BasePerp To Enable Creation of Perpetual Futures Markets on Base

November 3, 2025 – Singapore, Singapore

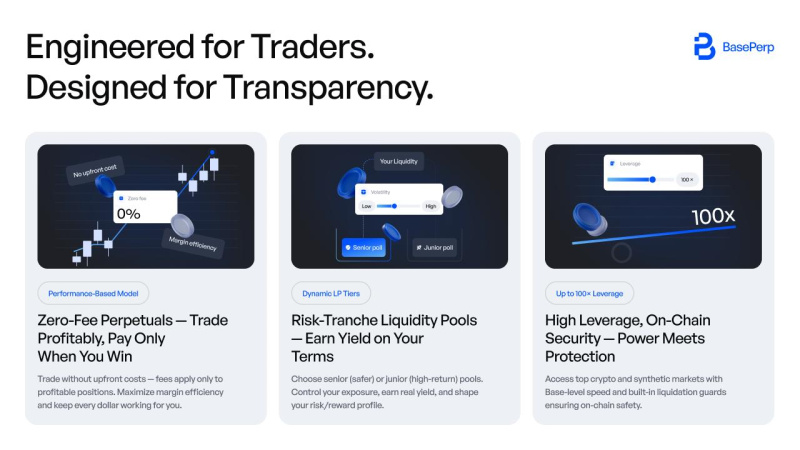

BasePerp has announced the launch of the first native perpetual DEX (decentralized exchange) built on the Base blockchain.

The platform is designed to deliver high-performance derivatives trading within one of the fastest-growing ecosystems in 2025, combining scalability, security and deep liquidity to support both retail and institutional participants.

Perpetual DEXs have become the main narrative in 2025, driving substantial liquidity growth and increased institutional participation across major blockchain networks.

New-generation perpetual trading platforms illustrate how the derivatives market can enhance ecosystem adoption and TVL (total value locked) through greater speed, liquidity depth and diverse trading options.

The perpetual futures market now represents a dominant liquidity driver in the crypto sector, attracting institutional capital, market makers and high-frequency traders.

Strong perpetual markets enhance a blockchain’s financial relevance, often surpassing spot trading and yield-farming activity in both scale and engagement.

Perpetual DEXs he new frontier of DeFi power

The perpetual futures market now represents a dominant liquidity driver in crypto.

Platforms across the sector have proved that perpetual derivatives can outpace spot market growth, bringing attention from institutional capital, market makers and high-frequency traders.

The success of perpetual DEXs causes the growth of deep liquidity pools and new high-volume DeFi ecosystems.

The explosive growth of next-gen perp DEXs proves that institutional capital and funds participate in high-performance trading infrastructures.

Derivatives traders and LP users influence TVL growth and the development of DeFi systems.

Strong perpetual markets make a chain financially relevant, outperforming spot trading and yield-farming activity.

BasePerp he first perpetual DEX launching on Base blockchain

Base has become one of the fastest-growing ecosystems by this year, overtaking Optimism in TVL, and continues to show strong user and developer interest.

Recent network inflation spikes and massive user migration can boost the chain’s rapidly increasing usage.

BasePerp , with its release, can become a cornerstone of perpetual trading for Base investors and traders. It can boost TVL to $100 billion and 25 million users, according to analyst data.

Reports indicate over 25,000 developers are building on Base, and BasePerp can become a driver that will enter the entire Base ecosystem, encouraging DeFi protocols and accumulating migration from networks where perpetual trading is already saturated.

Perpetual DEXs already dominate volume metrics, and BasePerp has strong upside potential. It can leverage the Base infrastructure and offer fresh liquidity options, scaling derivative capital inflow.

About

Based on Base’s scalability and security, BasePerp is positioned to become the first native perpetual DEX on Base, offering high-performance trading.

Attracting the interest of retailers and institutional investors, it has the potential to become a fundamental component of the Base ecosystem, boosting the DeFi market and liquidity.

Website

Contact

Mark , BasePerp

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Internet Computer's Rapid Rise: Key Drivers and What It Means for Long-Term Investors

- Internet Computer (ICP) surged 385% in November 2025, driven by Caffeine AI, Chain Fusion, and institutional partnerships. - Caffeine AI's no-code dApp platform and Chain Fusion's cross-chain interoperability expanded ICP's utility and developer adoption. - Institutional adoption via Microsoft/Azure and $237B TVL growth positioned ICP as a decentralized infrastructure leader in AI and DeFi. - Price forecasts range $4.4-$30 by 2025-2030, but risks include volatility, regulatory uncertainty, and unproven u

How Will the 2026 Federal Reserve Affect the Crypto Space?

To transition from the Powell era's technocratic caution to a more explicit policy framework aimed at reducing borrowing costs and advancing the President's economic agenda.

Bitcoin’s Sharp Decline: What Sparks Anxiety During a Bullish Market?

- Bitcoin's 2025 bull market collapsed 30% to $83,824 amid Fed policy shifts and liquidity contractions, defying typical risk-on dynamics. - A 0.72 correlation to Nasdaq 100 and $19B leveraged liquidation event exposed Bitcoin's vulnerability to macro risks and institutional sentiment shifts. - AI-driven algorithms and algorithmic feedback loops amplified volatility, with Treasury yields and dollar strength triggering cascading sales. - Market psychology metrics (Fear & Greed Index, stablecoin outflows) an

Infrastructure Initiatives Fuel Real Estate Growth in Upstate New York: The Impact of Local Government Projects on Industrial Market Transformation

- Webster , NY leveraged a $9.8M FAST NY grant to transform a 300-acre Xerox brownfield into a high-tech industrial hub, slashing vacancy rates to 2%. - Infrastructure upgrades attracted food processing and semiconductor firms , with a $650M fairlife® dairy plant expected to create 250 jobs by 2025. - Strategic site readiness and pre-leased industrial space at the NEAT site reduced investor risk, driving 10.1% residential property value growth since 2023. - The model highlights underpenetrated markets' pot