On-Chain Revenue Hits $20 Billion in 2025 as DeFi Drives Growth

On-chain revenue has grown to $20 billion in 2025, driven mainly by decentralized finance (DeFi) platforms, according to a new report by crypto investment firm 1kx.

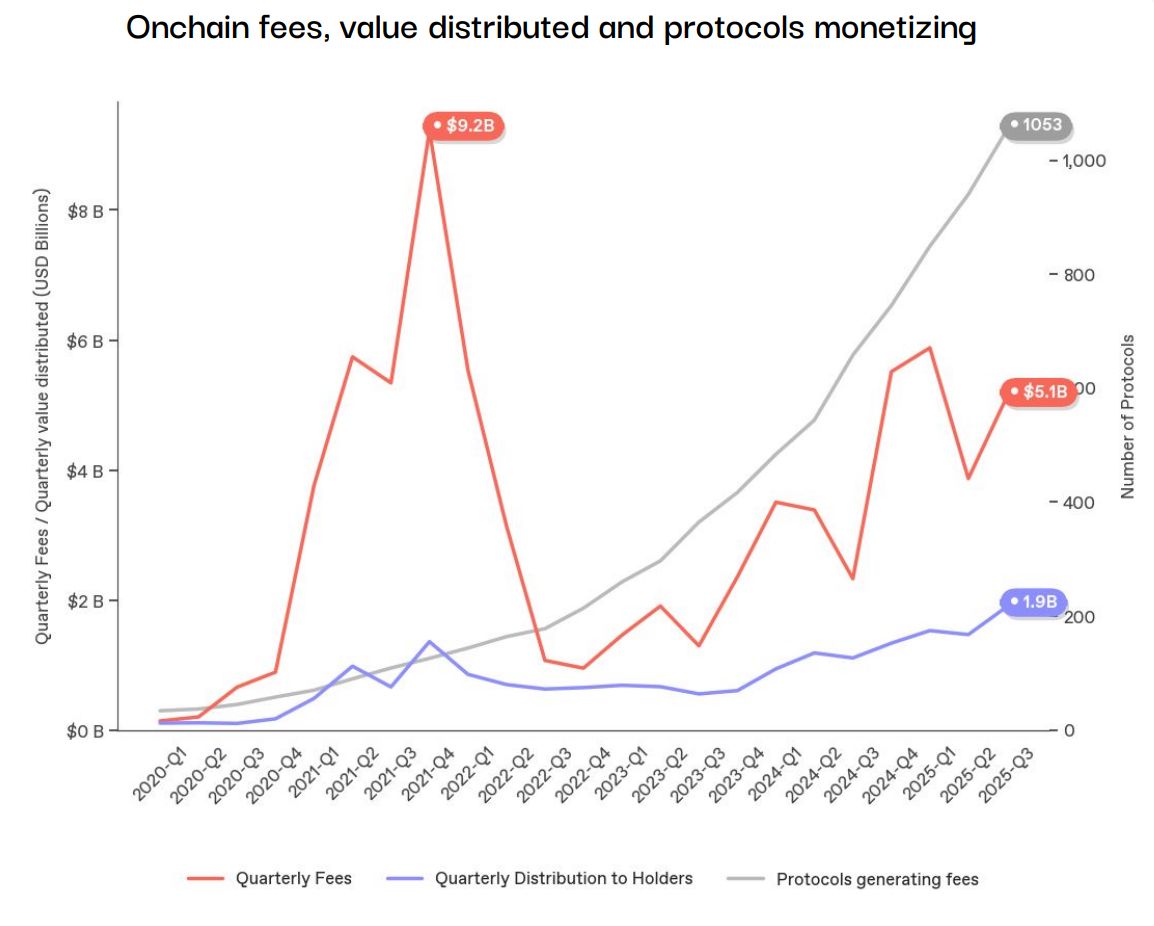

Users paid roughly $9.7 billion in on-chain fees in the first half of 2025, up 41% from the same period last year and the highest H1 total on record. DeFi accounted for 63% of all fees, led by trading activity on decentralized exchanges (DEXs) and derivatives platforms.

Despite this growth, 2021 remains the historical peak, though on-chain fees have grown more than tenfold since 2020, representing a compound annual growth rate of roughly 60%.

The report cites blockchain technology as becoming more stable and reliable, helping earnings remain steady even as user fees are lower than in the past. Better efficiency and cheaper infrastructure are also helping drive overall revenue growth.

“On-chain fees, though still a minority of industry income, offer clear signals of adoption and long-term value creation: 2025 YtD has close to 400 protocols with $1M+ ARR, and 20 passing over $10M in value to their token holders,” the report reads. “This is enabled by blockchain’s global reach and rising efficiency, which allow applications to scale rapidly and profitably.”

DEXs like Raydium and Meteora benefited significantly from Solana’s surge this year, while Uniswap lost market share, dropping from 44% to 16%. In derivatives, Jupiter increased its fee share from 5% to 45%, and Hyperliquid, launched less than a year ago, now accounts for 35% of category fees.

Lending remains dominated by Aave, the largest DeFi protocol with a total value locked (TVL) of $39 billion. Meanwhile, Morpho, a lending aggregator with a TVL of $8.25 billion, increased its share to 10% from nearly zero in H1 2024.

Looking ahead, total on-chain revenue is expected to rise to more than $27 billion in 2026, the authors predict, driven by new technologies and clearer regulations like the GENIUS Act.

“Applications are scaling faster and larger than ever with increasing value distribution, while regulatory clarity supports broader investor participation,” the report concludes. “As the relationship of fees and valuations for applications shows, on-chain economics have entered a more mature phase where fundamental fee metrics warrant close attention from investors.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Skims Appoints Beauty Lead to Champion Diversity, Signaling Industry Move Toward Black-Owned Brand Innovation

- Skims hires Ami Colé founder Diarrha N'Diaye as beauty EVP, signaling industry recognition of Black-owned brands' role in driving inclusivity and innovation. - N'Diaye's appointment follows Ami Colé's 2025 shutdown due to unsustainable costs, yet its legacy of inclusive products and community focus left lasting industry impact. - Skims Beauty aims to extend size/shade inclusivity to cosmetics, leveraging N'Diaye's melanin-rich skin expertise and prior experience at L'Oréal/Glossier. - The move highlights

AlphaTON Connects Conventional Finance and Web3 through DeFi, Artificial Intelligence, and TON Payment Solutions

- Brittany Kaiser, AlphaTON CEO, will address DeFi, tokenization, and digital asset treasuries at SALT London 2025, aligning with the firm's mission to bridge institutional finance and blockchain ecosystems. - AlphaTON raised $71M to expand its TON ecosystem footprint, including GPU investments for Telegram's Cocoon AI network and validator operations in DeFi and gaming protocols. - The firm launched a TON Mastercard with PagoPay and ALT5 Sigma, enabling crypto spending at 60+ million merchants, while deve

Bitcoin Updates: Bitcoin Lending Evolves with Lava Introducing an Affordable and Flexible Credit Line

- Lava secures $200M to launch BLOC, a Bitcoin-backed credit line with 5% interest and no monthly payments. - The product allows instant borrowing against 50% of Bitcoin's value via self-custody wallet, blending DeFi and traditional finance. - Innovations include liquidation protection and 7% annual cost, positioning Lava as a low-cost lending alternative amid Bitcoin's $108k surge. - Market growth highlighted by Fold's crypto rewards partnership and regulatory challenges like Singapore's $150M fraud freez

Ethereum News Update: Tokenized Treasury Assets Surpass $8.6 Billion While Banks Manage Operational Challenges Amid Collateral Transition

- Ethereum's 2025 Fusaka upgrade (Dec 3) introduces 12 EIPs, including EIP-7594, to enhance scalability and security through sampled blob validation. - On-chain fees hit $19.8B in 2025 (35% YoY growth), driven by DeFi (63% share) expanding into DePINs and consumer apps. - Tokenized U.S. Treasuries exceed $8.6B as banks test collateral workflows, despite higher operational risks compared to traditional repos. - AI adoption in blockchain development (50% production use) and cybersecurity ($22.97B 2030 market