Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona

Centralized Governance and Open Innovation

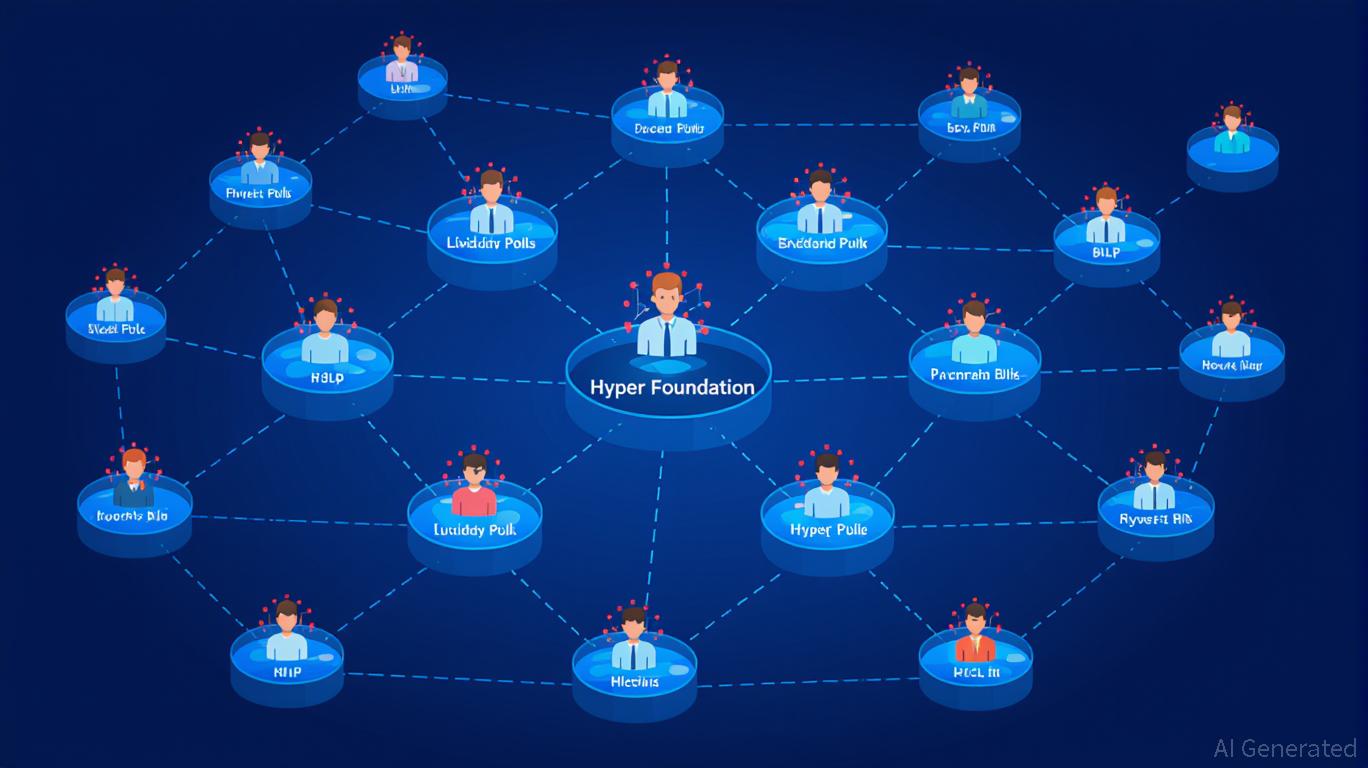

Hyperliquid’s on-chain governance structure presents both opportunities and challenges. The platform operates with 24 validators, and the

A major milestone in 2025 was the USDH stablecoin introduction, which was approved through a governance vote that favored Native Markets over alternatives like Paxos and Frax, as reported by LiveBitcoinNews. Although this step lessens dependence on

User-Powered Liquidity: Strengths and Weaknesses

Hyperliquid’s liquidity framework is anchored by the Hyperliquidity Provider (HLP) vault, which aggregates user deposits to ensure constant counterparties. During a $10 billion market downturn, the HLP generated $40 million in returns, as cited by Coinotag. Additionally, the Borrow Lending Protocol (BLP) testnet allows for on-chain borrowing of assets like USDC and PURR to help manage leveraged trading risk, as reported by Bitget. These features position Hyperliquid as a bridge between centralized and decentralized finance, offering both speed and liquidity while maintaining user control.

However, the system’s dependence on HYPE token staking for launching new markets introduces certain vulnerabilities. For instance, the AERO/USDC perpetual contract, which debuted with 3x leverage, highlights Hyperliquid’s appeal to active traders but also its exposure to asset volatility, as observed by Lookonchain. Regulatory pressures add another layer of complexity, especially as rivals like BlockchainFX obtain institutional licenses, according to Cryptopolitan. Despite regulatory uncertainty, user engagement remains strong: total value locked (TVL) soared from $564 million at the end of 2024 to $5 billion by the close of 2025, according to Oak Research. Active wallet addresses also increased by 78%, reaching 518,000, per Oak Research’s data.

Sustainability: Navigating Growth and Control

The future success of Hyperliquid depends on its ability to balance centralized oversight with decentralized participation. The introduction of the HIP-3 protocol and HyperEVM (an Ethereum-compatible execution environment), as detailed in CoinMarketCap’s recent update, improves both composability and scalability, though validator concentration remains a concern. Growing institutional interest—such as 21Shares’ application for a HYPE ETF, as reported by Bitget—reflects confidence in the platform’s potential. However, price instability and leadership transitions (for example, CEO Michael Rowe stepping down) could impact investor confidence, as noted in Bitget’s coverage.

Clearer regulatory guidelines are also essential. The Jelly incident, which involved a $12 million loss from the HLP that was offset by an oracle intervention, as reported by Oak Research, highlighted the importance of strong security protocols. Hyperliquid’s buyback initiative, which uses 97% of protocol fees as per CoinMarketCap, creates deflationary pressure, but broader economic challenges and competition from centralized exchanges could threaten its market position.

Conclusion: High Risk, High Potential

Hyperliquid’s advancements in governance and liquidity have made it a frontrunner in decentralized trading. The platform’s rapid TVL growth, expanding user base, and strategic alliances (such as with Felix), as reported by Bitget, point to solid fundamentals. Still, its centralized decision-making, upcoming token unlock, and regulatory ambiguity present notable risks. For investors, Hyperliquid offers a high-risk, potentially high-reward scenario: its open market creation and HLP system could fuel ongoing expansion, but underlying structural issues warrant a cautious approach.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Update: Significant Leverage, Limited Liquidity: POPCAT's $5 Million DeFi Breach

- Hyperliquid suffered a $4.9M loss after a trader manipulated Solana-based memecoin POPCAT through leveraged long positions and a sudden price crash. - The attacker used $3M in USDC from OKX to create a $20–30M leveraged position, inflating POPCAT’s price before triggering cascading liquidations. - Hyperliquid paused its Arbitrum bridge to stabilize the platform, highlighting vulnerabilities in DeFi’s automated liquidation systems and low-liquidity markets. - Experts warn such attacks expose DeFi risks, u

Vitalik Buterin's Advances in Zero-Knowledge Technology and the Prospects for Blockchain Scalability: An Investment Outlook for 2025

- Vitalik Buterin's GKR protocol breakthrough reduces ZK verification costs by 10-15x, enabling 43,000 TPS on ZKsync with near-zero fees. - ZK Layer 2 market grows at 60.7% CAGR to $90B by 2031, driven by Ethereum's "Lean Ethereum" optimizations and institutional adoption. - ZKsync, StarkNet, and Immutable lead DeFi/gaming expansion, but face regulatory risks (Zcash scrutiny) and technical barriers to mass adoption. - Investors must balance ZK's scalability potential with execution risks, regulatory uncert

Vitalik Buterin Supports ZKsync and the Advancement of Scalable Blockchain Technology

- Vitalik Buterin endorsed ZKsync's Atlas upgrade, boosting its market profile as Ethereum's scalability solution. - ZKsync now achieves 15,000 TPS, 1-second finality, and real-time Ethereum liquidity access, outperforming Layer-2 rivals. - The ZK token surged 50% post-endorsement, with growing institutional adoption and RWA integration as key drivers. - ZKsync's zero-knowledge proofs and decentralized governance model position it as a leader in secure, scalable blockchain infrastructure.

Bitcoin News Update: Clearer Regulations and Growing Institutional Interest Propel Crypto Market to $2.4 Trillion as Industry Evolves

- U.S. crypto market surges to $2.4T as institutional adoption, regulatory clarity, and macro optimism drive gains. - Bitcoin and Ethereum rebound post-government shutdown, with crypto-linked stocks like SBET and GLXY rising 3-5% pre-market. - Regulatory frameworks like CLARITY Act and Project Crypto aim to resolve ambiguity, boosting institutional confidence. - Analysts caution volatility risks despite ETF inflows and blockchain adoption milestones, urging diversified long-term strategies.