Zcash Overtakes Stellar: What's Next for XLM?

The price of the privacy-focused token Zcash (ZEC) has risen in several weeks. This price growth has caused its market capitalization to increase, currently at $9.41 billion.

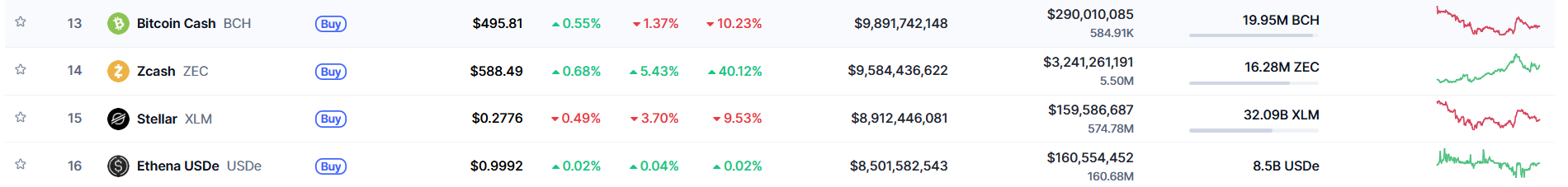

At its current market valuation, Zcash has surpassed Stellar (XLM), ranking the 14th largest cryptocurrency ahead of XLM, which has a market cap of $8.88 billion.

Zcash, created in 2016 via a fork of Bitcoin’s codebase, supports anonymous transactions with zero-knowledge proofs.

Zcash has surged 1,172% yearly, surpassing Monero to become the largest privacy token. Unlike past rallies, the current rise seems driven by real usage, increasing shielded adoption and shifting perceptions of privacy in crypto.

Zcash, until recently a fairly obscure cryptocurrency, started rising in late September, and has risen over tenfold since then.

From under $54 in late September, Zcash rose unrelentingly to reach a high of $748 on Friday, last seen in January 2018.

At the time of writing, Zcash was up 5.59% in the last 24 hours to $589 as the larger crypto market traded down, and up 41% weekly.

What's next for XLM?

Stellar network saw 37% growth in full-time developers in the last quarter, about eight times faster than the industry growth rate. The network added 1,450 new developers in Q3, a 70% quarterly increase. Daily smart contract invocations on the network rose nearly 100%, surpassing 1 million per day. By the end of Q3, total invocations hit 157 million.

The Stellar Ambassador program also continued to scale in Q3, with 400 new signups, 160 community events and double-digit regional growth across Latin America and Asia Pacific.

The figures suggest increased developer activity, which demonstrates growing momentum on the network. However, this is yet to translate into price growth for XLM, which is just up 175% yearly.

In the coming days, attention will be paid to XLM's price, with a break above $0.5 sparking a fresh uptrend for the token.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Nationalist Cryptocurrency Fraud Cons People Out of $6.5 Billion, Affecting 128,000

- Chinese "Cryptoqueen" Zhimin Qian faces UK sentencing for orchestrating a $6.5B Bitcoin Ponzi scheme targeting 128,000 victims, including elderly investors. - Her Lantian Gerui company used patriotic marketing and false 200% returns promises, with proceeds funding a £17,000/month London mansion and £6B in seized crypto assets. - UK authorities seized 61,000 BTC (worth $6B) and are pursuing asset recovery, as Qian's case highlights risks of unregulated crypto investments amid global regulatory crackdowns.

Pi Network’s Mainnet: Evolving from Smartphone Mining to an AI-Powered Blockchain Platform

- Pi Network's Testnet 1 achieves near-zero transaction failures, accelerating Mainnet v23 launch after successful high-volume stress tests. - Price jumps 3.5% as AI integration with OpenMind and decentralized computing prove scalability, while KYC streamlining boosts user onboarding. - Upcoming Mainnet will enable smart contracts and DeFi tools, but faces challenges including 10% price decline and only 296 active nodes currently operational.

a16z Elevates Wuollet to Lead Crypto Regulatory Affairs and Drive Innovation Strategy

- Andreessen Horowitz promoted Guy Wuollet to crypto general partner, focusing on infrastructure, DeFi, and DePIN to drive blockchain innovation. - U.S. regulatory clarity on crypto ETP staking and CFTC discussions on domestic spot trading align with a16z's advocacy for market-friendly policies. - The firm's investments in projects like Pakistan's ZAR stablecoin and stakes in Solana/EigenLayer highlight its strategy to bridge traditional and decentralized finance. - Wuollet's track record of 20+ crypto inv

Rumble's $767 Million Agreement with Northern Data Drives Growth in AI Infrastructure

- Rumble agreed to acquire Northern Data in a $767M all-stock deal to expand AI infrastructure and cloud computing. - Tether , owning 48% of Rumble, committed $250M in GPU services and advertising to support the merged entity. - The transaction requires regulatory approval and includes potential $200M cash payment if Northern Data sells a Texas data center. - Shareholders controlling 72% of Northern Data agreed to the 15% discounted stock exchange ratio, with 30.4% ownership in the combined company. - Rumb