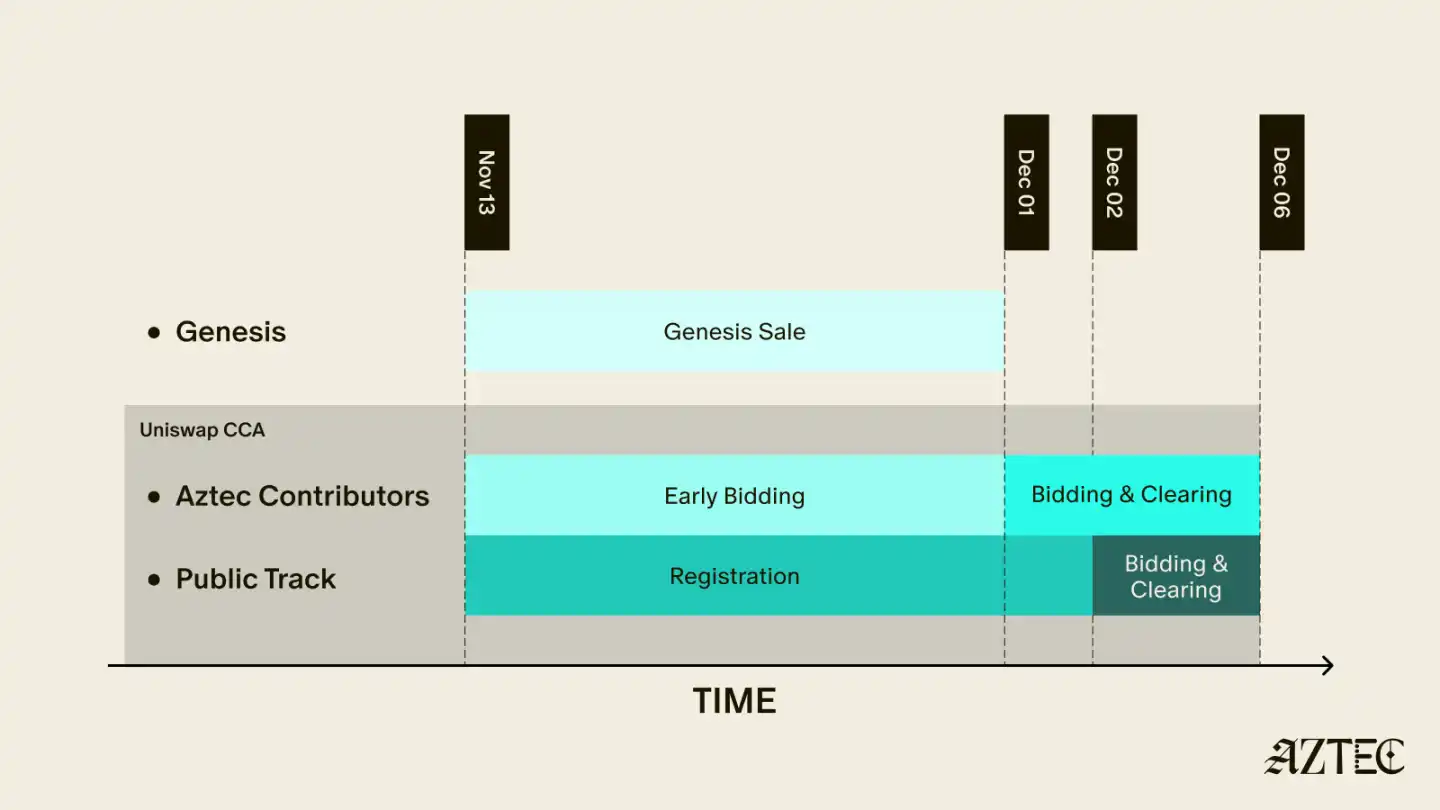

Registration and bidding for early participants will start today (November 13) at 3 p.m. (CET), with early participants enjoying a day of exclusive early access before opening bidding to the public. On December 1, AZTEC will be distributed to contributors and Genesis bidders; on December 2, all NFT holders can participate in the auction bidding.

The public auction will take place from December 2 to December 6, 2025, during which tokens can be withdrawn and staked.

This offering does not have an airdrop phase and does not have a special allocation mechanism. Over 300,000 addresses have been whitelisted, and these addresses will qualify for first-day participation. The event is open to global users, including U.S. citizens.

Contributor Qualification Verification Rules

Participants who have been involved in one or more of the following:

· Aztec testnet sequencers and verifiers

· ETH solo stakers, including selected StakeCat ETH operators, Obol Silver, Rocketpool, LidoCSM, and Stakers Union.

· zk.money users

· Active community members

· Uniswap traders (selecting 3000 from the past 30 days' active traders)

· Nansen's Ice, North, and Star tiers.

This also includes Genesis Sorter Nodes, as well as top 200 high-quality node operators who have demonstrated exceptional performance on the Aztec testnet.

Auction Method: Continuous Clearing Auction Protocol

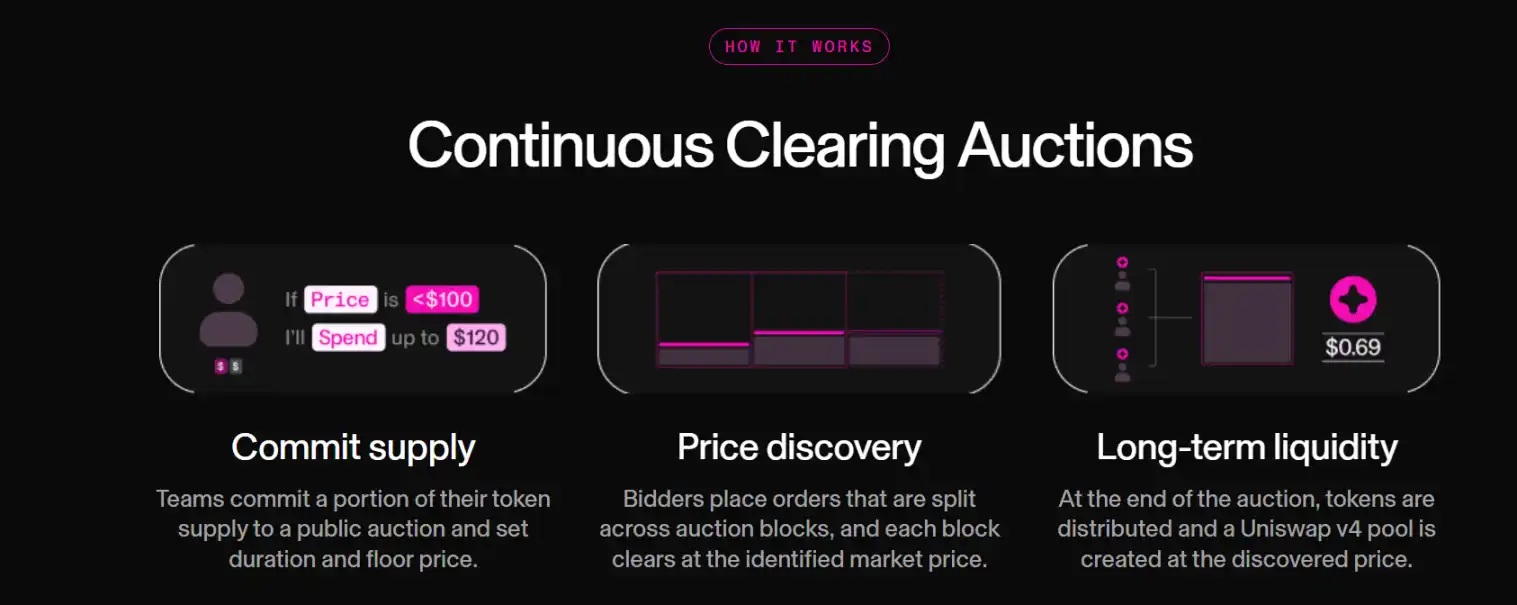

Uniswap has announced the launch of the "Continuous Clearing Auction Protocol (CCA)," a customizable protocol designed to bootstrap liquidity and token issuance on Uniswap v4. The protocol, designed in partnership with Aztec, features a ZK Passport module to enable private and verifiable participation.

The team commits a portion of token supply to a public auction with a set duration and reserve price. Bidders participate in price discovery, with their orders being split in the auction block and settled at the agreed-upon market price.

Upon the conclusion of the Continuous Liquidity Auction, tokens will be distributed, and a Uniswap V4 liquidity pool will be created at the discovered price.

Tokenomics

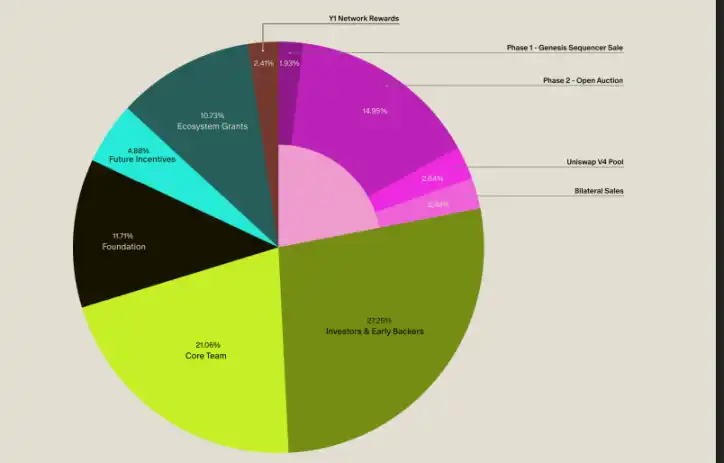

The Aztec whitepaper reveals that the total initial supply of AZTEC is 10,350,000,000 tokens, distributed as follows: 27.26% allocated to investors and early supporters, 21.06% allocated to the core team, 11.71% allocated to the foundation, 10.73% allocated to ecosystem grants, 14.95% allocated to Phase 2 public auction, 1.93% allocated to Phase 1 Genesis Sorter Sale, 2.44% allocated to Bilateral Sales, 2.64% allocated to Uniswap V4 Liquidity Pool, 4.89% allocated to future incentives, and 2.41% allocated to Y1 Network Rewards.

The total allocation accounts for 21.96%, equivalent to 2,272,500,000 tokens. These tokens will be held by token holders and the foundation at launch.

The token features include

· Sorter Staking: The token will be used for securing the network through staking by Aztec validators, known as "sorters," who are responsible for block generation on the Aztec network. Token holders not operating as sorters can choose to delegate their tokens to sorters.

· Governance: Token holders can participate in the governance of the Aztec Network ("Aztec Governance").

· Execution Environment: If the network is upgraded in the future through Aztec Governance to support a smart contract execution environment, the token will be used to pay transaction fees on the Aztec Network.

12 months after the start date of the token (November 13, 2025)

· Aztec Governance may adjust the total token supply, including issuing additional tokens annually up to a certain percentage cap;

· If the execution environment is enabled, transaction fees may be adjusted through a self-governed mechanism similar to Ethereum's EIP-1559.

Upon completion of the process, the Uniswap v4 liquidity pool may provide secondary market liquidity, with the foundation planning to inject 273 million tokens into the pool. The contract will automatically inject the corresponding tokens into the liquidity pool based on the ETH ratio paid by the purchasers. The liquidity pool will be controlled by Aztec Governance and will be locked in an immutable smart contract for at least 90 days after launch, with the option to lift the restriction through governance voting thereafter. Additionally, the token may be listed for trading on other decentralized exchange protocols or centralized exchanges.

7-Year Wait

Since the end of 2018, Aztec completed a $2.1 million seed funding round, followed by another funding round in September 2019. In January 2020, the Aztec Network went live. Amidst the ZK zero-knowledge and L2 craze, in December 2021, a $17 million Series A funding round was completed with Paradigm as the lead investor and participation from celebrities like Vitalik. Subsequently, in December 2022, a $100 million Series B funding round was completed with a16z leading the round.

However, the lineup of prestigious investors did not result in the growth of the protocol.

In March 2023, the Aztec Network announced the gradual shutdown of the DeFi privacy bridge project Aztec Connect. It would disable deposits into the Aztec Connect contract from zk.money and other frontends (such as zkpay.finance) and completely abandon the Aztec Connect contract a year later, ceasing all Rollup functionalities. The decision was primarily driven by business considerations, according to its leadership.

In May 2025, it launched its public testnet, initially attracting many airdrop enthusiasts. However, the recent release of the tokenomics revealed that Aztec did not have any airdrop allocation.

BTC has fallen below $100,000, signaling a market downturn. The extent to which investors will step in to buy the dip remains uncertain, posing a real test for Aztec.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Major Whale Faces Uncertainty on $95M BTC Position Amid $327M in Crypto Liquidations Due to Market Volatility

- $327M in crypto positions liquidated, driven by longs as a whale buys 1,000 BTC ($95.3M) on Hyperliquid. - BTC volatility pushes price below $95K, exposing $5.52B in leveraged exposure with $159M in long losses. - Crypto slump sees $492M ETF outflows, 1.5% ETH drop, and 2.2% SOL decline amid AI stock concerns. - Tether invests €1B in German robotics firm Neura, expanding beyond stablecoins into AI and real-world assets. - Japan and UK introduce stablecoin regulations as macroeconomic uncertainty amplifie

Bitcoin News Today: Harvard Invests $442M in IBIT—Traditional Finance Turns to Bitcoin for Portfolio Diversification

- Harvard triples stake in BlackRock's IBIT to $442.8M, becoming top institutional holder. - Bitcoin ETFs attract $60.8B in inflows since 2024, with BlackRock's IBIT dominating the market. - Harvard's move reflects institutional shift toward crypto as inflation hedge despite volatility. - Analysts highlight Bitcoin's scarcity and regulatory clarity as key drivers for portfolio diversification. - Brown University and others may follow, signaling broader adoption of Bitcoin ETFs.

Solana News Update: Solana ETFs Attract $370 Million Despite 34% Price Drop—Institutional Optimism Defies Negative Sentiment

- Solana ETFs attracted $370M in 13 days despite 34% price drop, driven by Bitwise and Grayscale products. - Institutional inflows contrasted broader crypto outflows as technical indicators signaled bearish sentiment below $140. - NYSE launched Solana ETF options, intensifying altcoin ETF competition with VanEck's regulatory filings. - Diverging ETF demand and price weakness raised sustainability concerns amid declining retail enthusiasm.

XRP News Today: "Hakimi Coin Surges 50% Driven by Retail Hype, Yet Core Value Still Unclear"

- Hakimi Coin (HAKIMI) surged 50% to $40M market cap on Nov 15, 2025, fueled by Canary XRP ETF's $58M debut. - The rally contrasts with broader crypto declines, as speculative retail traders favor high-growth altcoins over fundamentals. - Analysts warn of volatility due to HAKIMI's opaque use cases and lack of project updates, despite regulatory shifts under Trump. - Other ETFs like Bitwise's Solana also saw strong volume, but experts caution rapid gains may not sustain without clear utility.