US Non-Farm Payroll Report Missing Amid Government Shutdown

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- NFP report gap impacts market data significantly.

- Federal Reserve uses alternative data amid shutdown.

The US Non-Farm Payroll reports for September and October 2025 remain unreleased due to an ongoing federal government shutdown. This data gap leaves market participants relying on alternative sources like ADP reports and payroll processors for labor market insights.

The US Non-Farm Payroll report for September and October 2025 is unavailable, creating a data void for financial markets. This results from the ongoing US federal government shutdown impacting data publication agencies.

This missing data underscores problems for financial markets relying on accurate indicators. Immediate effects include increased volatility in currency markets and alternative data usage for forecasting.

The US Bureau of Labor Statistics failed to release the September and October data, attributed to the ongoing federal government shutdown. The Federal Reserve, noting labor market softness, executed rate cuts, impacting monetary policy adjustment.

“Labor market softness and ongoing data uncertainty were key reasons for the latest rate cut to 3.75–4.00%.” – Federal Reserve, FOMC October 2025

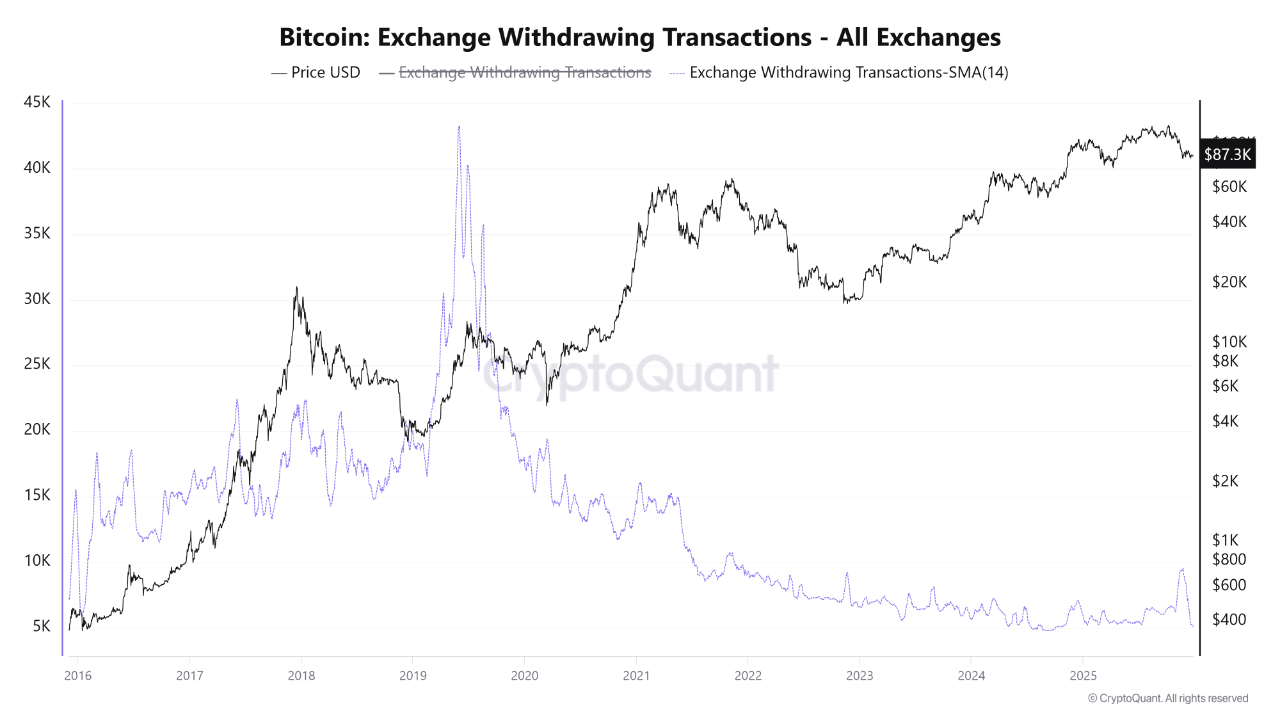

The absence of the NFP report has resulted in increased volatility across DXY and major Forex pairs, while crypto assets including Bitcoin and Ethereum remain stable. Institutional traders now rely on alternative data reflecting job trends.

Financial markets, deprived of vital labor data, face significant uncertainty, prompting reliance on non-governmental reports. Political leaders face mounting pressure to resolve the shutdown, which impacts data releases.

According to the US Treasury , the scenario leads to speculation on how financial markets will adapt. Historically, long-term impacts are minimal; however, short-term fluctuations are likely until official data is available. The Federal Reserve continues monitoring inflation and employment metrics closely.

The scenario may prompt deeper reliance on private-sector data and technological solutions in financial forecasting. Despite this, history suggests the eventual release of missing reports will stabilize markets post-disruption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan Lawmakers Consider Separate Taxation for Crypto Trading Derivatives and ETF Activity

Zcash (ZEC) Eyes Higher Ground: After a 14% Rally, Can Bulls Drive a Strong Week Ahead?

Bitcoin To Retest $85,000 As Bearish Technicals And On-Chain Weakness Align