Mono Protocol Sets Out to Transform Cross-Chain DeFi Infrastructure by 2025

- Mono Protocol's Stage 15 presale raised $2.8M of $3M target, offering 1011% profit potential at $0.500 launch price. - Project focuses on cross-chain interoperability, developer-first design, and Omnichain Paymaster for gas-free transactions. - Strategic partnerships with LI.F.I, Celestia, and Chainlink enhance scalability and data security in DeFi infrastructure. - Community incentives and October 30 audit highlight commitment to transparency, positioning Mono as a 2025 DeFi innovation leader.

Mono Protocol's development has drawn notable interest from investors, establishing itself as a key player in the evolution of cross-chain DeFi infrastructure. This strong momentum highlights increasing trust in Mono's focus on practical solutions for blockchain issues, rather than speculative trends, as mentioned in

Mono stands out for its developer-centric approach and commitment to cross-chain compatibility. By simplifying complex infrastructure, the protocol allows developers to build applications across various blockchains more efficiently and at lower costs, as previously reported by crypto.news. Its Omnichain Paymaster also improves user experience by enabling gas fee payments across different networks without the need for native tokens, as detailed in

Mono's upcoming milestones will be crucial for its development. A Smart Contract Audit scheduled for October 30 is intended to strengthen security and transparency—key factors for DeFi projects, as noted in

Active community involvement is central to Mono's approach. The Reward Hub encourages engagement through social, referral tasks, offering bonus tokens and promotional codes, as described in

Mono's technical partnerships with LI.F.I,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US ETF Market Hits Triple Crown While BTC Bleeds and XRP Soars

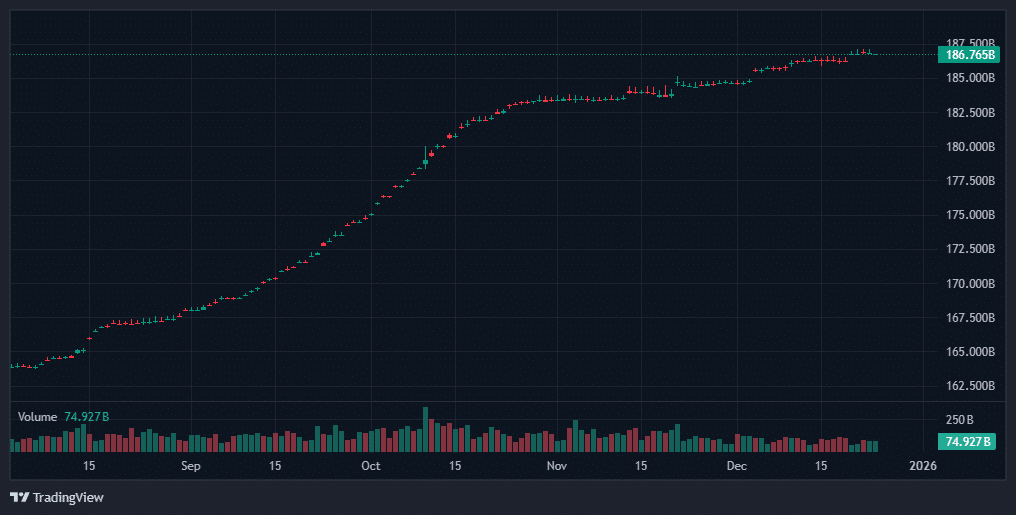

Altcoin Market Cap Breaks 90-Day Downtrend: 5 Crypto Coins Worth Risking as TOTAL Eyes an 80% Upside Move

Bitcoin Price Trading Near 'Fair Value,' Says On-Chain Model

Stablecoins hit $310B ATH, but macro and regulatory questions arise