Solana in the Shade: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

The word "solana" in Spanish means sunshine or sunny place, and that's a perfect description for exchange-traded funds (ETFs) based on the programmable blockchain Solana's native token, sol SOL$156,34.

Investors have been channeling funds into U.S.-listed spot SOL ETFs even as they withdraw capital from their bitcoin BTC$103.539,43 and ether ETH$3541,12 counterparts. Since their late October debuts, Bitwise and Grayscale’s spot SOL ETFs have seen cumulative net inflows of $368.5 million while bitcoin and either ETFs suffered outflows exceeding $700 million each, SoSoValue data shows.

Traders don't seem to have noticed the difference, and have kept SOL under pressure alongside the two largest cryptocurrencies and the broader crypto market in the past 24 hours. The solana-ether (SOL/ETH) ratio on Binance extended its multiweek decline today, falling to the lowest level since August, while the SOL/BTC ratio remains at recent lows.

Bitcoin, for its part, has struggled to gain upward momentum despite holding above the key $100,000 support level amid mixed signs of renewed spot demand.

In the past 24 hours, BTC has remained between $101,000 and $104,000, even as smaller altcoins like FIL, UNI, NEAR and WLFI posted gains. Ether moved mostly sideways near $3,500. Meanwhile, the CoinDesk DeFi Select Index and Metaverse Select Index lost 6% and 4.2%, respectively.

In key news, the U.S. House passed legislation to end a record 41-day government shutdown, releasing back pay and restarting federal spending. Timothy Misir, head of research at BRN, said the reopening will unlock nearly $40 billion in deferred liquidity over the next month. How much will flow into risk assets like crypto remains to be seen.

In traditional markets, the yen dropped to a record low against the euro after Prime Minister Sanae Takaichi urged the central bank to "go slow" on interest-rate increases.

This dovetails with market expectations of another quarter-point Fed rate cut next month. Yet bitcoin is failing to rally in response, a stark contrast to past bullish reactions to rate cut speculations. Is stimulus fatigue setting in? Only time will tell. Stay alert.

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Nov. 13, market open: Canary Capital's "Canary XRP ETF", the first pure spot XRP ETF to register under the U.S. Securities Act of 1933, is expected to start trading on Nasdaq under the ticker XRPC.

- Nov. 13, market open: Leap Therapeutics begins trading as Cypherpunk Technologies Inc. on Nasdaq with a new ticker CYPH, following a Nov. 12 announcement of a $50 million Zcash ZEC$506,35 treasury strategy and company rebrand.

- Macro

- Nov. 13, 7 a.m.: Brazil Sept. Retail Sales YoY Est. 2%, MoM Est. 0.3%.

- Earnings (Estimates based on FactSet data)

- Nov. 13: Hyperion Defi (HYPD), post-market, N/A.

- Nov. 13: Bitfarms Ltd (BITF), pre-market, -$0.02.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- CoW DAO is voting to replace the fixed solver reward cap with a dynamic one tied to protocol fees and to introduce a 2 basis-point (0.02%), volume-based fee. Voting ends Nov. 13.

- ShapeShift DAO is voting to approve $35,330 USDC for its 2026 retreat in Hawaii, covering a $27,330 venue reimbursement and an $8,000 stipend for contributor flights. Voting ends Nov. 13.

- Arbitrum DAO is voting to grant current AGV Council members a one-time 90,000 ARB bonus, funded from AGV's existing budget, to compensate for their heavier-than-expected startup workload. Voting ends Nov. 13.

- Unlocks

- Nov. 13: AVAX$17,29 to unlock 0.33% of its circulating supply worth $27.14 million.

- Nov. 13: CHEEL$0.6529 to unlock 2.95% of its circulating supply worth $13.06 million.

- Token Launches

- Nov. 13: Planck (PLANCK) to be listed on Binance, HTX, Gate, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 3 of 3: Mining Disrupt Conference (Dallas)

- Day 2 of 2: Cardano Summit 2025 (Berlin)

- Day 2 of 3: Blockchain Summit Latam 2025 (Medellin, Colombia)

- Nov. 13: Canadian Bitcoin Consortium's 5th Annual Summit (Toronto)

- Nov. 13: Digital Asset Investment Event (Amsterdam)

- Day 1 of 2: Bitcoin Amsterdam

Market Movements

- BTC is up 0.85% from 4 p.m. ET Wednesday at $102,785.04 (24hrs: -1.83%)

- ETH is up 1.75% at $3,482.55 (24hrs: -1.08%)

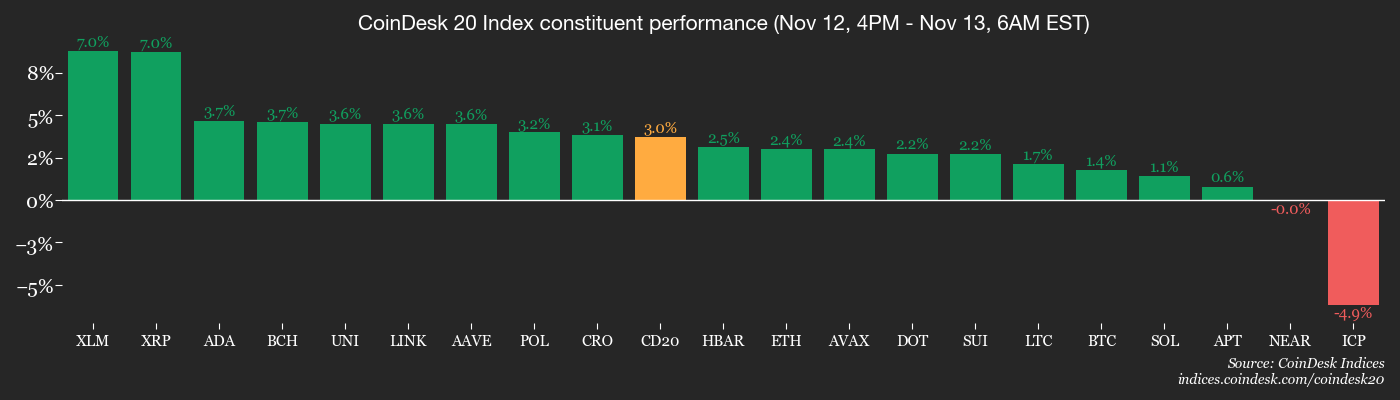

- CoinDesk 20 is up 2.04% at 3,368.95 (24hrs: -0.81%)

- Ether CESR Composite Staking Rate is down 7 bps at 2.86%

- BTC funding rate is at 0.0059% (6.459% annualized) on OKX

- DXY is down 0.19% at 99.31

- Gold futures are up 0.49% at $4,234.10

- Silver futures are up 0.67% at $53.81

- Nikkei 225 closed up 0.43% at 51,281.83

- Hang Seng closed up 0.56% at 27,073.03

- FTSE is down 0.42% at 9,870.02

- Euro Stoxx 50 is up 0.19% at 5,798.45

- DJIA closed on Wednesday up 0.68% at 48,254.82

- S&P 500 closed unchanged at 6,850.92

- Nasdaq Composite closed down 0.26% at 23,406.46

- S&P/TSX Composite closed up 1.38% at 30,827.58

- S&P 40 Latin America closed down 0.97% at 3,145.09

- U.S. 10-Year Treasury rate is up 0.9 bps at 4.088%

- E-mini S&P 500 futures are unchanged at 6,871.00

- E-mini Nasdaq-100 futures are unchanged at 25,600.00

- E-mini Dow Jones Industrial Average Index are up 0.04% at 48,389.00

Bitcoin Stats

- BTC Dominance: 59.77% (-0.22%)

- Ether-bitcoin ratio: 0.03391 (0.94%)

- Hashrate (seven-day moving average): 1,081 EH/s

- Hashprice (spot): $42.75

- Total fees: 2.61 BTC / $268,962

- CME Futures Open Interest: 138,410 BTC

- BTC priced in gold: 24.4 oz.

- BTC vs gold market cap: 11.46%

Technical Analysis

- SOL has established a series of lower highs and lower lows since mid-September in a sign of strengthening bearish trend.

- Prices are now holding on to the 61.8% Fibonacci retracement line, the so-called golden ratio widely tracked by traders.

- An acceptance below this level could embolden bears, potentially yielding a deeper slide to $129.

Crypto Equities

- Coinbase Global (COIN): closed unchanged on Wednesday at $304, +0.58% at $305.76 in pre-market

- Circle Internet (CRCL): closed at $86.3 (-12.21%), +2.67% at $88.60

- Galaxy Digital (GLXY): closed at $31.27 (+1.72%), +0.64% at $31.47

- Bullish (BLSH): closed at $45.5 (+0.24%), -0.88% at $45.10

- MARA Holdings (MARA): closed at $14.41 (-1.5%), -0.35% at $14.36

- Riot Platforms (RIOT): closed at $15.46 (-4.21%)

- Core Scientific (CORZ): closed at $16.44 (-5.08%)

- CleanSpark (CLSK): closed at $13.33 (-5.09%), +0.23% at $13.36

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $47.73 (-4.64%)

- Exodus Movement (EXOD): closed at $19.91 (-6.48%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $224.61 (-2.91%), +0.45% at $225.62

- Semler Scientific (SMLR): closed at $25.73 (-5.92%), -3.23% at $24.90

- SharpLink Gaming (SBET): closed at $11.57 (+0.09%), +3.89% at $12.02

- Upexi (UPXI): closed at $3.38 (+5.3%), +1.48% at $3.43

- Lite Strategy (LITS): closed at $2.01 (-3.37%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$278.1 million

- Cumulative net flows: $60.19 billion

- Total BTC holdings ~1.34 million

Spot ETH ETFs

- Daily net flows: -$183.7 million

- Cumulative net flows: $13.59 billion

- Total ETH holdings ~6.53 million

Source: Farside Investors

While You Were Sleeping

- Japan Exchange Looks at Ways to Curb Crypto Hoarding Firms (Bloomberg): The market operator is weighing tougher reverse-takeover rules and new audits after losses in bitcoin-treasury shares. Three listed companies have paused planned crypto purchases since September amid heightened scrutiny.

- How Bitcoin and XRP Traders Are Positioning Themselves in a Choppy Market Environment (CoinDesk): Deribit data shows large BTC traders are employing non-directional options strategies like strangles and straddles to benefit from volatility, while XRP block flow points to bias for volatility compression.

- Yen Sinks to Record Low vs Euro as Japan PM Touts Slow Rate Hikes (Reuters): After the newly elected leader urged a cautious approach to tightening and closer central bank coordination, markets put 22% odds on a December quarter-point move, rising to 43% by January.

- UK Economy Unexpectedly Contracted by 0.1% in September (Financial Times): A cyber attack on Jaguar Land Rover cut auto output 28.6%, dragging activity lower, while swaps imply 83% odds of a December Bank of England cut after weak jobs data.

- Firm Behind First U.S. Spot XRP ETF Files for MOG Fund (CoinDesk): On Wednesday, Canary Capital proposed an exchange-traded product tracking a TikTok-born cat meme token on Ethereum, a $170 million asset ranked 339 that has fallen 78% over the past year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Investors Consider XRP ETF Prospects Versus Presale Options

- XRP consolidates between $2.39-$2.41 in late 2025 amid mixed market sentiment, with analysts debating its breakout potential and $1.90 support level significance. - Pending XRP ETF approvals could inject $3-8B in capital, pushing price toward $2.50-$2.80 if SEC clears Bitwise, Franklin Templeton, and 21Shares applications. - XRP defies broader crypto outflows with $28M weekly inflows and $2.4B AUM, contrasting Bitcoin/Ethereum's $1.37B combined outflows despite subdued open interest at $3.36B. - Presale

Bitcoin News Update: Crypto Takes a New Turn as DeFi's Core Strengths Surpass the Hype-Fueled Phase

- Crypto market shifts focus to DeFi fundamentals as altcoins like Plug Power , Hyperion, and Mutuum show strong financial growth and innovation. - Plug Power reports $177M Q3 revenue and $370M funding, targeting EBITDAS-positive results by mid-2026 despite $363.5M net loss. - Hyperion DeFi achieves $6.6M net income via HYPE token treasury, leveraging Hyperliquid's 70ms block time for transparent trading and dApps. - Mutuum's $18.7M presale and 250% token price surge highlight DeFi lending growth, while Bi

ZEC Rises 5.93% in 24 Hours as Privacy Coins Experience a Surge

- Zcash (ZEC) surged 5.93% to $524.73 on Nov 13, 2025, despite a 10.98% weekly decline, driven by long-term gains of 32.18% monthly and 850.45% yearly. - Cypherpunk Technologies (formerly Leap Therapeutics) rebranded to focus on ZEC, purchasing 203,775 ZEC ($50M) or 1.25% of circulating supply, with Winklevoss Capital leading a $58.88M funding round. - The firm restructured leadership, appointing Khing Oei and Will McEvoy, and rebranded its ticker to CYPH , emphasizing ZEC’s privacy-centric zk-SNARKs techn

XRP News Update: Regulatory Hurdles Challenge XRP’s ETF Surge—Is $10 Within Reach?

- XRP gains traction as Canary Capital's ETF generates $46M in debut trading, signaling institutional interest. - Crypto.com CEO predicts $8B in ETF inflows for XRP, highlighting its potential as a regulated crypto investment cornerstone. - mXRP liquid-staking product on BNB Chain adds yield-generating utility, boosting demand among DeFi users. - Technical indicators show XRP trading above key EMA but face volatility risks amid declining open interest. - Regulatory uncertainties persist as SEC's XRP classi