Ethereum News Today: Ethereum’s Steep Decline Ignites Discussion: Immediate Challenges or Strong Long-Term Outlook?

- Ethereum dropped 3.46% to $3,417.77, its largest 24-hour decline since November 2025, amid 184,700 ETH net outflows from centralized exchanges. - Institutional Ethereum ETF outflows and declining staking reserves highlight short-term weakness, though $200B in tokenized assets and 4–6% yield products sustain long-term optimism. - Exchange-held ETH supply hits a two-year low, with Binance balances falling sharply, suggesting increased accumulation and reduced circulating supply pressures. - Bitcoin's 59.25

Over the past 24 hours, Ethereum's value dropped by 3.46% to $3,417.77, marking its steepest one-day loss since November 4, 2025. This decline occurred as centralized exchanges (CEX) saw a net withdrawal of 184,700 ETH, according to

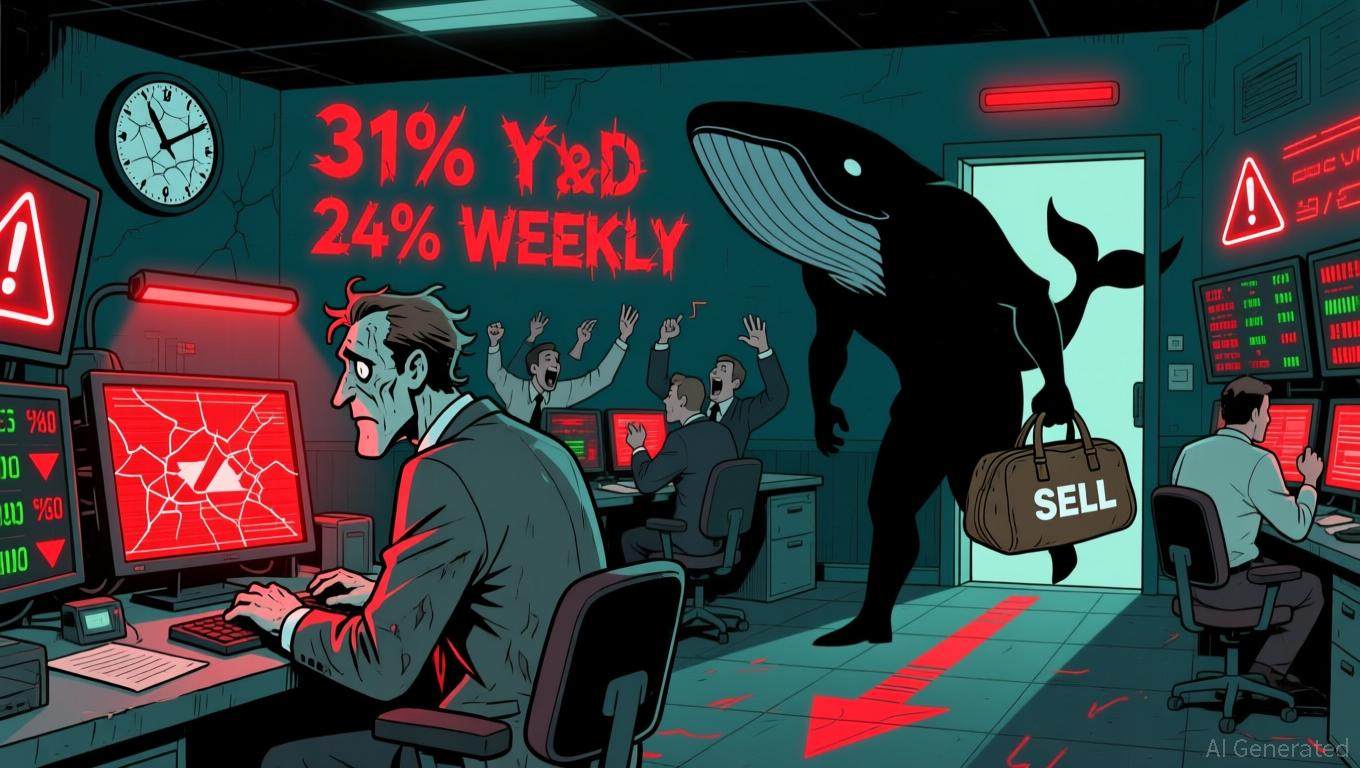

This recent downturn follows Ethereum's record high of $4,950 reached in August 2025, with the token now trading 31% below that level. Institutional involvement appears to be waning, as ETF inflows and corporate staking reserves have both slowed. Data shows that since August, ETFs and companies staking ETH have reduced their holdings by more than 200,000 ETH, with average daily net outflows of $250 million in recent weeks, according to

Despite short-term challenges, Ethereum's $200 billion tokenized asset ecosystem continues to inspire confidence among analysts regarding its future price prospects. Platforms such as

Short-term headwinds persist, as Ethereum ETFs saw $127 million in outflows on October 23, primarily from Fidelity and BlackRock, according to

Looking further ahead, optimism for Ethereum is rooted in its structural strengths. Analysts at Token Terminal believe that the $430 billion in tokenized assets on Ethereum provides a solid foundation for its market cap, tying its value to on-chain utility, as stated in

Although the short-term outlook is still unclear, some analysts believe Ethereum could rebound if regulatory conditions improve and risk appetite returns. Key resistance levels to monitor are $3,650 and $3,920, with a potential breakout in 2026 depending on continued liquidity inflows and increased staking, as noted by

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Separating Hype from Reality—Crypto Market Shifts as BlockDAG, Ethereum, and XRP Aim for Leadership by 2026

- BlockDAG's $435M presale and hybrid DAG/Proof-of-Work model position it as a top 2026 growth candidate with 3.5M active miners. - Ethereum faces technical risks like potential death cross but retains 53% stablecoin dominance through JPMorgan/BlackRock partnerships. - XRP shows $2.40 recovery amid Bitcoin ETF inflows but needs sustained confidence to maintain $3.95B derivatives open interest. - Market shifts toward projects with institutional validation (CertiK audits) and real-world adoption (Seattle spo

Brazil's Cryptocurrency Clampdown: Combating Illicit Activity or Hindering Progress?

- Brazil's Central Bank enforces strict crypto rules by Feb 2026, requiring VASPs to obtain authorization or exit the market. - Stablecoin transactions and cross-border transfers are reclassified as foreign exchange operations under $100k capital controls. - $2-7 million capital requirements spark industry criticism, with concerns over stifling competition and compliance timelines. - Mandatory reporting for international transactions aims to combat money laundering, aligning with global standards like EU's

Whales Offload PEPE While Bulls Resist Decline, Forecasting Record High

- A major PEPE whale liquidated a $46M position this week, reflecting broader memecoin market weakness as prices fell 31% year-to-date. - Institutional holders offloaded 0.5% of PEPE holdings amid bearish technical indicators, while some long-term investors predict a new all-time high. - Cross-chain activity highlights volatile memecoin dynamics, with whales shifting focus to ASTER as Coinbase restructures in Texas over regulatory concerns. - Technical analysts warn of continued losses as PEPE forms a "bea

South Korea Seeks to Compete with USD Stablecoins Through Blockchain-Based VAT Reimbursements

- NH NongHyup Bank tests VAT refund system using stablecoin tech with Avalanche , Fireblocks, Mastercard , and Worldpay. - Aims to challenge USD stablecoin dominance by streamlining cross-border refunds via blockchain automation. - South Korea’s FSC plans KRW-pegged stablecoin rules by year-end, restricting non-bank issuers. - Domestic stablecoin transactions exceed $41B, as major banks collaborate on won-backed infrastructure. - Pilot could redefine cross-border payments with faster processing and reduced