November 6th Market Key Insights, How Much Did You Miss?

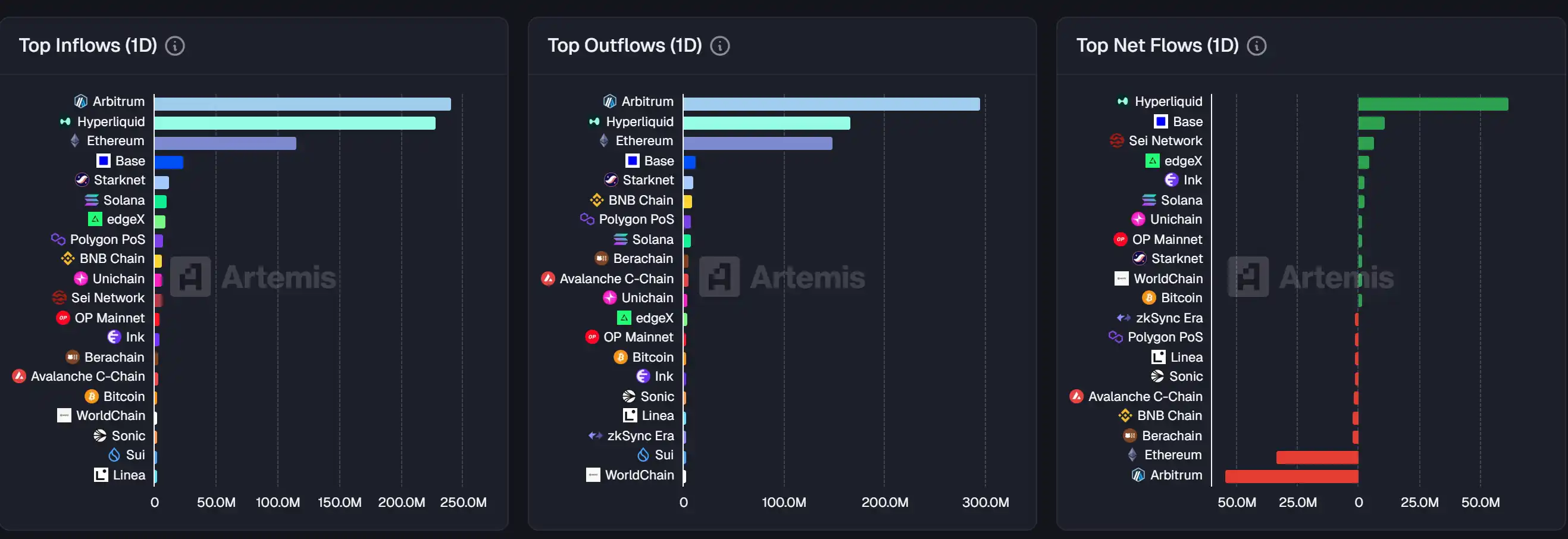

1. On-chain Volume: $61.9M inflow to Hyperliquid today; $54.4M outflow from Arbitrum 2. Largest Price Swings: $SAPIEN, $MMT 3. Top News: ZEC Surpasses $500, Naval's Shill Sees 575% Surge

Featured News

1. ZEC Surges Past $500, Naval's Call Sees 575% Gain

2. Trump Expresses Desire to Make the U.S. a "Bitcoin Superpower"

3. MON Pre-market Trading Price Briefly Exceeds $0.06, 24-hour Gain at 10.3%

4. BNB Chain Ecosystem Tokens See Significant Rebound, GIGGLE and Binance Life Lead in Market Cap

5. ASTER Has Repurchased a Total of 25.5 Million ASTER Since Public Buyback, with a Daily Average Repurchase of about 2.76 Million tokens

Trending Topics

Below is the translation of the original content:

[PIPWORLD]

Today, PIPWORLD gained attention due to its ranking on KaitoAI, as it has built the world's first AI-driven trading ecosystem. Users can create, train, and deploy PiP World intelligent agent clusters on any decentralized exchange (DEX) and blockchain. The project has been likened to an "AI hedge fund playground," and the user activity tracking leaderboard has officially launched. The addition of former Kraken executive Saad Naja and other notable figures has added credibility, and the platform's potential to innovate AI trading has garnered significant interest, with many investors expressing interest in its innovative model.

[MEMEMAX]

Today, MEMEMAX's discussion is centered around its integration with Kaito and the ongoing MaxPack event (which rewards on-chain transactions). Users are actively participating in trading to receive higher-value gift packages, with some users reporting generous rewards. The community is also actively discussing MEMEMAX's platform potential and future development, including its onboarding process and fee structure. The high return potential and strategic partnerships established by the platform are core reasons for the market excitement.

[MEGAETH]

Today's discussion on MEGAETH mainly revolves around the public distribution strategy and process transparency. The team has been praised for detailing the allocation method (including a scoring system based on on-chain activity, social interactions, and MEGAETH-specific signals). The community's response has been mixed, with some users celebrating their selection in the core community list, while others express disappointment for not being included. The discussion also touches on MEGAETH's potential as a leading platform for crypto applications, with some users having strong confidence in its future development.

[MONAD]

Today's core discussion on MONAD focuses on the upcoming mainnet launch scheduled for November 24th and the accompanying airdrop activity. This news has triggered strong excitement and anticipation in the crypto community, with multiple tweets highlighting the mainnet launch, airdrop details, and the support from major platforms and wallets. Additionally, the market is also focusing on Monad's strategic partnerships, ecosystem development, and comparative analysis with other blockchain projects.

[INTUITION]

INTUITION, with the trading symbol $TRUST, is receiving attention today due to its mainnet launch and subsequent listings on major exchanges such as Binance, KuCoin, and Kraken. The project focuses on decentralizing information and turning data into assets, with its airdrop activity and staking opportunities receiving positive market feedback. The community actively engages in project interactions, celebrating its potential to innovate the knowledge economy through decentralized trust and reputation systems.

Featured Articles

1.《Market Volatility Intensifies, Why Bitcoin Still Has a Chance to Reach $200,000 in Q4?》

This article was first published on October 27, 2025. On November 6, Tiger Research published another article stating that amid intensified market volatility, they still maintain the $200,000 target price. The article elaborates on the reasons.

2.《Crypto Market Macro Research Report: U.S. Government Shutdown Causes Liquidity Contraction, Crypto Market Sees Structural Turning Point》

In November 2025, the crypto market is experiencing a structural turning point. The overall market capitalization decline corresponds to mid-term turnover and value layout in the fear index. Key risks lie in regulatory uncertainty, on-chain complexity and multi-chain fragmentation, information asymmetry, and emotional turmoil. The next 12 months will be a "structural bull" instead of a comprehensive bull, with a focus on mechanism design, distribution efficiency, and attention operations; seize early-stage distribution and execute a closed loop, prioritizing disciplined allocations around the long curve theme of AI×Crypto, DAT, and others.

On-chain Data

On-chain Fund Flow for the Week of November 6

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Update: SEC Sets November 2025 as Pivotal Deadline for Dogecoin ETF Approval

- Bitwise files a fast-track SEC 8(a) ETF application for Dogecoin , targeting November 2025 approval if regulators remain silent. - The move reflects growing institutional demand for crypto exposure amid regulatory uncertainty and a competitive ETF landscape. - Grayscale's DOJE ETF and rivals' XRP/Dogecoin products highlight intensified competition, with $24M+ in early trading volumes. - Analysts project 300% DOGE price gains if resistance breaks, while SEC's crypto-friendly leadership and legal battles w

Ethereum Updates Today: SharpLink Moves ETH—A Bid for Stability or Signs of Major Overhaul?

- SharpLink Gaming transferred $14M ETH to OKX ahead of Q3 earnings amid crypto market declines. - The move highlights challenges for crypto-holding firms as ETH drops 25% in 30 days and stocks like SBET fall 4.28%. - Institutional investors increasingly use ETH staking for yield, contrasting Bitcoin-focused strategies lacking comparable returns. - CertiK emphasizes treasury management integrity as spot crypto ETFs shift focus to secure asset handling amid governance scrutiny.

Tesla’s $1 Trillion Musk Deal: Strategic Move to Keep CEO or Example of Excessive Corporate Power?

- Tesla shareholders approved a $1 trillion compensation package for Elon Musk, tied to aggressive targets like $8.5 trillion valuation and 20 million vehicle deliveries. - Critics call the package excessive, while Tesla defends it as critical to retain Musk amid his SpaceX, xAI, and Trump administration commitments. - The Texas-based approval bypasses Delaware's strict governance rules, sparking debates over "race to the bottom" in corporate accountability. - Skeptics question feasibility of targets, with

The Quantum Computing Hype Cycle and What It Means for the Valuation of Cybersecurity Stocks

- Quantum computing threatens RSA/ECC encryption by 2025, accelerating post-quantum cryptography (PQC) adoption and investment in quantum-safe firms. - NIST's 2030 PQC standards and "harvest now, decrypt later" strategies force urgent infrastructure upgrades, with governments stockpiling sensitive data. - SEALSQ leads the quantum-safe sector with $220M liquidity, $17.5M 2025 revenue guidance, and PQC-embedded semiconductors for IoT/automotive sectors. - High-risk plays like BTQ (blockchain PQC) and pre-rev