Why HYPE Long Traders Should Worry About $24 Million Liquidations

HYPE long traders are on alert as $24 million in potential liquidations loom near $35.3 support, with bearish signals and weak sentiment threatening deeper losses unless recovery momentum returns.

Hyperliquid’s native token, HYPE, is showing signs of weakness following recent market volatility. After several failed recovery attempts, the altcoin is struggling to maintain its footing above crucial support levels.

While short-term traders anticipate a potential rebound, technical indicators suggest long traders should proceed cautiously.

Hyperliquid Traders Could Face Losses

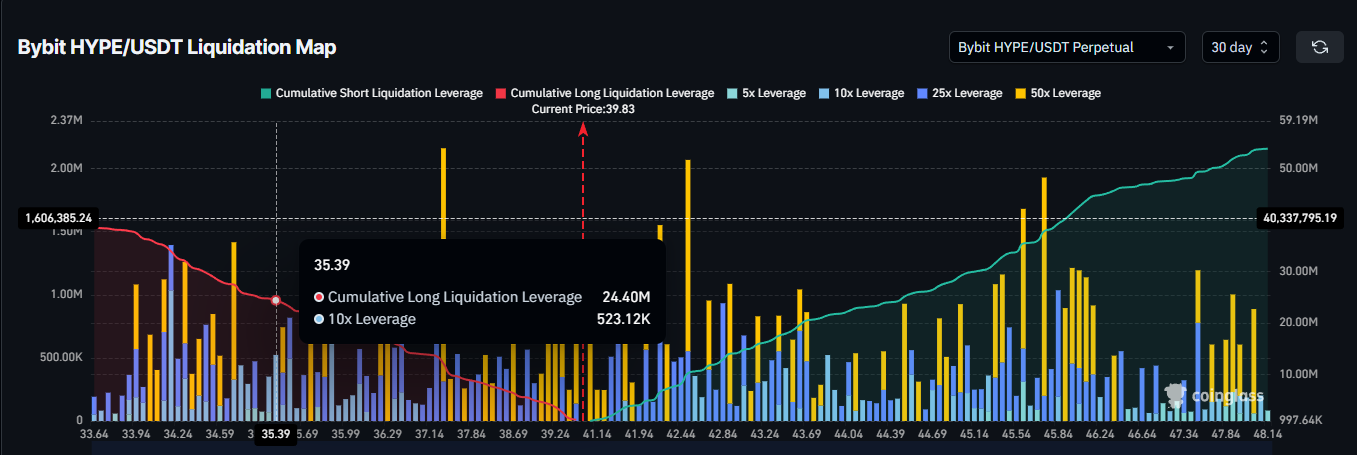

The liquidation map reveals that HYPE long traders could face up to $24.40 million in potential liquidations if the token drops to its month-long critical support at $35.3. This would represent a substantial risk, as it could trigger widespread position closures among leveraged traders.

What makes this development more concerning is that this level has already been tested twice in the past month. A third test could undermine market confidence and discourage new long positions, leaving HYPE vulnerable to increased volatility and downward price pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HYPE Liquidation Map. Source;

HYPE Liquidation Map. Source;

HYPE Liquidation Map. Source;

HYPE Liquidation Map. Source;

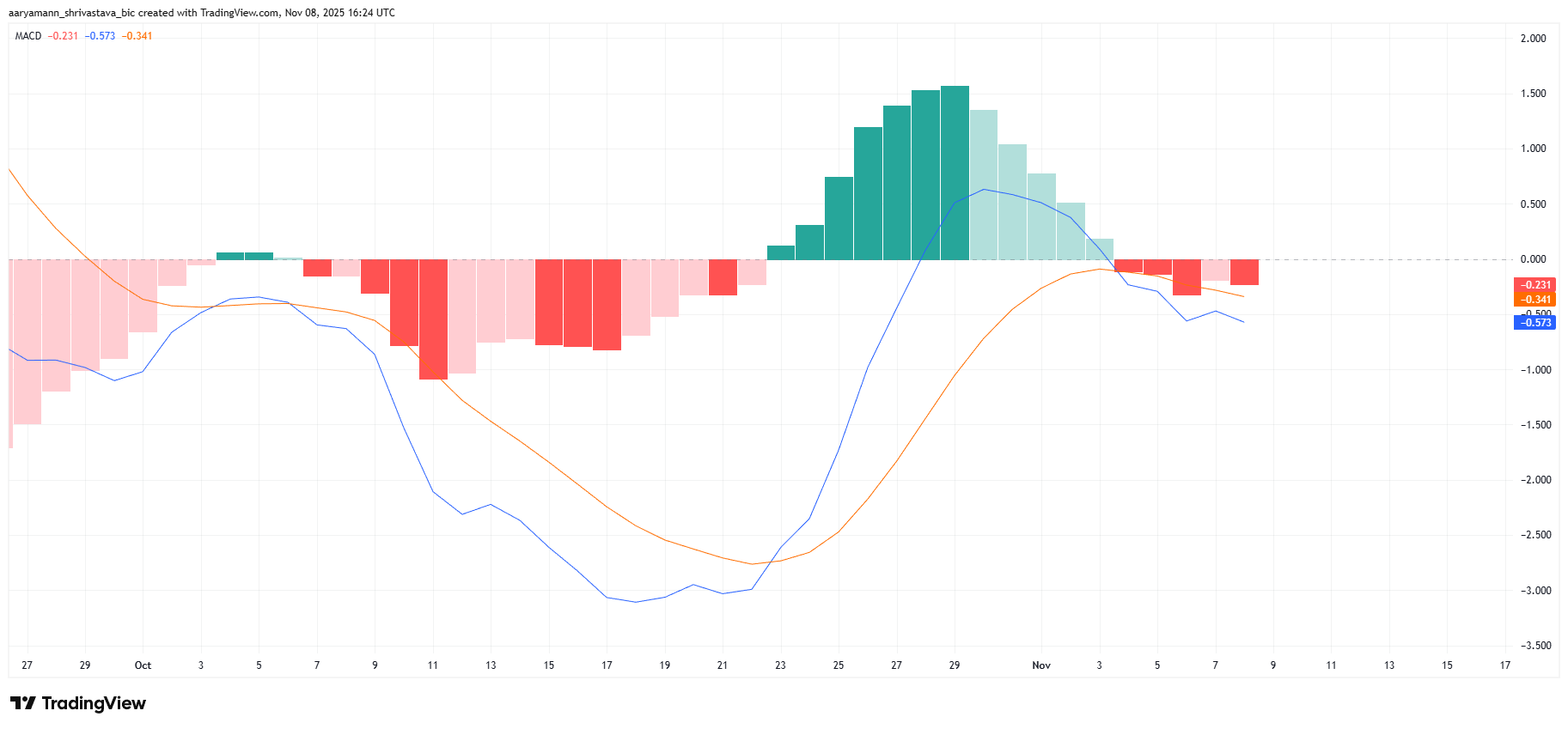

The Moving Average Convergence Divergence (MACD) indicator is flashing early warning signs of intensifying bearish momentum.

A bearish crossover recently occurred, suggesting a possible continuation of selling pressure. Although the current downturn is not yet severe, a decline in market confidence could accelerate losses.

If broader crypto market sentiment worsens, HYPE could face difficulty maintaining its current trading range. A deepening bearish trend may prolong recovery efforts, pushing traders to exit before conditions improve. On the other hand, stabilization in Bitcoin and altcoin markets could ease selling pressure on HYPE.

HYPE MACD. Source:

HYPE MACD. Source:

HYPE MACD. Source:

HYPE MACD. Source:

HYPE Price Could Slip To Support

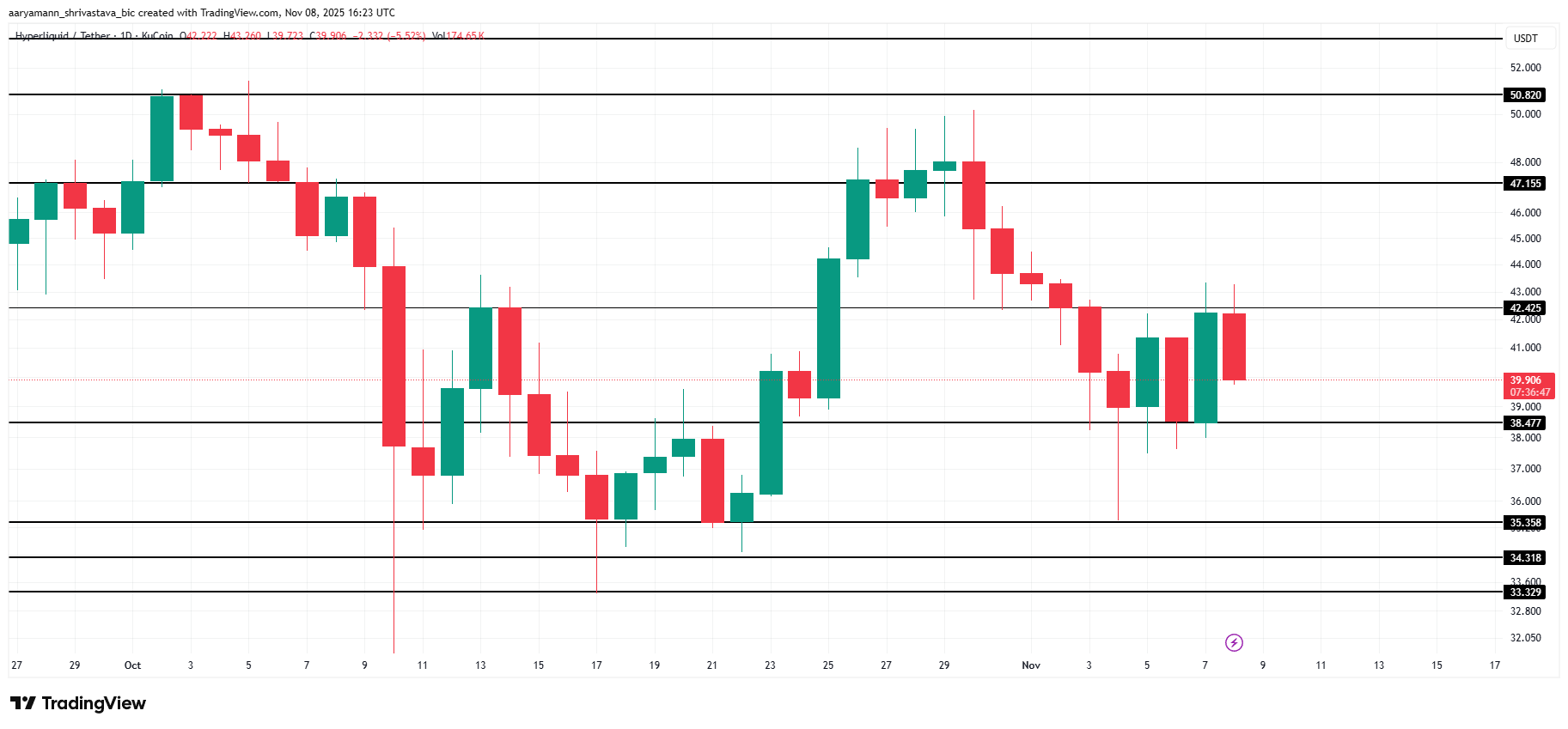

HYPE is trading at $39.9 at the time of writing, consolidating within a narrow range between $42.4 and $38.4. The chances of an upward breakout appear limited unless market sentiment improves considerably and buyers return.

If bearish conditions persist, HYPE could lose its $38.4 support, testing the $35.3 level again. A breakdown below this threshold could trigger millions in long liquidations, amplifying the decline and delaying any recovery attempts.

HYPE Price Analysis. Source:

HYPE Price Analysis. Source:

HYPE Price Analysis. Source:

HYPE Price Analysis. Source:

Conversely, if positive momentum builds and investor support strengthens, HYPE could attempt to breach the $42.2 resistance level.

Successfully flipping this barrier into support could propel the altcoin toward $47.1, invalidating the bearish outlook and restoring optimism among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE Rises 8.63% Over the Past Week: DeFi Buyback Momentum and Treasury Advancements

- Aave's $50M annual buyback program shifts DeFi tokenomics toward deflation, redirecting protocol earnings to reduce $AAVE supply. - The 7-day 8.63% price surge reflects growing adoption of buyback strategies by DeFi platforms like EtherFi and Maple Finance. - BTCS Inc. leverages Aave's 24/7 automated lending to cut borrowing costs by 5-6% while expanding Ethereum holdings through DAT strategy. - Analysts predict deflationary models will enhance price resilience, with metrics like protocol revenue replaci

Zcash Surges Above $500, Marking Multi-Year Peak and Huge Trader Profits

Shiba Inu Eyes Breakout: $0.000009 Level Could Spark Massive SHIB Price Rally

PEPE Plummets 67% in a Bearish Market Shift