Grayscale’s Filecoin (FIL) Holdings Hit Record High as Price Shows Signs of Recovery

Filecoin’s price recovery in November 2025 reflects rising confidence in decentralized storage solutions. With Grayscale expanding its FIL holdings and trading volumes soaring, institutional and retail investors are betting on FIL’s long-term relevance in the AI and DePIN sectors.

Filecoin (FIL), a leading cryptocurrency in the decentralized storage sector, is showing strong signs of recovery in November 2025. Although the price remains far below the peak of its previous cycle, market sentiment has clearly shifted. Investors are now focusing more on projects with real-world applications.

What’s driving investors’ optimism about FIL’s future? Here are some notable points.

Filecoin Trading Demand Surges in November

Filecoin (FIL) is a decentralized blockchain project designed to create an open data storage marketplace. It enables users to rent or lease storage capacity globally, eliminating the need for centralized providers like Google Drive, Amazon S3, or Dropbox.

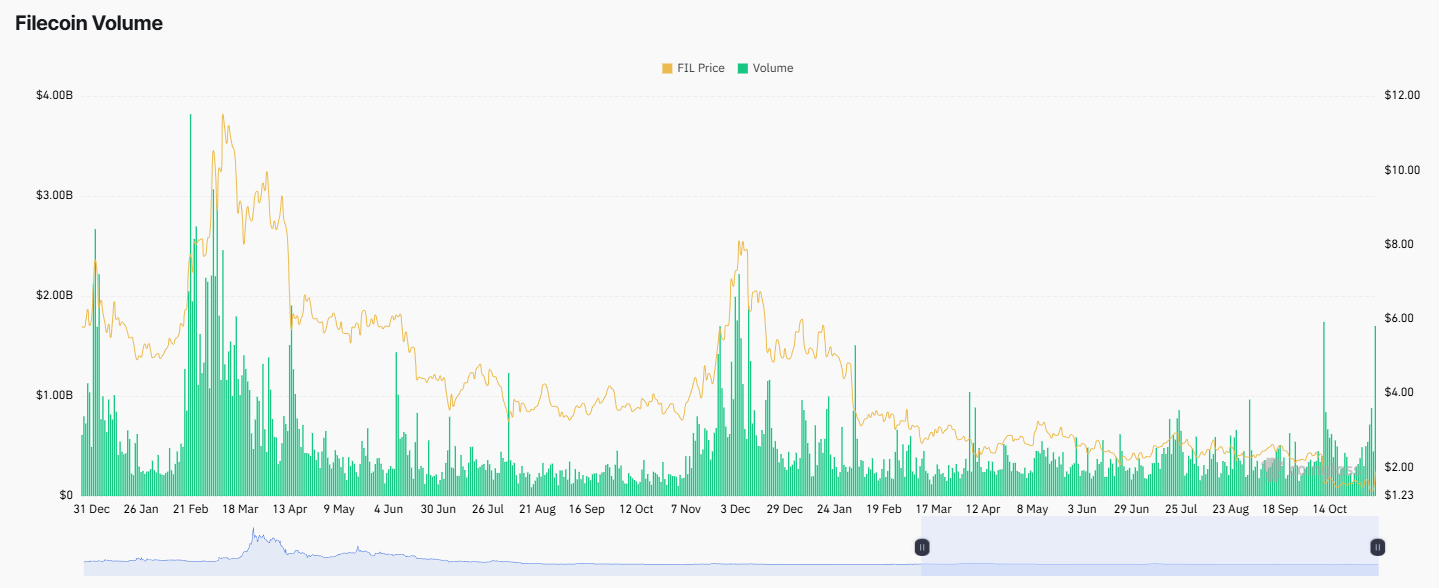

According to BeInCrypto data, Filecoin’s price surged nearly 60% during the first week of November, with 24-hour trading volume exceeding $1.4 billion.

Filecoin Price & Volume. Source:

Coinglass

Filecoin Price & Volume. Source:

Coinglass

Historically, such high trading volumes have only occurred a few times in the past two years. Each time the volume exceeded $1 billion, it was followed by a strong price rally, as seen in February 2024 and December 2024.

The return of billion-dollar daily trading volume in November reflects rising market activity and renewed investor interest. Market sentiment has also shifted dramatically.

Investors are increasingly favoring projects with practical use cases that have survived multiple cycles. This trend explains the recent gains in altcoins such as Zcash (ZEC), Dash (DASH), and Internet Computer (ICP).

“Look, Filecoin woke up after months of silence. Up more than fifty percent in twenty-four hours as DePIN and AI storage narratives collide. For years people dismissed it as outdated infrastructure, but the truth is AI needs storage that’s massive, decentralized, and fast. FIL was built for that before it was cool,” investor Justin Wu said.

Grayscale’s Filecoin (FIL) Holdings Reach New High

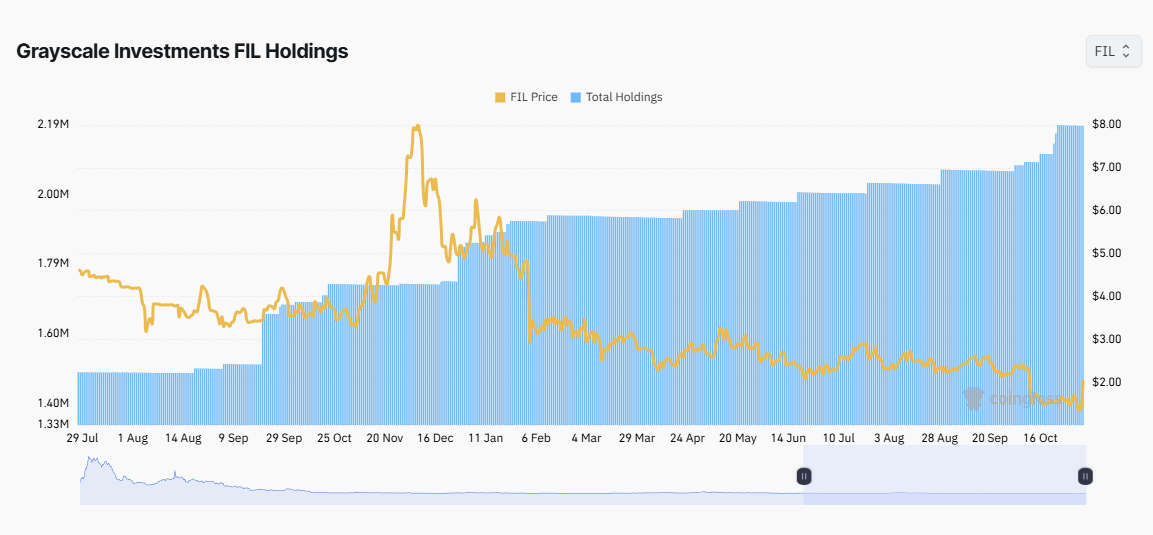

Further evidence of Filecoin’s growing recognition can be seen in Grayscale’s actions. Grayscale Investments — one of the world’s largest crypto funds — has been steadily accumulating FIL over the past two years. In November, its holdings reached an all-time high of more than 2.2 million tokens.

Grayscale Investment FIL Holding. Source:

Coinglass

Grayscale Investment FIL Holding. Source:

Coinglass

Interestingly, Grayscale continued to increase its FIL position even as the token’s price fell from above $10 to below $2. For the fund, the decline appeared to be an opportunity to accumulate more of this altcoin.

The Grayscale Filecoin Trust is one of the first investment vehicles allowing investors to gain exposure to Filecoin (FIL) in the form of a security. It offers a way to participate in FIL’s performance without dealing directly with the challenges of purchasing, storing, or safeguarding the token.

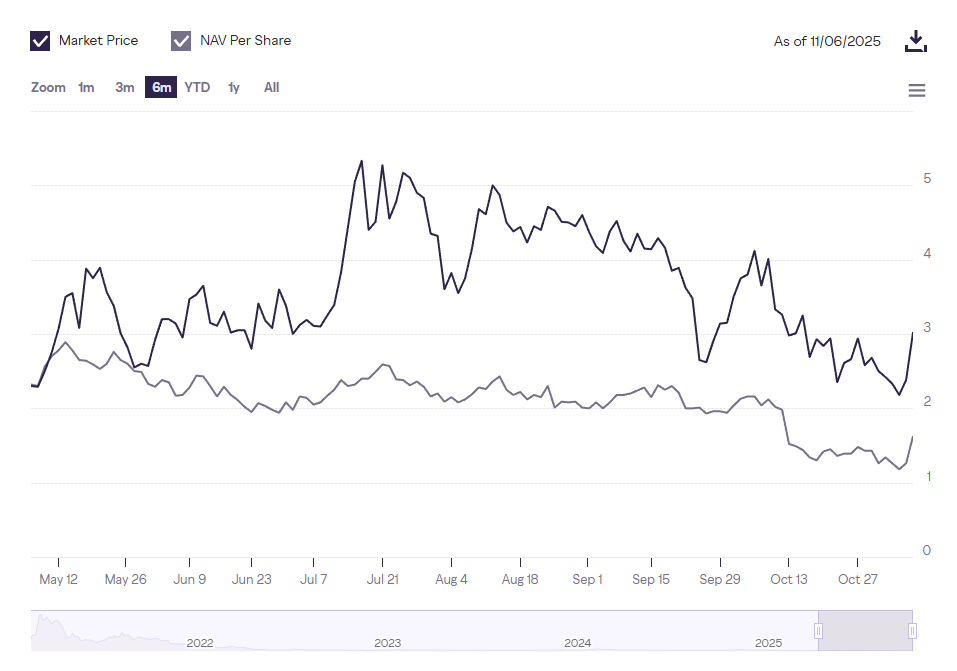

The Grayscale Filecoin Trust Performance. Source:

Grayscale

The Grayscale Filecoin Trust Performance. Source:

Grayscale

Currently, the Grayscale Filecoin Trust trades above $3 per share — higher than FIL’s spot market price. Meanwhile, its NAV per share remains lower than the trust market price, a situation that has persisted for years. This means the trust’s shares are trading at a premium, implying that investors are willing to pay more than the actual value of the assets held by the fund.

Analysts suggest that institutional investors often accept such premiums because they believe the underlying asset is worth that price — or potentially even more.

Despite these positive signals, Galaxy Research reports that FIL remains one of the worst-performing altcoins among the top 100, having fallen as much as 99% from its peak. The recovery journey, therefore, may take time and is unlikely to happen overnight.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC Drops 4.42% on November 8 as Short Liquidation Threats Rise and Large Holders Adjust Positions

- ZEC fell 4.42% on Nov 8 to $574 after a 42.1% 7-day rally, amid a broader privacy coin sector correction. - A 6.27M USDC deposit on HyperLiquid signaled strategic ZEC accumulation, contrasting with a $34M short position adding $36.8M collateral to avoid liquidation. - ZEC's largest long position reduced exposure by selling 5,000 ZEC, while BitMEX co-founder Arthur Hayes revealed Zcash as his second-largest holding after Bitcoin . - Market volatility intensified as bulls and bears reinforced positions, wi

Trust Wallet Token (TWT) Price Forecast: Is a Fresh Ecosystem Momentum Emerging?

- Trust Wallet Token (TWT) surged to $1.6 in 2025, driven by Trust Premium's tiered rewards system boosting token utility and demand. - TWT's integration into cross-chain operations and RWA partnerships with Ondo Finance expanded its use cases, unlocking institutional-grade asset access. - Analysts project $3–$15 price targets by 2025–2030, but risks include regulatory scrutiny of RWAs and competition within the Binance ecosystem. - The token's shift from governance asset to engagement driver highlights it

Astar 2.0's Strategic Enhancement and Market Impact: Advancements in Blockchain Infrastructure and the Changing Landscape of DeFi

- Astar 2.0 redefines DeFi by addressing scalability, interoperability, and security through infrastructure upgrades like zkEVM and cross-chain protocols. - Strategic partnerships with Japanese web2 giants and innovations like dApp Staking v3 enhance real-world utility and community-driven governance. - By bridging Polkadot , Ethereum , and BSC ecosystems, Astar positions itself as a cross-chain hub, outperforming traditional DeFi's fragmented models. - Emphasis on security and compliance aligns with indus

DASH Aster DEX Listing: Could This Transform the Future of Decentralized Finance?

- Aster DEX, a hybrid DeFi perpetuals exchange, combines AMM and CEX features with multi-chain support (BNB, Ethereum , Solana) and a yield-collateral model offering 5–7% asset returns. - Post-TGE, its TVL surged to $17.35 billion within a month, driven by institutional backing (Binance, YZi Labs) and 1001x leverage in "Simple Mode," surpassing sector averages. - DASH token saw 1,650% TGE growth but stabilized at $1, reflecting speculative volatility, while institutional investors expressed cautious optimi