MegaETH announces token sale allocation strategy

Different allocation strategies for existing community members and long-term investors.

Original Title: MegaETH Allocation Strategy

Author: namik (CSO of MegaETH)

Translation: Jiahua, ChainCatcher

Handling a token sale event that was oversubscribed by 28 times, with over 53,000 participants, is not as fun as it sounds. In my previous articles, I emphasized that our main focus this time was on two groups of people:

-

Early and active MegaETH community members

-

People we believe will grow with MegaETH in the long term

A few days before the sale ended, Artemis (our data lead) and I met in Istanbul and started running a lot of simulations. We tried many different ways to “perfectly” measure everyone’s contribution, and quickly realized that it was impossible to do so in such a short time, because “contribution” is multi-faceted.

Therefore, we decided to break the problem into two parts:

The rest of this article will detail how we achieved these two things and accomplished this goal:

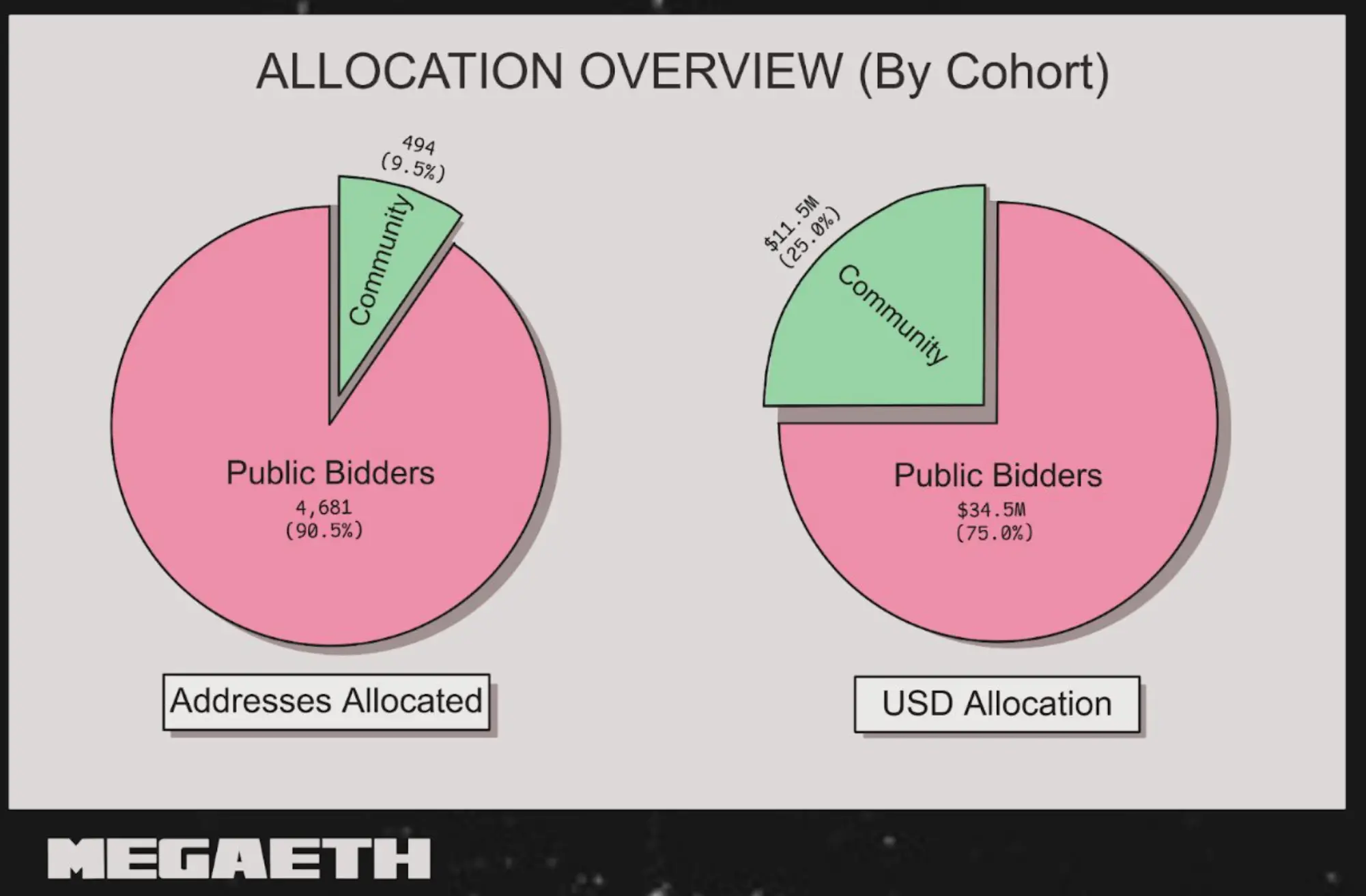

Allocation for Existing Community Members

For the first group, our existing community, we used the old-fashioned way: manually.

We relied on existing community channels, including @Heisenbruh and our mod circle, to compile a list of people who have been substantially involved with MegaETH since we came out of “stealth.”

This list includes those who:

-

Participated early and continuously

-

Helped shape the project's atmosphere and values

-

Supported us during bear markets and quiet times

-

Provided feedback, signals, and energy before the token attracted speculation

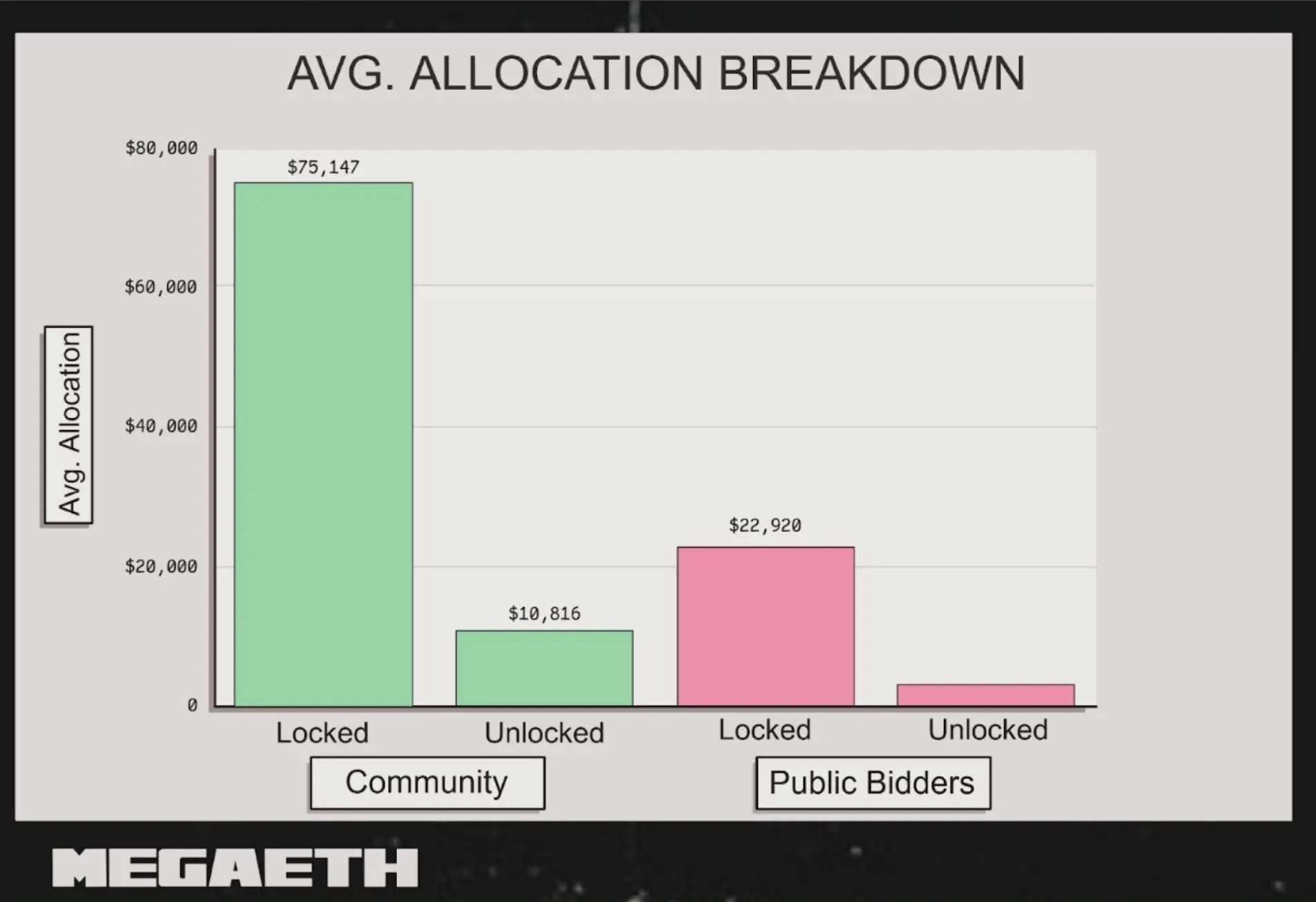

It should be noted that most of these people did not choose to lock their tokens. We think that’s fine. They have already contributed with time, attention, and belief. In our view, they have already “put in the work.”

In the spirit of transparency, here is the allocation list that we believe represents our core community over the past few years .

This list is not perfect. We definitely missed some people, and for that I sincerely apologize.

This group, plus application developers who chose a one-year lock, are the only people handpicked by the team.

Even within this group, not everyone received a full allocation. Far from it. The scale and demand of the sale still forced us to make trade-offs. But we are comforted that this approach respects those who helped us get here, without turning the sale into a pure popularity contest. These users received much larger shares than what algorithmic sorting would have allocated, and, except for the aforementioned application developers, the vast majority of these participants are unlocked.

Measuring Long-Term Investors

The second group is everyone who participated through the public process and may become long-term holders of MegaETH.

Here, we wanted to systematize. We designed a scoring system that combined:

-

On-chain activity

-

Social signals and influence

-

MegaETH-specific engagement

-

Not treating it as a trade (willingness to lock for 1 year)

Our goal was not to reward “points grinders,” but to assess genuine conviction.

Metrics Used

We used four different metrics in the overall scoring system

1. Moni Score

The Moni Score was used as both:

-

A basic screening criterion

-

As a component of the broader social score

Background info:

-

My Moni Score is about 7,000

-

@artemis_onchain’s Moni Score is about 300

Based on this distribution, we felt that setting the Moni Score at 50 as the minimum threshold in most cases was appropriate. It’s not a perfect measure of quality, but it’s a useful boundary to distinguish blank accounts from those with at least some activity. Alternative forms of social verification are discussed and implemented below.

2. On-Chain Activity Score

The on-chain activity score is a weighted composite of several categories.

-

Early (15%)

Early interactions and adventurous behavior

-

OG (15%)

Long-term participation in the broader ecosystem

-

Holdings (15%)

Financial commitment and proxy indicators of vested interest

-

NFT (7.5%)

Current on-chain participation and activity as reflected by NFTs

-

Recent (15%)

Your recent activity, not just from years ago

-

MEGA-specific (32.5%)

Activities related to MegaETH, including CAP score, MEGA NFT, and specific testnet operations

3. Social Score

The social score combines:

-

Moni

-

Kaito

-

Additional references (marked with []) and Ethos for manual review

We used an overlay of different tools rather than trusting a single metric. This helped us avoid obvious bots and low-quality spam accounts, and also helped identify truly engaged participants.

4. Mega Score

The Mega Score is a MegaETH-specific signal. It includes:

-

CAP score

-

Ownership of MEGA NFT

-

Specific testnet activities

We used the Mega Score in two ways:

-

As part of the on-chain activity score

-

As a filter for certain thresholds, to ensure Mega-specific participants are not squeezed out by generic on-chain grinders

Why Locking Is Important

We placed significant weight on whether someone chose to lock their $MEGA for a year.

In our view, locking for a year in a volatile market is a strong indicator of conviction. No one knows what will happen tomorrow. Committing to a one-year lock is a statement that you are here for the long term, not just for a quick trade.

Participant Screening and Allocation Process

Once we had the scores, we still needed to decide:

-

Who gets included in the allocation list

-

How to convert scores into actual allocation sizes

We divided this into two groups:

-

Locked participants

-

Unlocked participants

Allocation Process for Locked Participants

For participants who chose to lock, you mustmeet at least one of the following criteriato be considered:

-

Moni Score above 50

-

On-chain score above 200

-

Mega Score shows more than just one Fluffle NFT

In other words, you need to meet at least one of these:

-

Have a basic level of social activity

-

Have clear on-chain signals

-

Have strong MegaETH-specific engagement

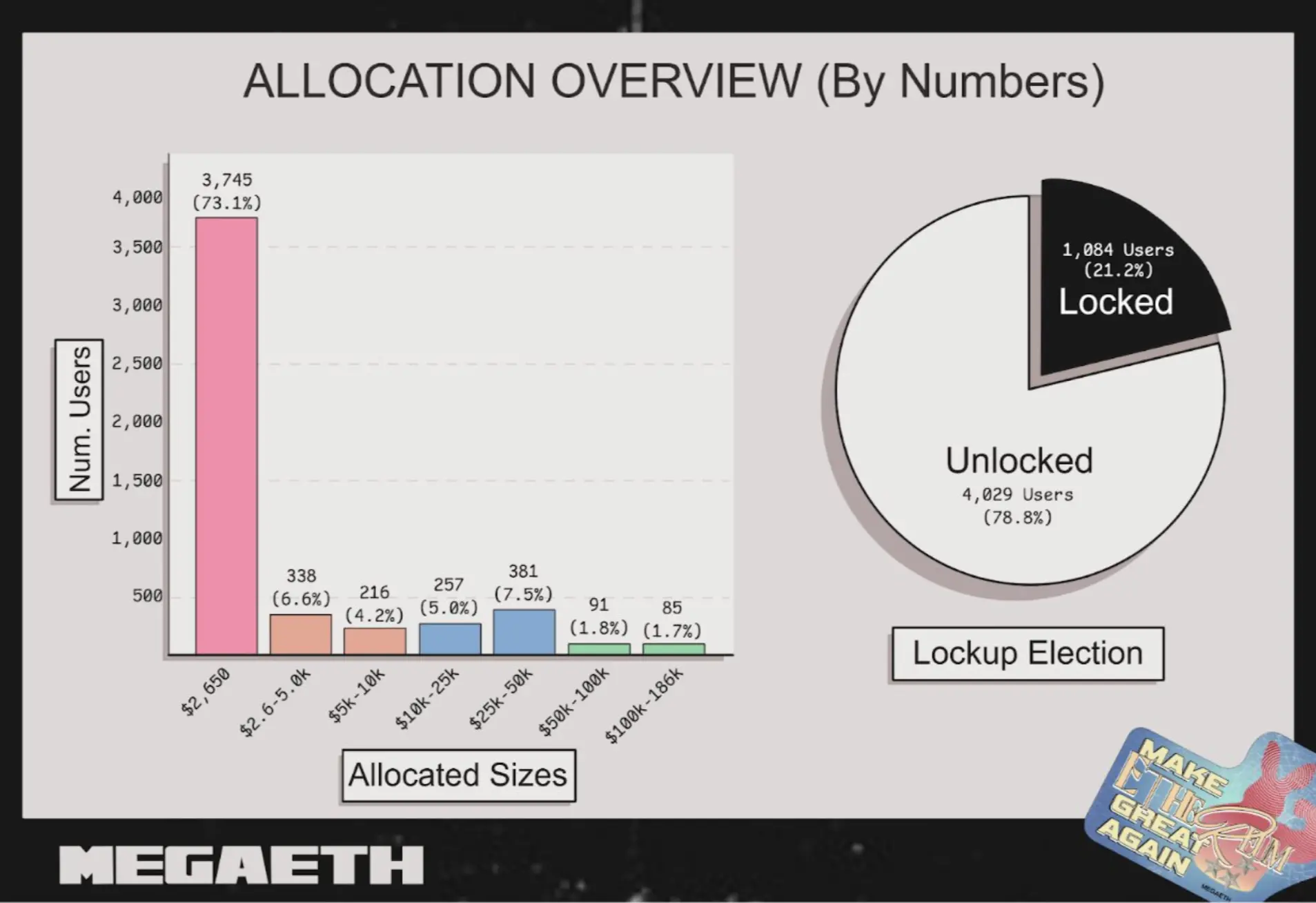

After applying these filters, about 29.4% of locked addresses were included in the allocation set. This is about 1,000 addresses.

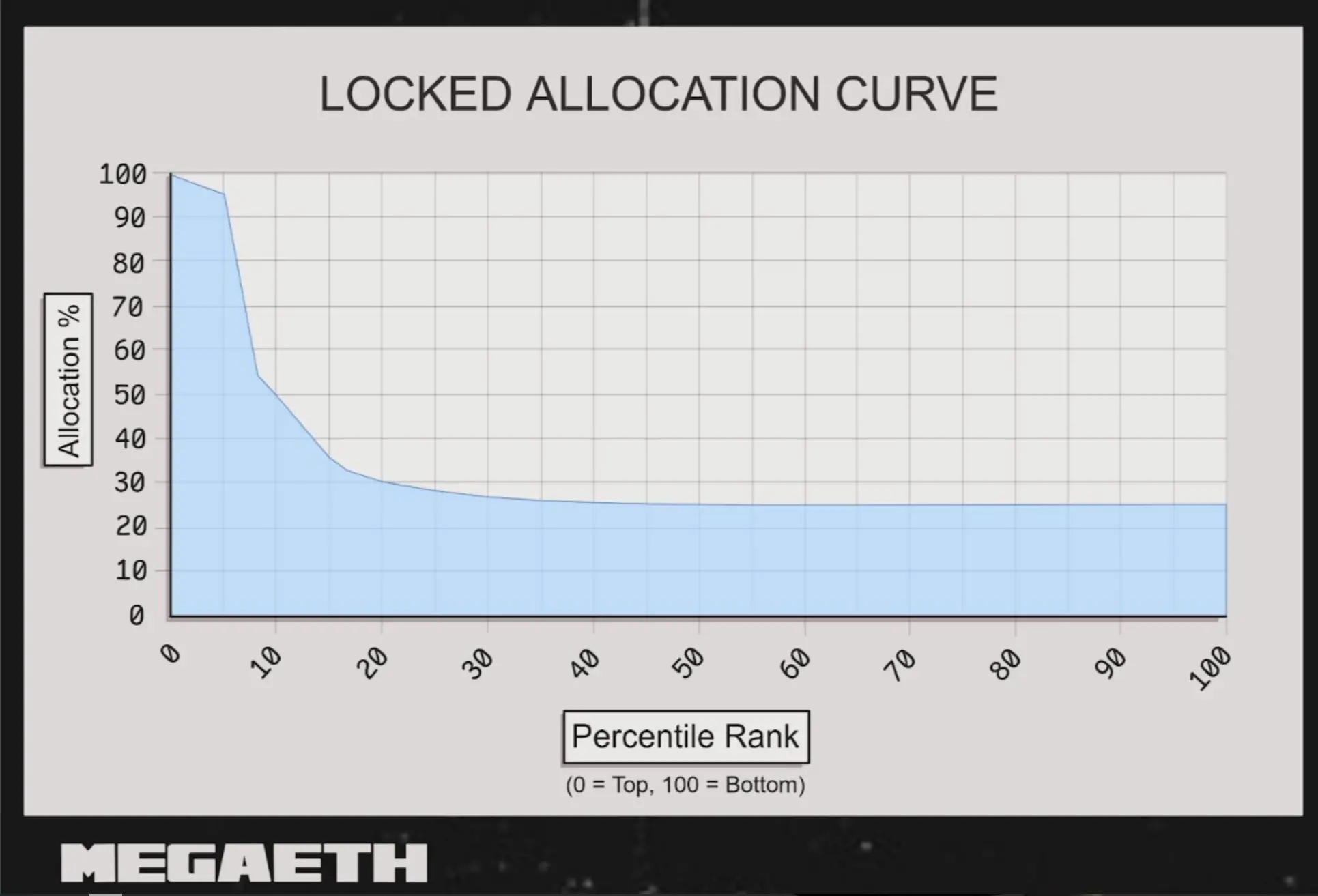

Once a wallet passed the screening, its allocation was a function of its final score, which blended on-chain and social signals. We used a piecewise continuous curve to reward top performers while maintaining a minimum allocation threshold.

This design resulted in:

-

Top 5%: Linear gradient from 100% to 95% share

-

Next 3% (5%-8%): Steep drop from 95% to 55% share

-

Next 7% (8%-15%): Gradual drop from 55% to 35% share

-

Remaining 85%: Exponential decrease from 35% to a minimum share of 25%

Allocation Process for Unlocked Participants

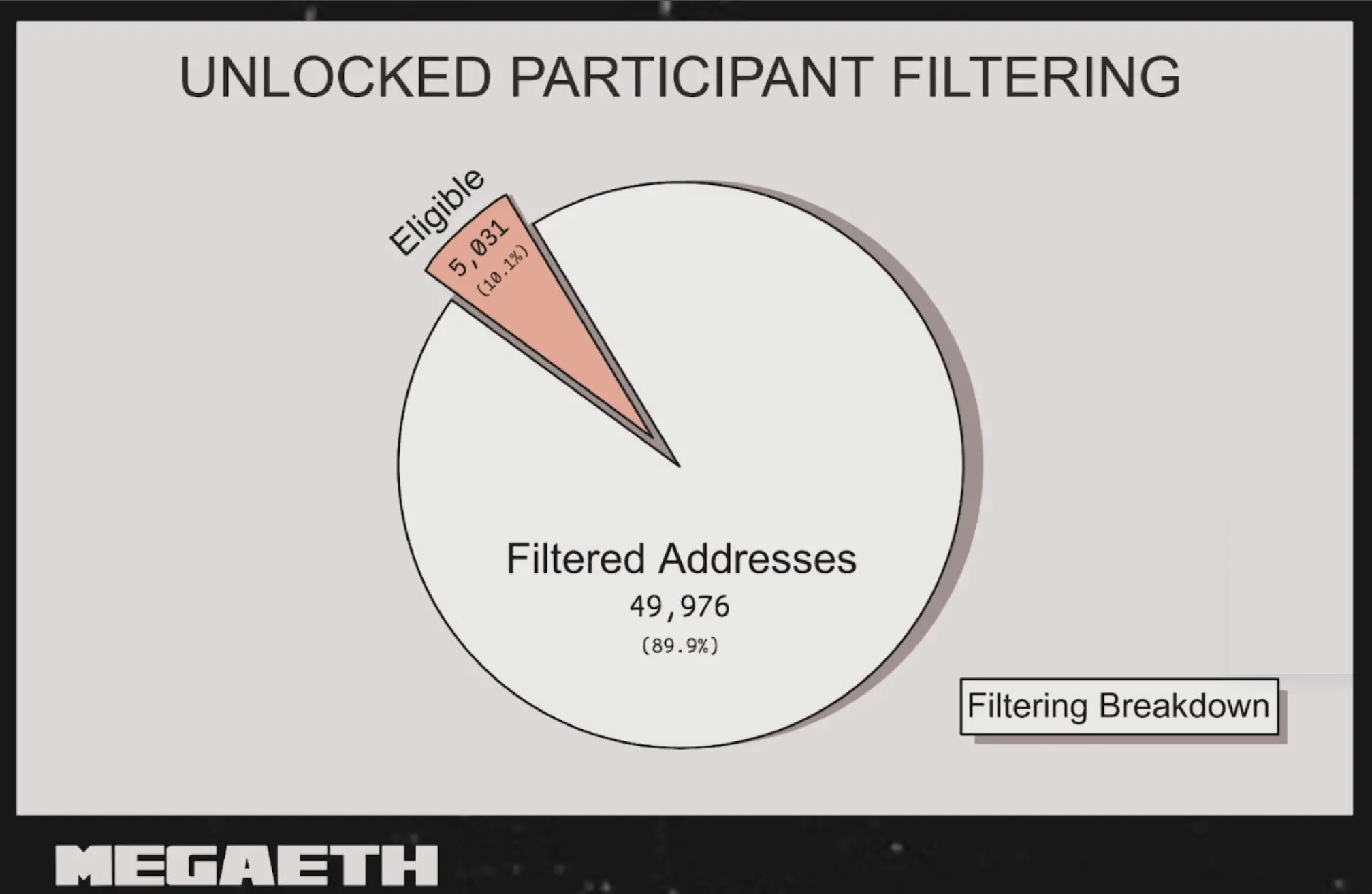

If an unlocked addresspasses at least one of the following thresholds, it will be accepted:

-

Moni Score > 200

-

Social Score > 200

-

On-chain Score > 300

-

Mega Score > 68 (more than one Fluffle NFT)

So, if you are clearly active on-chain, have strong social signals, or show significant MegaETH-specific engagement, you qualify. You do not need to pass all these thresholds.

In practice, among 49,976 unlocked participants, 5,031 wallets passed this screening, with an acceptance rate of about 10.1%. Competition among the accepted addresses was fierce, even for the minimum share. We trust the algorithm to do its job and are fully aware that some people—even with significant MegaETH activity and holdings—may not make the cut if their other metrics are weak. But this is a fair game, and we respect the results.

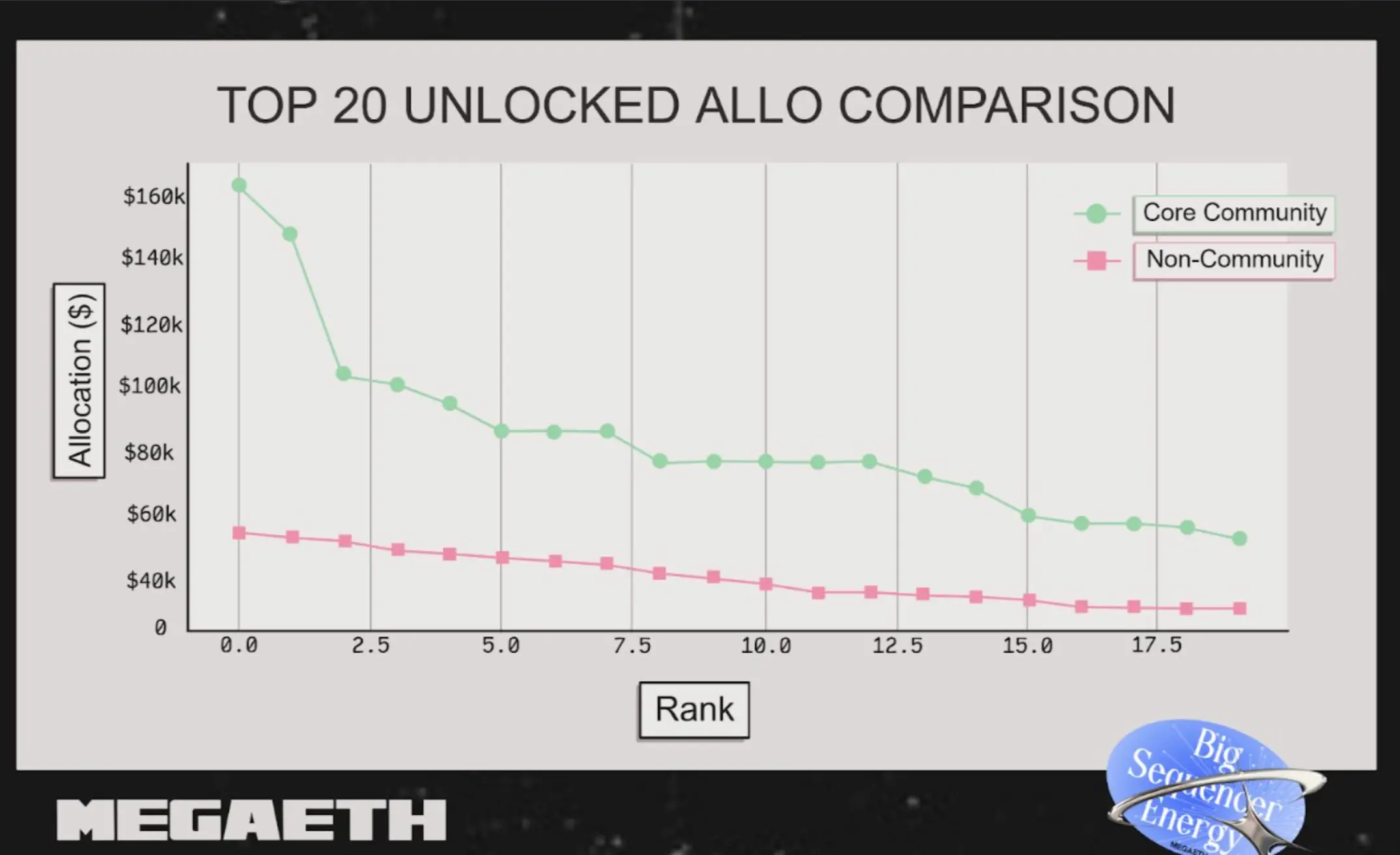

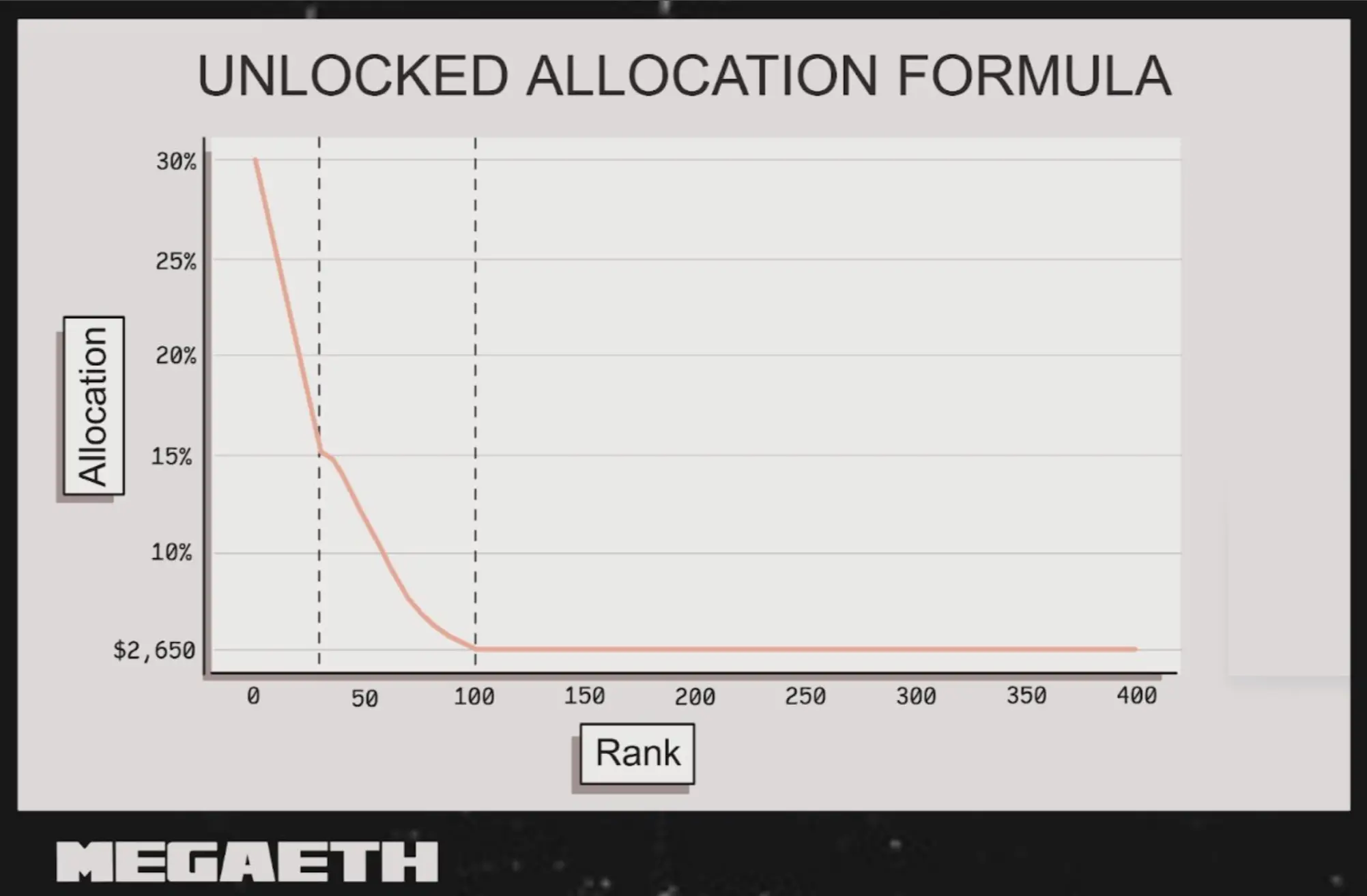

Among the accepted group, we ranked wallets by composite score and then determined the percentage of their requested allocation they received.

At the top of the rankings, allocation follows a smooth downward slope. The top-ranked wallets get the highest allocation share, and as your rank drops, this percentage gradually decreases.

After a certain rank, the curve flattens, and everyone else receives the same minimum allocation share.

Protection for Small High-Scoring Bidders

We noticed that some smaller bidders managed to achieve the same ranking as larger bidders. To maintain fairness, we ensured that no participant received an absolute amount lower than the five bidders next to them (i.e., those ranked immediately adjacent).

For example, @thedefinvestor, ranked in the top 15 among unlocked bidders, had no max bid. If allocated by percentage, he would have received a lower allocation. Meanwhile, his neighbors bid the max and received a similar percentage share, but got much more (in absolute terms).

To recognize @thedefinvestor’s outstanding performance and ability to rank so high despite a smaller bid, his allocation was raised to the cap, bringing it close to his neighbors. That’s where those 100% allocation shares come from.

Participant Examples

Case 1: Low Social Score, High On-Chain Score

@cp0xdotcom has little Twitter influence and has never tweeted about MegaETH. Thus, his social score is low. But this did not stop him from ranking in the top 20 of all participants by total score and receiving 92% of his locked maximum bid.

His strengths are:

-

Over 8 years of on-chain history

-

Burned 194 ETH in gas

-

High scores for early participation in contracts that later gained real traction in the Ethereum ecosystem

-

Interacted with 3,490 unique contracts historically

-

Active on Ethereum mainnet for 164 of the past 180 days

He has no NFTs and no Mega-specific activity. He still ranked high, showing that our system allows those who excel in their area—even without social or Mega-specific bonuses—to reach the top.

Case 2: Low On-Chain Score, High Social Score

@nics_off is almost the mirror image. The wallet he provided has less than 2 years of on-chain history, burned only 1.5 ETH in gas, and interacted with just 150 unique contracts, so his on-chain score is average. His social score played a major role.

Factors driving his ranking up:

-

Strong influence and consistent activity on Twitter

-

Ranked 13th on the Kaito MegaETH leaderboard

-

High-quality MegaETH-focused content

This combination gave him the highest total score among unlocked participants. He ranked in the top 17 of all unlocked users and received the highest allocation share (20%) in that group.

His example also shows that having a large Twitter following alone is not enough. Because the social score equally combines Moni and Kaito, high-quality Mega-related content matters more than raw follower numbers.

We saw many similar cases at the top of the rankings. We especially want to highlight:

-

@barthazian, who ranked first among all users and scored highly on every metric.

-

@0xMaxBT, who won the title of “MegaETH Testnet Legend,” and was the only one among 53,000 participants to hit 100% of all tracked testnet contracts.

Anti-Sybil Measures

We used multi-layered Sybil attack protection.

First, we received Sybil cluster reports from the community and external groups such as Bubble Maps and Echo. These clusters were used as direct filters for participants.

Second, our scoring system itself made it hard for Sybils to get through. To score highly, a wallet needed strong on-chain activity and a credible history. Low-quality linked addresses usually failed at this stage.

We also found many cases where the same wallet or social account was linked to multiple KYC bids. When we detected this pattern, we ignored all related requests.

Finally, we will continue to check for Sybils among wallets that received allocations and reserve the right to refund users if malicious activity is found.

I want to thank Artemis again for all the hard work. We are honored by the demand for this sale, and we hope this maximum transparency will help everyone understand how we arrived at the final allocation results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

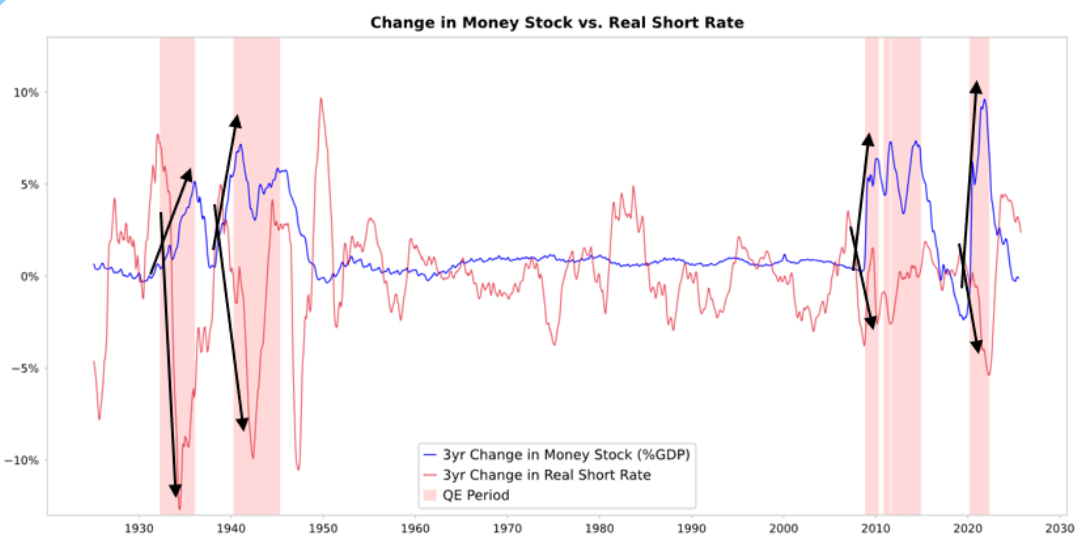

Ray Dalio's latest article: This time is different, the Federal Reserve is fueling a bubble

Due to the highly stimulative nature of current government fiscal policies, quantitative easing will effectively monetize government debt rather than simply reinjecting liquidity into the private system.

Latest! Polkadot updates its 2025 roadmap, with several core products set to launch soon!

"I'm not good at management" — Gavin Wood's choice is also Polkadot's opportunity!