XRP News Today: Mastercard’s Blockchain Initiative: Regulated Networks Set to Transform International Payments

- Mastercard explores $1.5B-$2B acquisition of MiCAR-licensed crypto infrastructure firm Zerohash to expand Web3 capabilities. - Partners with Ripple to pilot RLUSD stablecoin for credit card settlements on XRP Ledger, enabling instant cross-border transactions. - Zerohash's regulatory compliance and $1B valuation align with Mastercard's strategy to bridge traditional finance and blockchain infrastructure. - RLUSD's NYDFS-backed growth and XRP Ledger integration could reshape global payments while reinforc

Mastercard Inc. (MA) has become a significant force in the cryptocurrency sector, recently taking steps that reinforce its dedication to connecting conventional finance with blockchain innovation. Amid rumors of a possible $1.5 billion to $2 billion purchase of Zerohash—a crypto infrastructure firm licensed under MiCAR—the payments leader is also trialing stablecoin-powered credit card settlements with Ripple, utilizing its RLUSD stablecoin on the

Zerohash, which delivers stablecoin infrastructure to traditional banks and financial firms, recently obtained a Markets in Crypto-Assets Regulation (MiCAR) license, granting it the ability to operate throughout the European Economic Area (EEA). The company, which counts Morgan Stanley and Interactive Brokers among its clients, has raised more than $104 million and is valued at $1 billion. Messari’s Jakob Jake points out that Zerohash’s robust regulatory compliance—including U.S. FinCEN registration and money transmitter licenses—makes it a valuable asset for

In addition to the Zerohash talks, Mastercard is working with Ripple, WebBank, and Gemini to pilot RLUSD—a stablecoin pegged to the U.S. dollar on the XRP Ledger—for credit card settlements. Announced at Ripple’s Swell 2025 event, this pilot seeks to replace legacy settlement systems with blockchain-based alternatives, allowing for nearly instant, low-fee international payments. WebBank, which issues the Gemini Credit Card, will use RLUSD to settle Mastercard transactions on the XRP Ledger, potentially making it one of the first regulated U.S. banks to use a public blockchain for fiat card settlements, according to

RLUSD, which exceeded $1 billion in circulation by October 2025, is issued under a charter from the New York Department of Financial Services (NYDFS) and is fully backed by cash equivalents. Monica Long, President of Ripple, highlighted that this project shows how blockchain can improve payment speed and efficiency while still meeting compliance standards. Sherri Haymond, Mastercard’s Global Head of Digital Commercialization, stated that the company remains focused on upholding consumer protections and regulatory compliance as it explores new settlement approaches, as also covered by

Mastercard’s expansion into crypto highlights the increasing significance of regulatory structures such as MiCAR and NYDFS oversight. Zerohash’s MiCAR license, which permits operations in 30 EEA nations, supports Mastercard’s efforts to grow its presence in Europe. Similarly, RLUSD’s adherence to U.S. regulations positions it as a reliable link between blockchain and established financial systems. Experts believe these initiatives could boost institutional use of stablecoins, with RLUSD’s rise on the XRP Ledger—now the network’s largest stablecoin—demonstrating its potential to transform global payments, according to

The adoption of XRP Ledger-based solutions has renewed interest in XRP’s practical applications. Market observers note that real-world implementations, such as Mastercard’s settlement pilot, could increase long-term demand for XRP. TheCryptoBasic, a digital currency news source, called the partnership a “milestone” for XRP, stressing its importance in showcasing blockchain’s potential for mainstream financial use, as reported by

Mastercard’s calculated moves involving Zerohash and Ripple mirror a wider industry shift toward regulated blockchain solutions. As the company deals with regulatory challenges and market fluctuations, its progress in integrating stablecoins and tokenized assets could serve as a model for other financial players. With Zerohash acquisition discussions and RLUSD pilot projects moving forward, Mastercard’s influence on the future of digital payments is becoming more pronounced.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

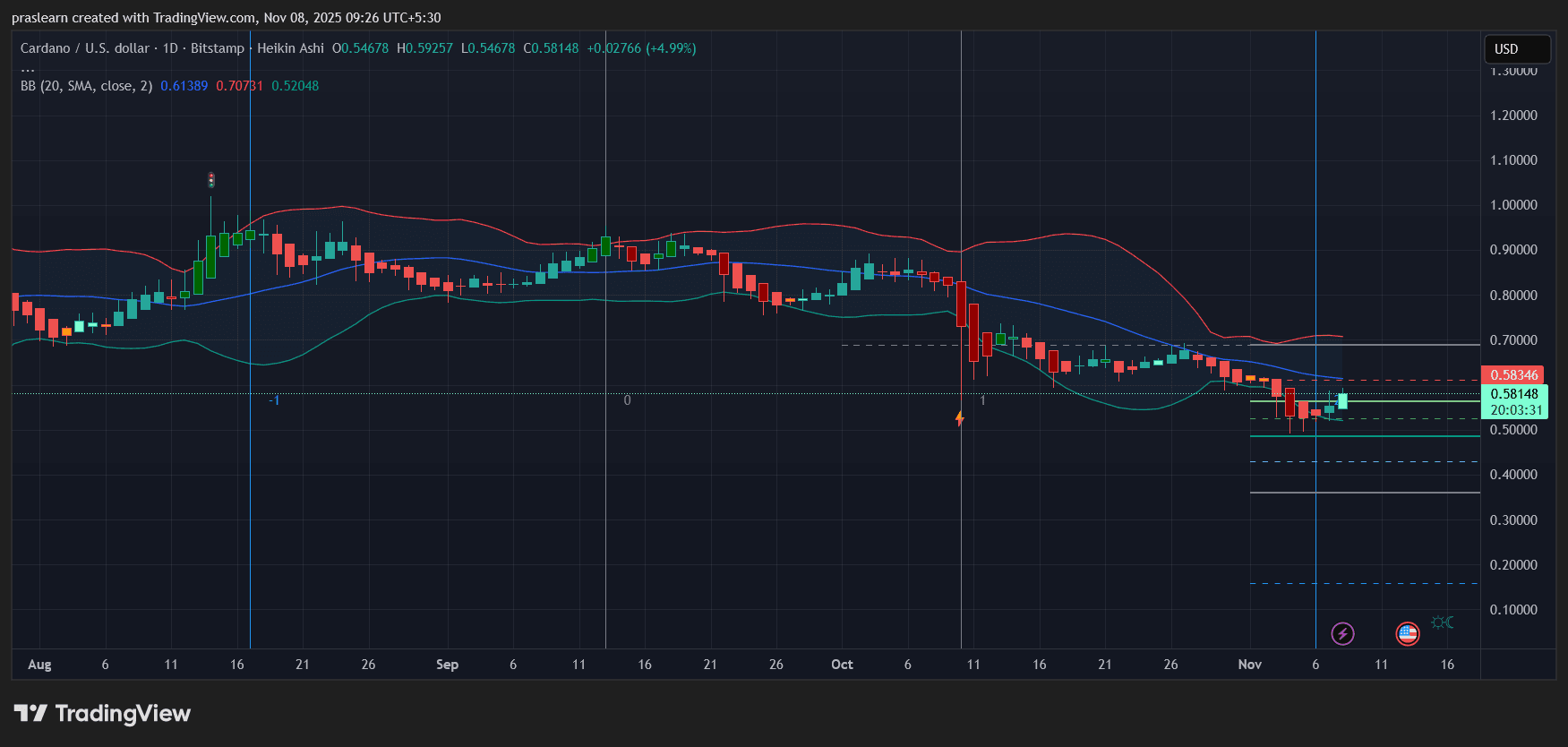

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ

"Study Reveals 25% of Polymarket's Trading Volume is Artificial Due to Ghost Trades"

- Columbia University study reveals 25% of Polymarket's trading volume may involve wash trading, where users self-trade to inflate activity. - Sports and election markets showed highest manipulation rates (45% and 17% fake volume), peaking at 95% in election markets in March 2025. - Platform's lack of transaction fees and pseudonymous wallets enabled manipulation, despite CFTC regulatory actions since 2022. - Researchers urge Polymarket to adopt their detection methods to exclude fraudulent wallets and res