Bitcoin Survives the $100,000 Crash Test — What’s Next for the Market?

Bitcoin’s drop below $100,000 tested market confidence but didn’t break it. Large holders are buying again, analysts see liquidity turning positive, and models from PlanB, Hayes, and Pal all point to a fresh bullish phase once the US spending freeze ends.

Bitcoin’s recent dip below $100,000 tested investor nerves and market conviction. Yet, the largest cryptocurrency quickly rebounded, reaffirming its new psychological floor.

Analysts across the board agree that, despite short-term turbulence, the structural trend for Bitcoin remains intact and potentially bullish. Most analysts view the US government shutdown as a significant constraint on prices in the current market.

PlanB: Mid-Cycle, Not Mania

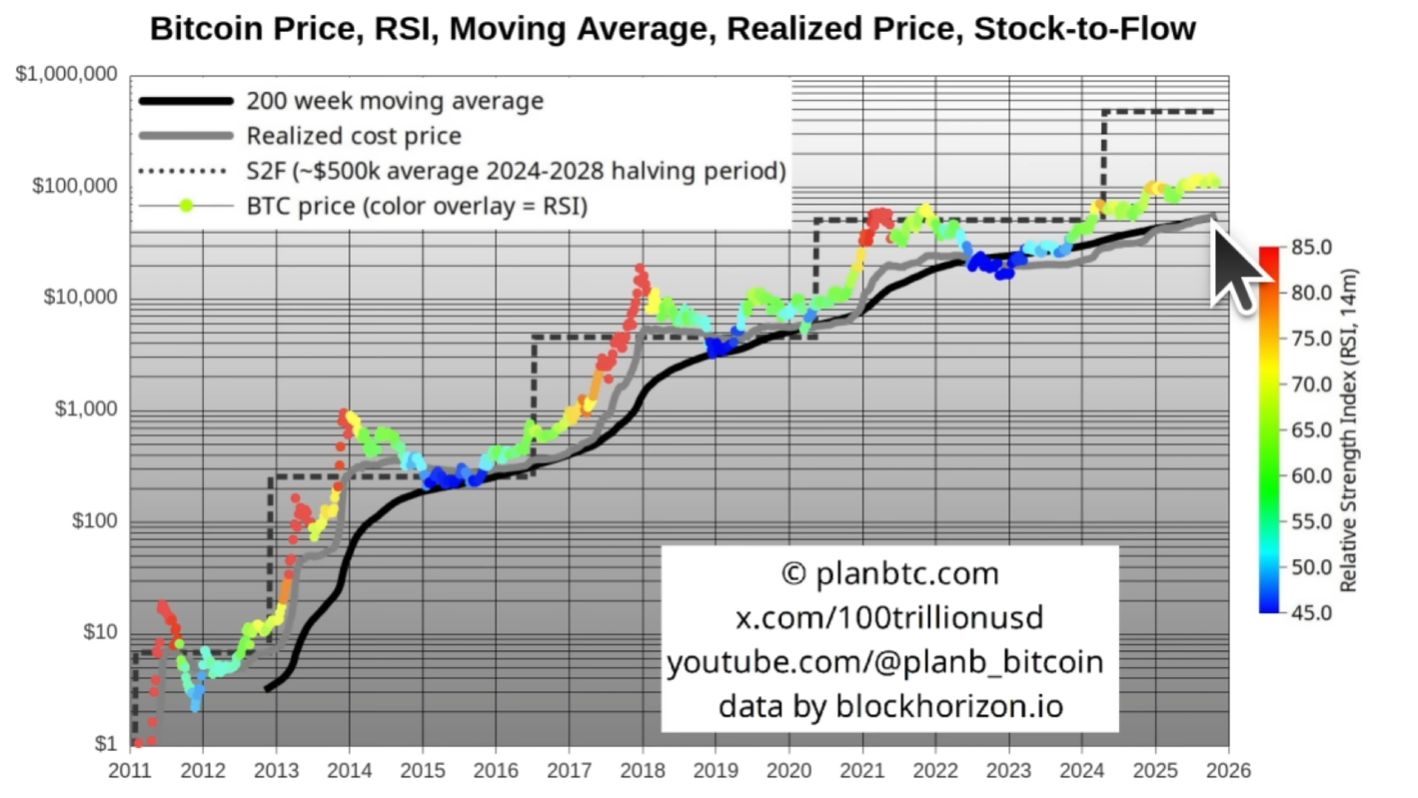

PlanB, creator of the Stock-to-Flow (S2F) model, sees the correction as a mid-cycle pause. His data shows Bitcoin has held above $100,000 for six consecutive months. This is a major shift from resistance to support.

Bitcoin Technical Indicators Chart. Source:

Youtube/PlanB

Bitcoin Technical Indicators Chart. Source:

Youtube/PlanB

He argues that the market hasn’t reached euphoria yet, with the RSI still around 66. This is well below the overheated 80+ levels of past cycle tops.

“Without that mania phase,” he notes, “we’re likely not at the final top.”

PlanB expects the next major leg higher could target the $250,000–$500,000 range, provided Bitcoin continues diverging from its realized price — a hallmark of ongoing bull markets.

Arthur Hayes: Stealth QE Ahead

Arthur Hayes connects Bitcoin’s short-term weakness to tightening US dollar liquidity. Since the US debt ceiling was raised in July, the Treasury General Account (TGA) has swelled, draining liquidity from markets.

$BTC (yellow) -5%, $ liq (white) -8% since US debt ceiling raised in July. TGA build up sucked $ out of the system. When US gov shutdown ends, TGA will fall +ve for $ liq, and $BTC will rise … and $ZEC will go up MOAR!

— Arthur Hayes (@CryptoHayes) November 5, 2025Hayes notes this dynamic caused both Bitcoin and dollar liquidity indices to drop in tandem.

However, he predicts the coming reversal — once the US government reopens and spends down its TGA balance — will mark the start of “stealth QE.”

The Fed, he argues, will indirectly inject liquidity through the Standing Repo Facility, expanding its balance sheet without officially calling it quantitative easing.

In his words: “When the Fed starts cashing the checks of politicians, Bitcoin will rise.”

Raoul Pal: The Liquidity Flood Lies Ahead

Raoul Pal’s liquidity model paints a similar picture. His Global Macro Investor (GMI) Liquidity Index — tracking global money supply and credit — remains in a long-term uptrend.Pal calls the current phase a “Window of Pain,” where liquidity tightness and investor fear test conviction. But he expects a sharp reversal soon.

Treasury spending will inject $250–350 billion into markets, quantitative tightening will end, and rate cuts will follow.

I know no one wants to hear bullish ideas and everyone is scared and wants to fling poo at each other… but the Road to Valhalla is getting very close.If global liquidity is the single most dominant macro factor then we MUST focus on that. REMEMBER – THE ONLY GAME IN TOWN IS…

— Raoul Pal (@RaoulGMI) November 4, 2025As liquidity expands globally — from the US to China and Japan — Pal says, “When this number goes up, all numbers go up.”

The Outlook: Accumulation Before Expansion

Across models, the consensus is clear: Bitcoin has weathered its liquidity-driven correction. Large holders are buying, technical support has held, and the macro setup points toward renewed liquidity expansion.Short-term volatility may persist as fiscal and monetary gears realign, but structurally, the next phase favors gradual recovery and accumulation.If liquidity indicators begin to rise again in Q1 2026, both Hayes and Pal suggest the next Bitcoin rally could unfold from the same foundation it just survived — the $100,000 crash test.

Additionally, CryptoQuant data indicates that large Bitcoin holders — wallets holding 1,000 to 10,000 BTC — added approximately 29,600 BTC over the past week, valued at roughly $3 billion.

Their collective balance rose to 3.504 million BTC. This marked the first major accumulation phase since September.

LATEST: Bitcoin whales added nearly 30,000 BTC this week, worth nearly $3 billion, while retail panic and ETF outflows dominate the headlines. Data from @cryptoquant_com and analyst @JA_Maartun

— BeInCrypto (@beincrypto) November 6, 2025This buying spree occurred as retail sentiment plunged and ETFs recorded $2 billion in outflows.Analysts interpret this divergence as a sign that institutional players are quietly reloading, strengthening Bitcoin’s support zone near $100,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trust Wallet Token (TWT) Price Forecast: Will the Latest Strategic Alliance Ignite a Bullish Turnaround?

- Trust Wallet's Onramper partnership expands fiat-to-crypto access via 130+ local payment methods in 190+ countries, aligning with post-DeFi utility-driven adoption. - The collaboration boosts TWT demand through 210M+ users funding wallets via UPI/VietQR/M-Pesa, enhancing token utility for governance and fee discounts. - Elliptic's $100M institutional backing highlights growing blockchain data infrastructure importance, indirectly validating Trust Wallet's compliance-focused onboarding strategy. - TWT's v

TWT Introduces a Revamped Tokenomics Framework: Transforming DeFi Rewards and Influencing User Actions

- Trust Wallet's TWT tokenomics shift to utility-driven incentives via Trust Premium, replacing speculative governance with tiered rewards for user engagement. - FlexGas and RWA partnerships expand TWT's utility as a fee currency and bridge between DeFi and traditional finance, enhancing demand and scarcity. - Tiered rewards and token locking create flywheel effects, stabilizing supply while incentivizing long-term participation over short-term liquidity. - Challenges include Binance's collateral ratio cut

Astar 2.0: Redefining Web3 Infrastructure for the Next Generation

- Institutional investors are increasingly allocating to digital assets, with Astar 2.0 emerging as a key platform due to its scalability and interoperability. - Astar 2.0’s hybrid architecture and partnerships with global enterprises like Casio and Sony enhance its institutional appeal through real-world applications. - The platform’s on-chain governance and enterprise-grade security align with institutional priorities, despite challenges in transparent communication and competition.

Aster DEX's Latest Strategic Move and Its Influence on DeFi Liquidity

- Aster DEX's 2025 governance changes redefined ASTER as a functional trading collateral and fee discount asset, boosting liquidity provider (LP) engagement. - The 80% margin ratio and 5% fee discount incentivized LPs to reallocate capital, adjust staking behaviors, and adopt novel yield strategies like "Trade & Earn." - ASTER's price surged 860% post-TGE, TVL grew from $172M to $2.18B, and Coinbase's roadmap inclusion signaled institutional validation of the platform's privacy-focused DeFi model. - Upcomi