Pi Coin Price Recovery Appears Difficult Despite Investor Support

Pi Coin’s price recovery remains uncertain as inflows rise modestly but fail to cross key levels, leaving the token consolidating near $0.229 and awaiting stronger investor participation.

Pi Coin’s price has struggled to gain stable momentum in recent sessions, showing heightened volatility as investors wait for a clear direction.

While the altcoin has seen a gradual improvement in inflows, it has yet to demonstrate sufficient strength to fuel a sustained price recovery.

Pi Coin Holders Are Coming Back

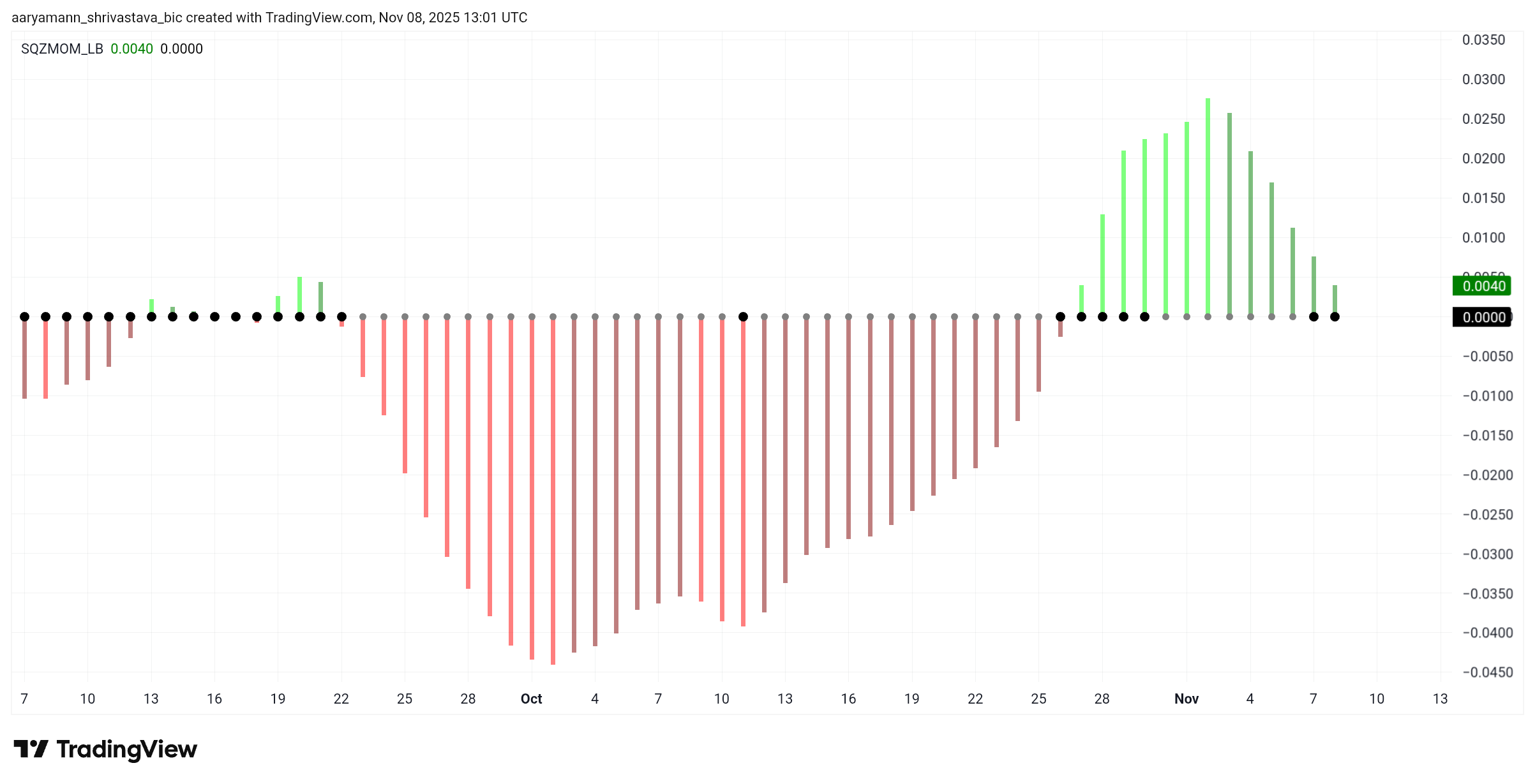

The Squeeze Momentum Indicator is showing that a squeeze is building up, suggesting that a major price move could be imminent. However, the indicator also signals a shift in momentum from bullish to bearish, which could lead to downside risks for Pi Coin if confirmed.

This confirmation would arrive once the histogram transitions into red bars, typically an early sign of selling pressure building up in the market. If the squeeze releases under these bearish conditions, Pi Coin could face a notable dip, delaying any short-term recovery attempts.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

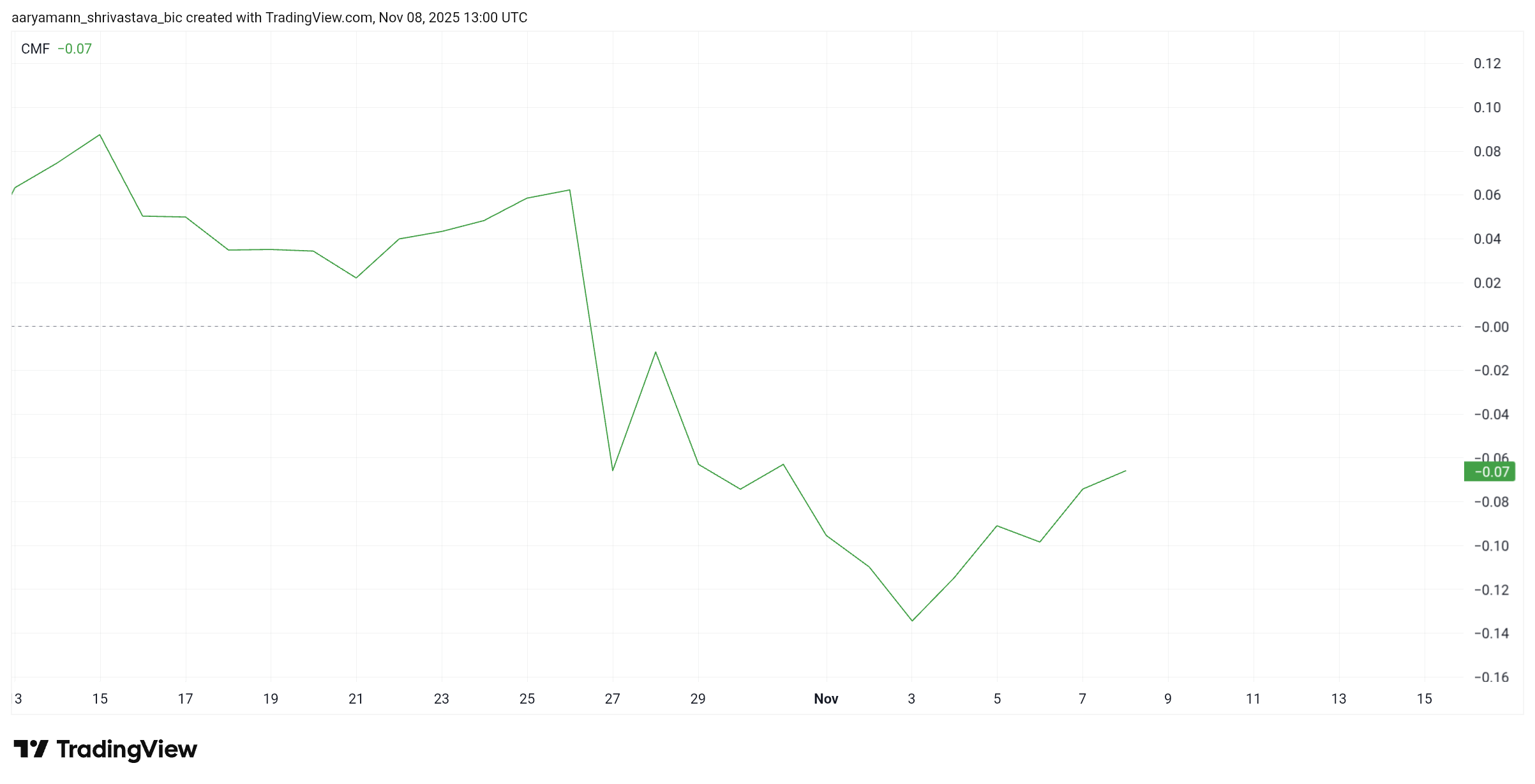

The Chaikin Money Flow (CMF) is showing encouraging signs, with a modest uptick over the past few days indicating improving inflows. However, the indicator remains below the zero line, meaning that outflows are still stronger than inflows for now. To confirm a trend reversal, the CMF must cross into positive territory.

Crossing the zero line would represent growing accumulation by investors, a key requirement for driving price recovery. While the decline in outflows is a positive step, Pi Coin still needs stronger market participation and sustained buying interest to offset recent selling pressure.

Pi Coin CMF. Source:

Pi Coin CMF. Source:

PI Price Awaits A Strong Push

Pi Coin is trading at $0.228 at the time of writing, sitting just below the $0.229 resistance level. The altcoin has held above the crucial $0.217 support for several days. This signals cautious optimism among traders despite the prevailing uncertainty.

Given these conditions, Pi Coin will likely continue consolidating between $0.229 and $0.217 in the near term. A sharp breakdown below this support is improbable unless broader market sentiment turns sharply bearish.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, if investor participation strengthens and inflows cross the required threshold, Pi Coin could push past $0.229 resistance. This would open the door for a rally toward $0.246, effectively invalidating the bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SI-BONE's innovative approach fuels both EBITDA gains and increased revenue

- SI-BONE reported Q3 2025 adjusted EBITDA of $2. 3M and raised full-year revenue guidance to $198M–$200M. - Gross margin expanded to 79.8%, while operating losses narrowed by 29.5% despite 11.9% higher operating expenses. - Cash reserves remained stable at $145.7M, with CEO citing growth from minimally invasive solutions and global expansion. - Analysts highlight innovation and expanded indications as key drivers for future orthopedic market share gains.

Ethereum Updates: Treasury's Staking Safe Harbor Redefines Institutional Approaches to Crypto

- U.S. Treasury and IRS issued 2025 guidance allowing crypto ETFs to stake assets, accelerating adoption of proof-of-stake blockchains like Ethereum and Solana . - Solana ETFs (BSOL, GSOL) attracted $659M in inflows, contrasting with $2.7B outflows from Bitcoin and Ethereum funds amid bearish price trends. - Institutional staking yields ($100M+ annualized for Ethereum) and ETF inflows signal maturing crypto markets, with technical indicators hinting at potential Q4 recovery. - Regulatory clarity on staking

Ethereum News Update: Regulatory Green Light for Staking—US Approves Crypto ETFs Offering 7% Returns

- U.S. Treasury and IRS issued guidance enabling crypto ETFs/trusts to stake assets and distribute rewards, resolving regulatory uncertainties. - The "safe harbor" framework requires single-asset PoS custody, liquidity protocols, and prohibits non-staking activities to avoid securities law violations. - Staking rewards are now taxable income for trusts, boosting yields up to 7% and accelerating institutional adoption of Ethereum/Solana networks. - Industry experts call it a "game changer," removing legal b

Bitcoin Updates: Bitcoin Rebounds Following Shutdown Deal, Looks Toward Major Regulatory Progress

- Bitcoin stabilized above $105,000 as U.S. lawmakers neared ending the 40-day government shutdown, potentially boosting market liquidity and crypto demand. - Analysts highlight a "dual catalyst" of shutdown resolution and expected lower CPI data, predicting Bitcoin could rise to $112,000 amid improved macroeconomic optimism. - Trump's $2,000 tariff dividend proposal and CFTC's planned approval of leveraged crypto trading next month further support risk appetite and institutional interest. - Regulatory del