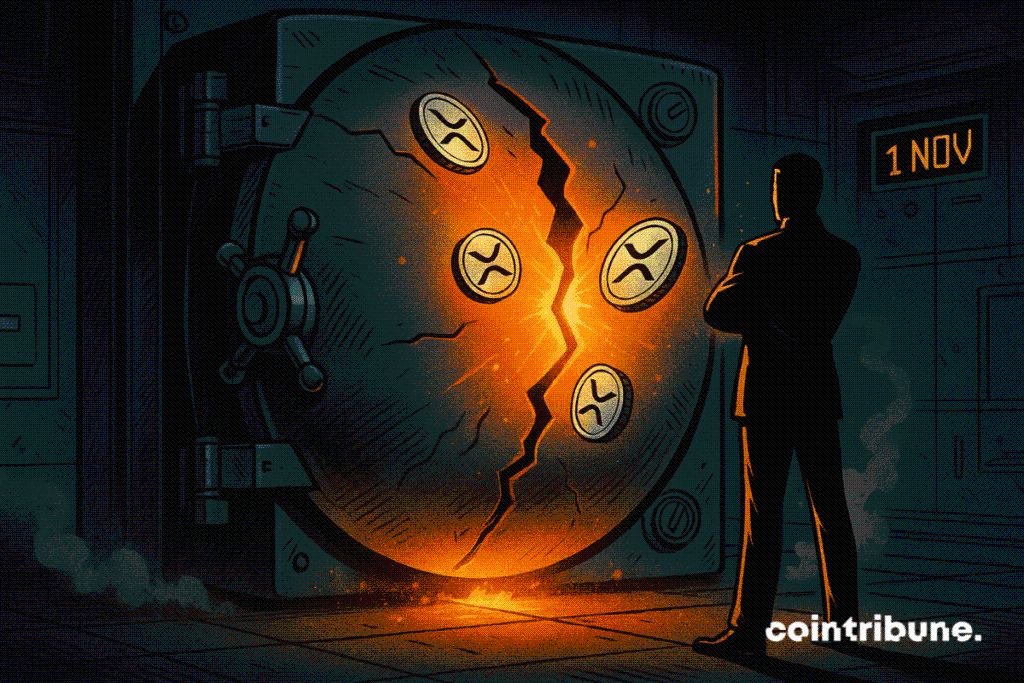

$2.49B In XRP : Ripple’s November Unlock Raises New Questions

While institutional interest in cryptos is rising again, the decisions of major players capture all the attention. This 1st November, Ripple plans to unlock 1 billion XRP, which is more than 2.4 billion dollars at the current price, from its escrow accounts, as part of a mechanism established in 2017 to regulate the supply. A regular operation, but one that, in the current climate, raises questions about liquidity strategies and market balance.

In Brief

- Ripple is about to unlock 1 billion XRP on November 1st, worth 2.49 billion $ at the current rate.

- This monthly release is part of a mechanism established in 2017 to regulate circulating supply.

- In reality, only a fraction of tokens, between 200 and 300 million XRP, is generally sold each month.

- The rest is placed back in escrow, limiting the actual market impact to about 500 to 750 million $.

A Planned Operation, an Unchanged Protocol

While the demand for XRP is exploding in the derivatives market , Ripple will proceed tomorrow, Saturday November 1st, with the scheduled unlocking of 1 billion XRP from its escrow, as has happened every month since the mechanism was implemented in December 2017.

At the current price of 2.49 dollars, this release theoretically represents a value of 2.49 billion dollars injected into the system. A figure likely to worry unseasoned observers. However, Ripple’s habits largely nuance this impression of massive unlocking. The previous month, for example, 750 million tokens were locked in a new escrow, limiting the amount actually injected into the market.

In practice, Ripple usually sells or uses between 200 and 300 million XRP per month, according to data observed in recent months. The rest is automatically placed back in escrow through new contracts. This functioning, originally designed to establish predictability and transparency, helps stabilize supply without causing imbalance. Thus, the actual impact on circulating liquidity for November could represent only :

- 200 to 300 million tokens actually used or sold ;

- Equivalent to a net value of 500 to 750 million dollars ;

- Well below the gross figure of 2.49 billion dollars ;

- The remainder locked again in future escrows.

This strategy of cautious management of injected volumes, repeated every month for several years, shows Ripple’s intention to reconcile supply control and gradual ecosystem development of XRP, without causing artificial market volatility.

The Early Sale of Rights on Escrows : A New Strategic Weapon ?

While the monthly unlocking ritual follows a now well-established pattern, the recent statement by David Schwartz, CTO of Ripple, introduced a new dimension to the analysis. He stated that Ripple has the right to sell or transfer the rights linked to XRP still locked in escrow, while respecting the protocol conditions.

“Ripple could sell the right to receive tokens released from escrow, or even directly assign the accounts in which these escrows mature,” he explained . A way of saying that the token does not circulate prematurely, but its future value can already be contractually engaged.

In short, Ripple can enter into private agreements with institutional partners, ceding them rights on future XRP, without violating release rules. A form of strategic pre-financing that opens new possibilities for monetizing resources, without generating immediate market pressure.

This approach could allow Ripple to finance projects, secure partnerships, or initiate initiatives like Evernorth, an XRP treasury platform developed by a Ripple-related entity holding nearly one billion XRP.

The ability to monetize future rights without injecting immediate supply positions Ripple in a hybrid stance, both respectful of its original framework but increasingly proactive in its institutional management. This dynamic could intensify if the company seeks to capitalize more on its escrowed reserve, while stabilizing the XRP price to avoid market turmoil.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.