Samourai Wallet Co-founder Sentenced for Money Transmission Conspiracy

- Samourai Wallet’s co-founder sentenced, sparking privacy debate.

- Government scrutiny on privacy tools increases.

- Developers face heightened prosecutorial risk.

Keonne Rodriguez, co-founder of Samourai Wallet, was sentenced to five years in prison for conspiracy to operate an unlicensed money transmitting business on November 6, 2025.

The sentencing highlights growing governmental scrutiny on privacy tool developers, sparking debate within the crypto community about regulatory overreach and the implications for open-source development.

In a landmark case, Keonne Rodriguez, co-founder of Samourai Wallet, has been sentenced to five years in prison for unlicensed money transmission . This decision marks increased scrutiny on privacy tool developers by government authorities.

Rodriguez, alongside co-founder William Lonergan Hill, was charged with conspiracy under federal law. The Department of Justice emphasized liability, even without custodial control, sparking concern among privacy advocates and open-source developers. Matthew Galeotti, Assistant Attorney General, U.S. DOJ, stated, “Where the evidence shows that software is truly decentralized and solely automates peer-to-peer transactions, and where a third-party does not have custody and control over user assets, new 1960(b)(1)(C) charges against the third-party will not be approved.”

The sentencing could impact developers working on privacy technologies. Privacy tools like Samourai Wallet, which uses CoinJoin and Ricochet features, face uncertain future as legal risks mount. This incident highlights challenges in the crypto privacy landscape .

Financial implications include Rodriguez’s $6.3 million forfeiture agreement, impacting his personal finances. Regulatory actions can also influence investor confidence and innovation in developing privacy-focused blockchain technologies.

Community backlash is notable, with many citing potential regulatory overreach. The case is compared to the Tornado Cash incident, illustrating ongoing tensions between privacy technologies and regulatory frameworks.

Potential outcomes appear grim for developers. As governmental focus sharpens on privacy tools, experts speculate a possible cooling effect on innovation. The implications could shape future regulatory landscapes for open-source blockchain projects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Government Reopens After 41 Days – What It Means for Bitcoin, Crypto, and Global Markets

Dogecoin Price Prediction: Can DOGE Reach $0.40 Before 2025 Ends?

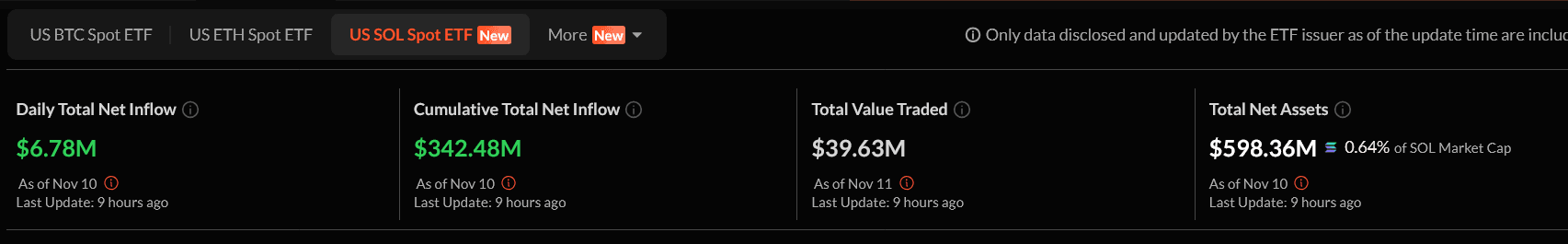

Solana ETFs Smash Expectations with $342 Million Inflows

Enterprise AI’s Upheaval Drives Crypto’s Push into Private Markets

- C3 AI faces potential sale after founder Thomas Siebel's health-related CEO exit triggered a 6% stock surge. - The company reported $116.8M Q1 losses and 54% share price decline, now exploring private capital raises under new CEO Stephen Ehikian. - IPO Genie's $0.0012 presale token aims to bridge crypto and private markets using AI-driven deal-screening, attracting 300,000+ participants. - With $500M in regulated assets and CertiK-audited security, IPO Genie contrasts C3 AI's struggles by targeting 750×