Appeals court upholds ruling that Custodia is not entitled to a Fed master account

Quick Take Last year, Judge Scott Skavdahl in the U.S. District Court for the District of Wyoming ruled that the Federal Reserve does not have to give Custodia access to a master account. An appeals court affirmed that decision on Friday.

An appeals court has ruled that Custodia is not entitled to a Federal Reserve master account, the latest move in a years-long journey for the digital asset bank to get access.

In a filing on Friday in the U.S. Court of Appeals for the Tenth Circuit, the judges certified a previous decision made by a district court in Wyoming.

"Accordingly, Custodia is not automatically entitled to a master account," the judges said in the filing . 'We affirm the judgment of the district court in favor of Defendants on all claims."

Last year, Judge Scott Skavdahl in the U.S. District Court for the District of Wyoming ruled that the Federal Reserve does not have to give Custodia access to a master account and that the central bank has discretion over who is granted access or not. A master account allows institutions direct access to the Fed's payment systems and provides the most direct access to the U.S.'s money supply available to financial institutions. Those without master accounts are often forced to rely on partner banks with master accounts to provide services.

A few months after Judge Skavdahl's ruling , Custodia filed a notice of appeal.

Custodia, which was founded by Wall Street veteran Caitlin Long, filed its application for a master account with the Kansas City Fed in 2020. In the spring of 2021, the Federal Reserve Board of Governors intervened and sought control of the decision-making process.

The bank then sued the Federal Reserve Board of Governors and the Federal Reserve Bank of Kansas City in 2022 for delaying a decision on its application for a central bank master account.

Custodia (formerly Avanti Bank) is subject to Wyoming law and is a special purpose depository institution, which are banks that receive deposits and can custody assets, among other activities. However, as a Wyoming SPDI, Custodia cannot lend "customer fiat deposits" and have to hold those deposits 100% in reserve, according to Custodia's website , unlike other financial institutions that maintain fractional reserves.

The appeals court decision comes after Federal Reserve Governor Christopher Waller said this month the central bank plan is entering a new era and cryptocurrency and proposed the concept of a "skinny master account," which he said could be helpful for entities focused on innovations in payments.

Custodia did not immediately respond to a request for comment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

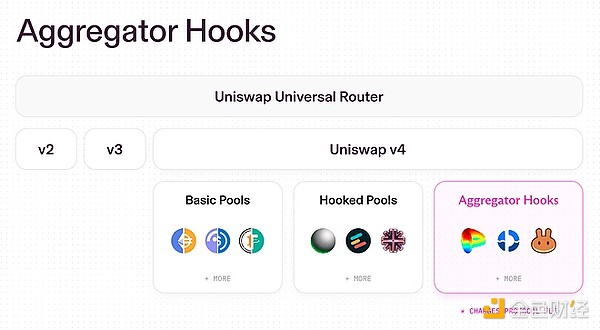

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.