Did One Whale Steal aPriori’s Airdrop? 14,000 Wallets Raise Big Questions

A single entity claimed 60% of aPriori's APR airdrop, sparking debate on crypto fairness.

Liquid staking project aPriori, preparing to join the Monad, has raised $30 million from Tier-1 VCs. However, it now faces accusations that one entity used 14,000 connected addresses to claim more than 60% of its airdrop.

The revelations have rattled markets and raised fresh questions about airdrop design and on-chain verification.

On-Chain Picture Behind aPriori: What Happened?

aPriori (APR) announced the claim portal on October 23, with its public window and split-claim mechanic (early vs. wait) appearing to have been gamed by the clustered wallets.

Airdrop claim is live.Check eligibility and claim at .You have 21 days to choose:• Claim Early: smaller portion now• Wait for Monad Mainnet: unlock majority laterChoose carefully, your selection is final.

— aPriori ⌘ (@aPriori) October 23, 2025

Indeed, Bubblemaps, a visual analytics platform for on-chain trading and investigations, flagged an unusually tight cluster of new wallets that claimed aPriori’s October 23 airdrop.

According to Bubblemaps, the project raised $30 million from tier-1 VCs. However, 60% of its airdrop was claimed by one entity via 14,000 connected or clustered addresses.

Reportedly, the cluster’s behavior involved wallets that were freshly funded via the Binance exchange, with approximately 0.001 BNB, in short windows. They then routed APR to new addresses, suggesting an orchestrated claim-and-redistribute operation rather than an organic, distributed claiming process.

3/ However, 14,000 connected addresses claimed 60%+ of the $APR airdropThese addresses were:> Freshly funded via Binance> Received 0.001 BNB each in tight time windows> Sent $APR to fresh addresses, forming a second layer in the cluster

— Bubblemaps (@bubblemaps) November 11, 2025

Project Messaging and Timing

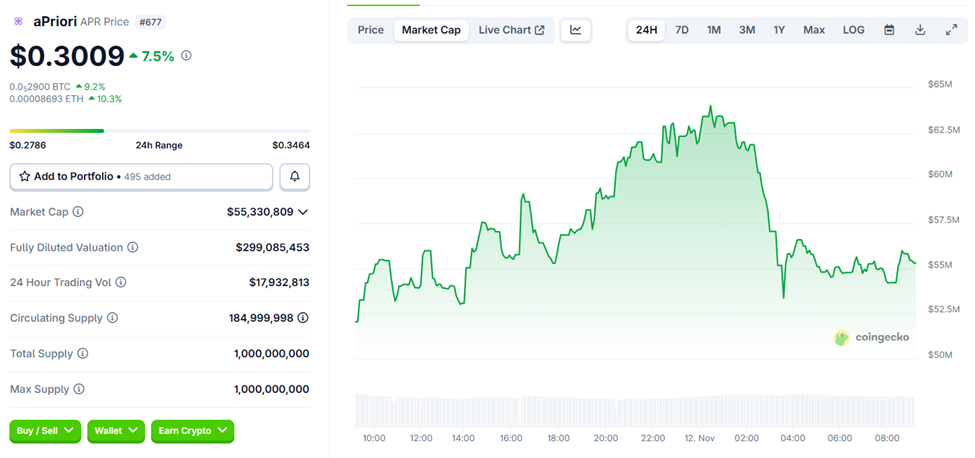

The fallout was immediate, with a sharp sell-off following the cluster activity. Likewise, there was a dramatic drop in the APR market cap soon after launch.

aPriori (APR) Price and Market Cap Performance. Source:

CoinGecko

aPriori (APR) Price and Market Cap Performance. Source:

CoinGecko

Concentrated airdrop claims, especially when claimers flip tokens quickly, can wipe out community trust and trigger steep repricing before a project reaches mainnet.

Why It Matters — Incentives, Verification, And Reputation

Crypto airdrops are meant to decentralize token ownership and bootstrap network effects. When a single actor captures the majority of distributed tokens, three problems arise:

- Incentive misalignment, where the token supply is effectively centralized

- Economic risk, where large concentrated holders can dump and destabilize the price, and

- Reputational damage, where partnerships and future fundraisers can be imperiled.

For aPriori, touted as “one of the biggest projects coming to Monad,” reputational risk now threatens its own rollout as well as associated ecosystem events.

Meanwhile, this scandal comes at a moment when Lighter is being celebrated as a model for institutional-grade DeFi growth. The Layer-2 DEX recently raised $68 million and surpassed $73 billion in weekly perpetual trading volume, emphasizing speed, scalability, and transparent on-chain execution.

Lighter is pursuing a zero-knowledge orderbook model to attract serious liquidity providers. By contrast, aPriori’s airdrop issues remind investors how easily tokenomics can be undermined by automation and poor verification.

Similarly, aPriori’s Sybil-attack-like airdrop highlights the fragility of token distribution mechanics still common in DeFi.

Bubblemaps says it reached out to the aPriori team but received no response; the project has not publicly disputed the cluster analysis.

As investigations continue and on-chain forensics deepen, aPriori’s path to the Monad mainnet and any associated MON sales will be closely monitored and evaluated based on on-chain evidence and, potentially, developer communication.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan Unveils $110B Stimulus: Major Shift from Fiscal Restraint to Economic Expansion and National Security

- Japan's PM Sanae Takaichi unveils $110B stimulus to combat stagnation and bolster security amid China tensions. - Plan includes tax cuts, utility subsidies, defense spending, and strategic investments in AI, semiconductors , and shipbuilding. - Funded by 14-trillion-yen supplementary budget, with potential expansion to 20-trillion-yen ($133B) as per analyst estimates. - Shift from austerity reflects Takaichi's hardline security stance and response to China's travel advisory over Taiwan remarks. - Impleme

Bitcoin News Update: Bitcoin Reaches $96K Amidst Institutional Interest and Challenges from Regulations and Price Barriers

- Bitcoin surged past $96,000 as buyer accumulation and seller exhaustion drove short-term recovery, though $106,000–$118,000 remains a key resistance zone. - Harvard’s $443M investment in BlackRock’s IBIT highlights growing institutional adoption, contrasting traditional preferences for private equity. - Bitcoin Depot reported 20% Q3 revenue growth but faces regulatory challenges, expanding internationally while projecting Q4 declines due to compliance costs. - MicroStrategy’s Michael Saylor denied Bitcoi

Bitcoin News Today: Bitcoin Faces $62K Drop Threat Amid Fed's Data Silence Predicament

- Bitcoin faces $62K crash risk amid Fed uncertainty caused by U.S. government shutdown's "data blackout" disrupting inflation/labor data. - Post-Nov 13 reopening saw BTC rebound above $102K, but markets remain fragile with 20% decline from October peak despite $140B ETF growth. - Fed rate cut odds dropped to 52% for December, creating volatility as institutions like Harvard Endowment invest $443M in Bitcoin ETFs. - U.S. miners struggle with 37.75% global hashrate share amid lack of federal incentives, con

Bitcoin Updates Now: Crypto Faces a Standstill as Market Anxiety Meets Harvard’s Confident Bitcoin Investment

- Alternative Data's Fear & Greed Index hit record low 10 on Nov 16, signaling extreme crypto market fear and frozen investor sentiment. - Bitcoin fell 5% to $96,000 while CD20 lost 5.8% as profit-taking, liquidations, and liquidity declines accelerated selloffs. - Rising U.S. Treasury yields and central bank uncertainty worsened losses, with Nansen noting "perfect storm" of macro risks and institutional outflows. - Harvard's $443M IBIT ETF investment contrasts current bearishness, highlighting diverging i