Bitcoin Updates: Senate Concludes 43-Day Stalemate—Crypto Markets Recover, ETFs Await Approval

- U.S. Senate passes funding bill to end 43-day government shutdown, awaiting House approval to restart SEC/CFTC operations by Thursday. - Crypto markets surge with Bitcoin up 1.8% as ETF reviews and enforcement actions resume, ending regulatory limbo for the sector. - Stablecoin infrastructure gains traction: Circle's USDC blockchain attracts Deutsche Börse, OwlTing reports $19.4B in 2025 payment volumes. - Grayscale files for GBTC IPO while CLARITY Act revival looms, signaling institutional confidence am

After 43 days of halted regulatory processes and stagnant crypto markets due to the U.S. government shutdown, a resolution seems imminent as the Senate approved a funding measure on Monday. The bill, which received support from both parties, now heads to the House for a vote, with experts anticipating a swift conclusion. Should the legislation pass both chambers, the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) could be back in action as soon as Thursday,

The conclusion of the shutdown would represent a significant shift for the digital asset industry, which has been in a state of regulatory uncertainty since October. During the shutdown, the SEC and CFTC

Stablecoin infrastructure is also in the spotlight as companies seek to benefit from increasing payment activity. OwlTing, a provider of stablecoin infrastructure,

The reopening of the government may also speed up progress on the CLARITY Act, a long-delayed legislative framework for crypto regulation. Although the bill’s future is still unclear,

As the House gets ready to vote on the funding bill,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The community shapes the future of blockchain gaming with SACHI

- SACHI launches "The Origin" NFT event (200 exclusive OGs) to precede $SACHI token launch, offering early access and in-game perks. - CEO Jonas Martisius emphasizes NFTs as symbols of early support, fostering community engagement ahead of November 19 TGE. - Limited availability and "Origin" status incentives aim to drive exclusivity and loyalty in blockchain gaming ecosystem. - SACHI's vision integrates blockchain to create a self-sustaining gaming universe with tokenized rewards for player contributions.

SACHI's NFTs Mark the Beginning of a Player-Led Revolution in Blockchain Gaming

- SACHI launched "The Origin," a 200-NFT mint event granting early access to its blockchain gaming platform and future rewards. - The NFTs, called "SACHI OGs," symbolize early participation and offer exclusive perks like "Origin" status and visibility across official channels. - By integrating blockchain, SACHI aims to create a self-sustaining economy where players become stakeholders through tokenized rewards and digital identity markers. - Analysts predict the limited NFT supply could drive secondary mar

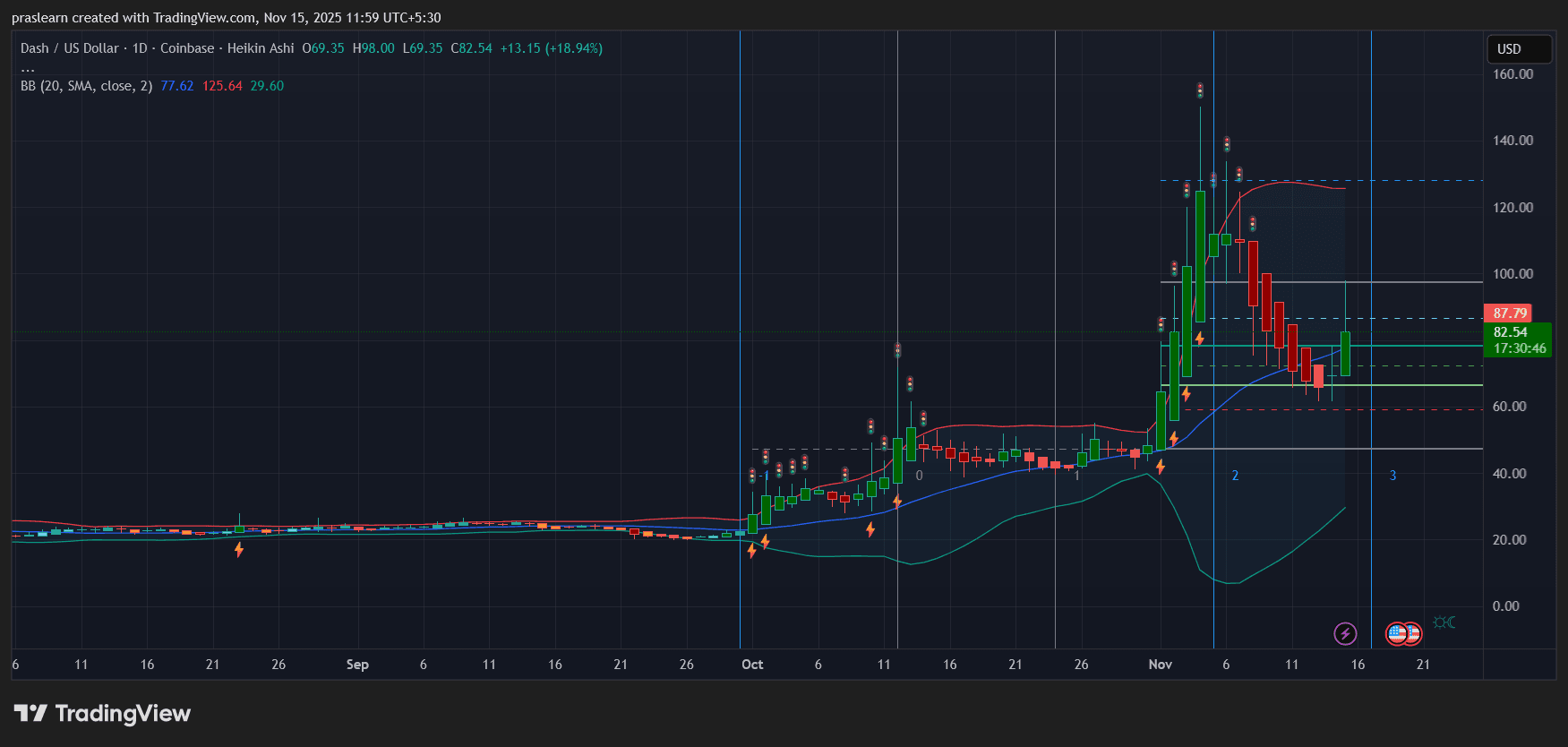

Zcash vs Dash: Which Privacy Coin Looks Stronger As Markets React to Tariff Relief?

Nigeria's Embedded Finance Experiences Rapid Growth Amidst Reforms and International Oil Market Uncertainties

- Nigeria's embedded finance market is projected to reach $4.34 billion by 2025 with a 12.2% CAGR, driven by digital adoption in e-commerce, healthcare , and education. - Economic reforms under President Tinubu led S&P to upgrade Nigeria's credit outlook to "positive," while Moody's raised its rating to "B3" in May 2025. - Fiscal challenges persist as Nigeria raised $2.35 billion via Eurobonds to address 2025 budget deficits amid global oil price volatility and implementation hurdles. - Fintech growth acce