Date: Tue, Nov 11, 2025 | 10:36 AM GMT

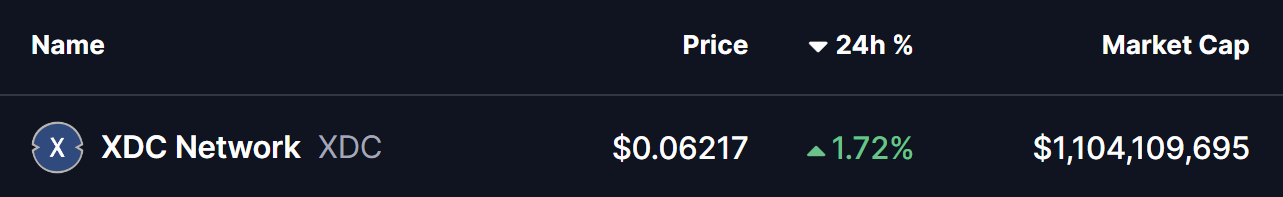

The cryptocurrency market is showing notable volatility today as Bitcoin (BTC) and Ethereum (ETH) trade slightly in red, adding pressure across major altcoins . Despite this, XDC Network (XDC) is holding firm and showing modest gains.

More importantly, its chart is beginning to flash the same bullish fractal that previously triggered a powerful breakout rally.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Breakout

The daily chart of XDC is starting to display a repeated bullish structure built around a descending channel correction, followed by a breakout and a reclaim of the 50 and 100-day moving averages.

Back in July, XDC corrected inside a descending channel. After weeks of compression, the token broke out of the channel and reclaimed both the 50-day and 100-day moving averages. That technical shift ignited a strong 69 percent rally straight toward its ascending resistance trendline.

XDC Network (XDC) Daily Chart/Coinsprobe (Source: Tradingview)

XDC Network (XDC) Daily Chart/Coinsprobe (Source: Tradingview)

The current structure is now showing striking similarities.

XDC has once again bounced from its local low around $0.049 and is now pressing against the upper boundary of the current descending channel near $0.062. The token is positioned just below key resistance from the 50-day and 100-day moving averages at $0.06477 and $0.07336. This setup mirrors the same alignment that preceded July’s breakout, hinting that bullish momentum may be quietly building beneath the surface.

What’s Next for XDC?

For this fractal setup to remain valid, XDC must break above the channel resistance and reclaim both moving averages. If buyers manage to push through these levels, the next key technical target sits near $0.11715, representing an upside potential of roughly 88 percent from current prices.

Beyond that, the long-term ascending resistance trendline leaves room for even larger expansion later in the cycle if momentum strengthens, just as it did during the previous fractal.

For now, confirmation is key. A decisive reclaim of the 100-day MA would offer the clearest signal that the bullish structure is active and that a continuation rally may be underway.