Why France’s New Wealth Tax Won’t Necessarily Target Your Crypto — Yet

France’s proposed wealth tax adds crypto to its “unproductive” asset list but targets only the ultra-rich. While most investors are unaffected, the move has stirred debate over whether France is discouraging innovation in its growing Web3 ecosystem.

France’s proposed “unproductive wealth” tax has raised eyebrows among crypto investors, but most won’t be affected. By lifting the taxable threshold to €2 million, the measure targets only the ultra-wealthy. Every day crypto holders will remain outside its reach.

Its real impact lies not in new tax burdens but in how France is redefining digital wealth within its broader fiscal policy.

Crypto Added To “Unproductive Wealth” List

France has advanced plans to include cryptocurrency in its revamped wealth tax, following lawmakers’ narrow approval of an amendment classifying digital assets as “unproductive wealth.”

Proposed by centrist deputy Jean-Paul Mattei, the measure passed the National Assembly by 163 votes to 150 during debates on the 2026 draft budget. It would replace the current real estate wealth tax with a broader version targeting assets deemed economically inactive.

France is changing how it taxes wealth by including large cryptocurrency holdings under a new rule targeting what it calls “unproductive wealth.”A new law passed by the French government now applies a 1% tax to net assets over €2 million, and this includes digital assets like…

— unusual_whales (@unusual_whales) November 4, 2025

Besides crypto, the reform expands the tax base to include luxury goods such as yachts, private jets, jewelry, and art. It raises the taxable threshold from €1.3 million to €2 million and introduces a flat rate of 1% on net assets exceeding that amount.

Supporters argue that the goal is to channel wealth into productive investments that foster economic growth.

For crypto investors, this raises an immediate question: Does holding Bitcoin or Ethereum make someone liable? The answer for most is no.

Higher Threshold Narrows Tax Impact

As reported this week, the tax is designed to affect only the wealthiest households. The move will largely leave ordinary investors and most crypto traders unaffected.

With the threshold likely rising to €2 million, even fewer people will fall under its scope. A holder with €100,000 in Bitcoin wouldn’t come close to owing anything. Only those with fortunes heavily concentrated in passive assets, such as gold, art, or cryptocurrency, could experience an impact.

Still, the inclusion of digital assets has unsettled parts of France’s crypto industry. Many in the sector see the move as a sign that innovation is being mistaken for inactivity.

Industry Fears Setback For Innovation

France has spent the past few years establishing itself as a leading European hub for Web3, drawing major players such as Binance and Ledger.

The new proposal, however, has sparked criticism from the crypto community, which argues that it undermines the industry’s contribution to innovation and growth.

Government are trying hard to invent ways to tax crypto..The most ridiculous could be FranceThey want to implement an "Unproductive Wealth Tax" for crypto holdings and some types of properties.If it's really unproductive, why tax it? it's like taxing someone because they…

— Hunter (@Hunter_Triumph) November 3, 2025

Some fear it could send the wrong message, deterring long-term investment at a time when countries like Portugal and Dubai are offering far more welcoming tax environments.

However, the government estimates the reform could bring in €1–3 billion annually, though that figure remains uncertain.

For now, the measure is still under review. It must clear the Senate and be incorporated into the 2026 national budget before becoming law, possibly as early as January.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Aster DEX: Could This Be the Upcoming Breakthrough in On-Chain Trading?

- Aster DEX merges AMM and CEX models for improved usability, targeting both retail and institutional traders. - Backed by Binance's ecosystem and CZ endorsements, it achieved top-50 crypto status via aggressive airdrops and CMC campaigns. - Hidden orders and AI-driven liquidity optimization drive growth, but regulatory risks and token supply concerns threaten sustainability. - With $27.7B daily volume and 2,200% token price surge, Aster challenges DeFi norms but faces competition from Hyperliquid and cent

Bitcoin News Update: Short-Term Holders Increase Holdings While Long-Term Holders Realize Gains—$100K Becomes Key Level

- Bitcoin fell below $100,000 as Coinbase premium hit a seven-month low, reflecting weak U.S. demand and ETF outflows. - On-chain data shows short-term holders (STHs) accumulating Bitcoin while long-term holders (LTHs) moved 363,000 BTC to STHs, signaling mixed market dynamics. - Analysts highlight a "mid-bull phase" with STHs absorbing selling pressure, and a $113,000 support level critical for potential rallies to $160,000–$200,000 by late 2025. - The Fear and Greed Index entered "Extreme Fear," and exch

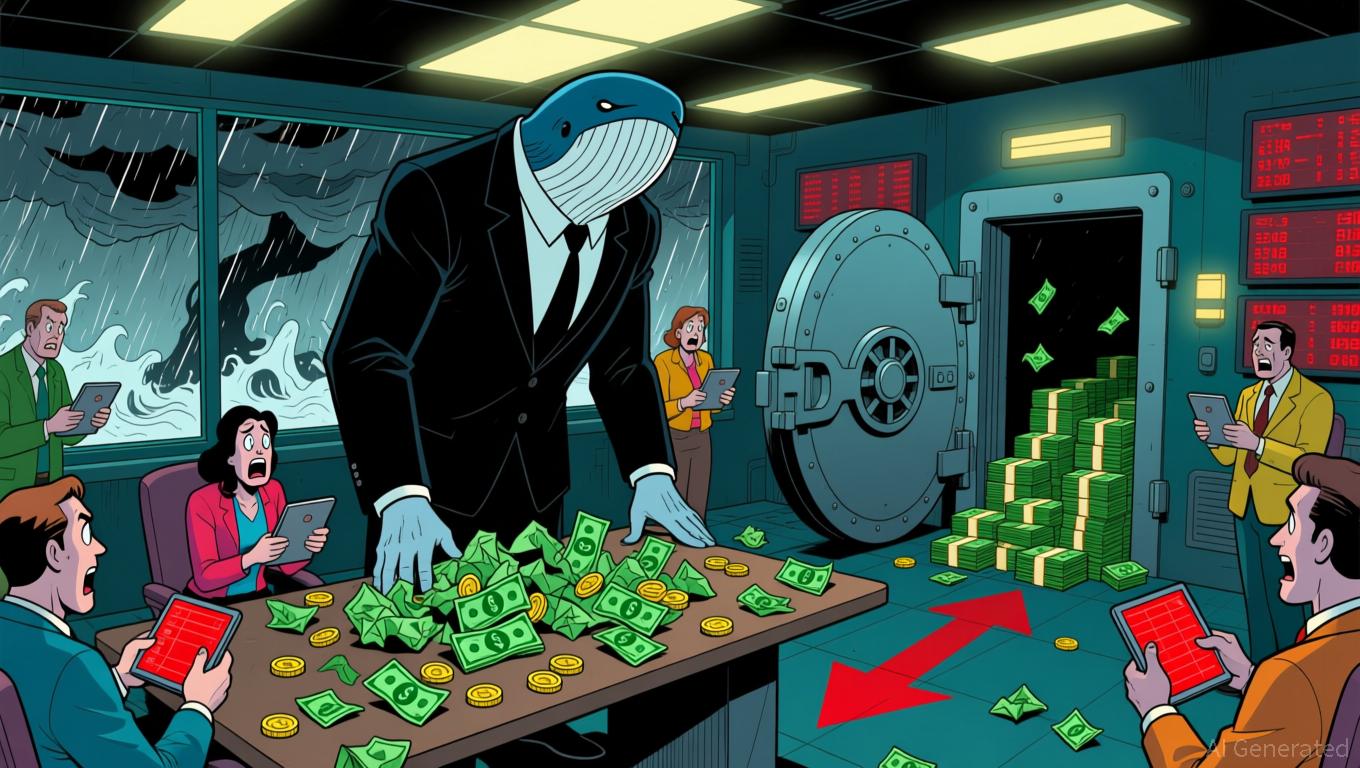

Bitcoin Update: Large Holders Depart and Economic Instability Push Bitcoin Under $100K

- Bitcoin fell below $100,000 as OG whales BitcoinOG and Owen Gunden moved $1.8B BTC to exchanges, signaling bearish bets. - $260M in long positions liquidated amid SOPR spikes, while Trump's crypto policies and China's $20.7B BTC holdings added macro risks. - Bit Digital staked 86% of ETH holdings for 2.93% yield, while Coinbase's negative premium highlighted waning U.S. buyer demand. - Analysts warn consolidation phases often follow whale profit-taking, with geopolitical tensions and derivatives volatili

Aster DEX's Latest Protocol Enhancement and What It Means for DeFi Liquidity Providers

- Aster DEX upgraded its protocol on Nov 5, 2025, enabling ASTER token holders to use their assets as 80% margin collateral for leveraged trading and receive 5% fee discounts. - Binance's CZ triggered a 30% ASTER price surge and $2B trading volume spike via a $2M token purchase three days prior, highlighting market speculation and utility convergence. - The platform introduced a "Trade & Earn" model allowing yield-generating assets like asBNB and USDF to be used as trading margin, enhancing capital efficie