AAVE Rises 0.86% as Large Investors Accumulate and Aave Founder Criticizes BoE

- AAVE rose 0.86% in 24 hours to $205.44 amid whale accumulation and regulatory scrutiny, despite 32.98% annual declines. - Major on-chain actors borrowed $180M+ from Aave to purchase 388,615 ETH ($1.32B), leveraging DeFi protocols for ETH accumulation. - Whale strategies maintain 2.1 leverage ratios, while backtests show Aave whale activity correlates weakly with sustained AAVE price gains. - Analysis suggests whale accumulation may signal distribution or liquidity provision rather than bullish price mome

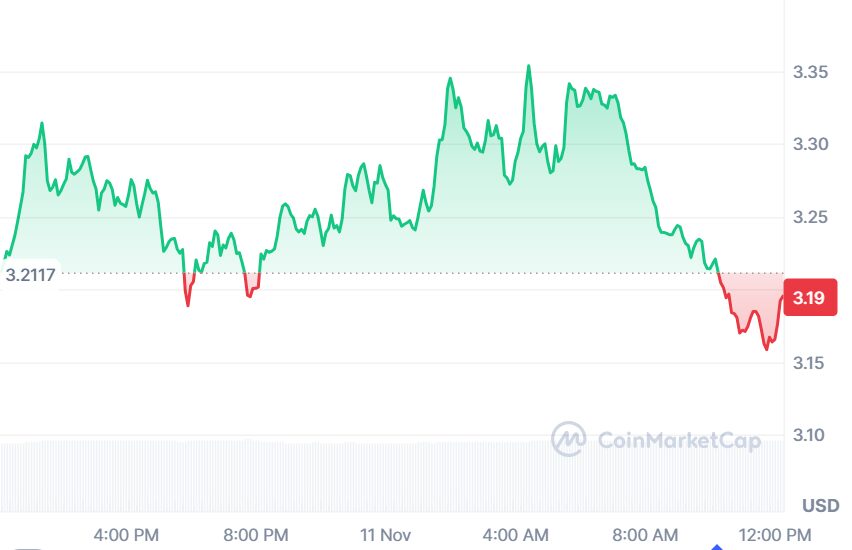

As of November 12, 2025,

Renewed interest in AAVE was fueled by notable whale accumulation and heightened regulatory attention from leading institutions. On November 12, a major on-chain entity borrowed 10 million

Meanwhile, another prominent whale, commonly known as the “66k ETH Borrow Whale,” continued to ramp up its accumulation. Blockchain data shows this whale borrowed an additional $80 million in stablecoins from Aave, transferred the funds to Binance, and exchanged them for 30,549 ETH. This brought the whale’s weekly ETH purchases to 385,706 ETH, worth $1.32 billion. The whale is maintaining a leverage ratio near 2.1, reflecting strong conviction in the long-term outlook for

These whale maneuvers are part of a larger trend where major players utilize Aave’s lending services to finance ETH acquisitions, thereby impacting the broader DeFi landscape. The surge in liquidity and leverage points to a generally optimistic stance among influential market participants.

Backtest Hypothesis

A recent backtest explored how whale accumulation events on Aave relate to subsequent AAVE price movements. The analysis reviewed public news from January 1, 2022, to November 12, 2025, searching for mentions of “Aave whale accumulation” and identified three significant accumulation periods. These periods defined 846 event days, which were then tested using a 30-day holding period and an equal-weight event study approach. Findings indicated that AAVE’s average return after such events did not notably outperform a crypto-market benchmark until day 19, with a distinct negative alpha by day 30. This implies that whale accumulation alone may not reliably predict sustained price gains and could instead point to distribution, market weakness, or liquidity provision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: SEC's 20-day review period begins, launching the XRP ETF competition toward mainstream adoption

- SEC's 20-day automatic review period for 21Shares' XRP ETF filing signals potential fast-tracked approval, mirroring Bitcoin/Ethereum precedents. - XRP's institutional adoption gains momentum with custodian partnerships and index-linked pricing, driving 6% price surge to $2.32. - Ripple's ecosystem growth (100M+ ledgers, Mastercard/WebBank deals) strengthens XRP's cross-border payment advantages over Ethereum's scalability challenges. - International XRP ETFs ($114.6M AUM) and institutional interest in p

Bitcoin Updates: Lawmakers Seek Solution to Ongoing SEC and CFTC Dispute Over Crypto Oversight

- U.S. Congress proposes two crypto regulatory frameworks: CFTC-led commodity model vs. SEC's "ancillary asset" approach, creating dual oversight challenges for exchanges. - Emerging projects like BlockDAG ($435M presale) and privacy coins gain traction amid market rebound, emphasizing utility over speculation post-government shutdown. - Bitcoin exceeds $102,000 with ETF inflows and Ethereum sees whale accumulation, though profit-taking risks and regulatory delays remain key headwinds. - Senate drafts and

APT Price Update: Aptos Shows Early Recovery Signs to $3.50 as EV2 Presale Draws Web3 Gaming Interest

Jack Dorsey backs diVine, a new version of Vine that features Vine’s original video library