Investors Inject $17.9 Million into Mutuum’s Robust DeFi Platform Amid Decline in Traditional Markets

- Mutuum Finance (MUTM) secures $17.9M in presale with 17,400+ investors, nearing final phase before Q4 2025 testnet launch. - Project introduces DeFi lending protocol with mtTokens, liquidator bot, and ETH/USDT support, prioritizing security via CertiK audit and $50K bug bounty. - Community incentives include $500 daily leaderboard rewards and $100K presale giveaway, fostering transparency and early adopter engagement. - Roadmap includes stablecoin integration and Layer-2 scaling, positioning MUTM as a sc

Mutuum Finance (MUTM), a decentralized finance (DeFi) initiative operating on

The strong performance of the project signals increasing trust in DeFi projects that offer transparent tokenomics and practical on-chain features, especially as established cryptocurrencies like

A major draw for Mutuum is its forthcoming V1 protocol, which will debut on the Sepolia Testnet in Q4 2025. This protocol will introduce a decentralized lending system with liquidity pools, mtTokens (interest-earning deposit receipts), Debt Tokens, and an automated Liquidator Bot for risk management. These features will allow users to lend, borrow, and use assets such as

Security remains a top priority for the team, with a comprehensive smart contract audit by CertiK resulting in a 90 out of 100 Token Scan rating. The project has also launched a $50,000 bug bounty to encourage external developers to find and report vulnerabilities. These steps reflect Mutuum’s dedication to long-term viability and regulatory adherence, further supported by the establishment of a legal and compliance division.

Mutuum also stands out for its community engagement initiatives. A real-time 24-hour leaderboard publicly displays user contributions, awarding $500 in MUTM tokens to the top contributor each day. This level of transparency encourages active involvement, while a larger $100,000 giveaway for verified participants demonstrates the project’s commitment to rewarding early supporters, as highlighted in the latest update.

The project’s roadmap outlines a clear progression, with Phase 1 finished and Phase 2 nearing its end. The first phase concentrated on completing audits and educating the community, while the second phase is focused on developing the protocol and technical infrastructure. Following the V1 launch, future enhancements are planned, including a USD-pegged stablecoin and integration with Layer-2 solutions to lower transaction fees, according to

Mutuum’s upward momentum highlights its potential as a rapidly growing DeFi platform. With over $17.9 million raised and a well-defined technical plan, the project aims to fill gaps in decentralized lending while maintaining a strong focus on security and user experience. Upcoming milestones in fundraising and protocol testing will be pivotal for establishing its place in the competitive DeFi sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Enterprise AI’s Upheaval Drives Crypto’s Push into Private Markets

- C3 AI faces potential sale after founder Thomas Siebel's health-related CEO exit triggered a 6% stock surge. - The company reported $116.8M Q1 losses and 54% share price decline, now exploring private capital raises under new CEO Stephen Ehikian. - IPO Genie's $0.0012 presale token aims to bridge crypto and private markets using AI-driven deal-screening, attracting 300,000+ participants. - With $500M in regulated assets and CertiK-audited security, IPO Genie contrasts C3 AI's struggles by targeting 750×

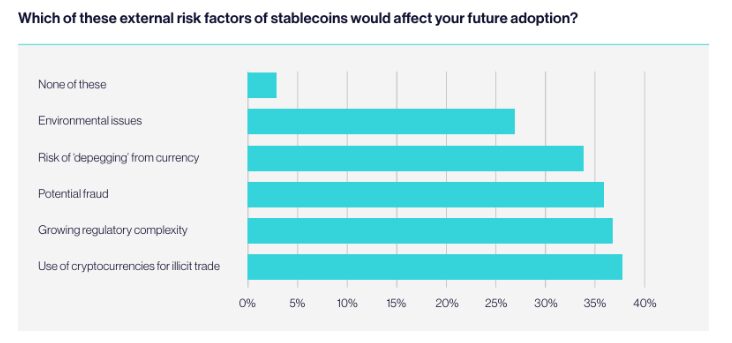

European Tech Startups Eye Stablecoins, But Risks Stall Adoption

Stellar News Today: Turbo Energy's tokenization opens up clean energy investment to everyone

- Turbo Energy partners with Taurus and Stellar to tokenize hybrid renewable energy projects, targeting the $74.43B EaaS market. - The pilot uses blockchain to fractionalize solar storage PPA debt, leveraging Stellar's low-cost infrastructure for transparent green finance. - Tokenization aims to democratize clean energy investment, with Turbo's CEO highlighting scalability and security in AI-optimized storage solutions. - The initiative aligns with sustainable development goals, driving a 12.5% premarket s

Cardano News Update: MoonBull's AI Wager—Will It Surpass Cardano and Ethereum by 2025?

- MoonBull's $590,000 presale gains traction as a 2025 crypto contender, leveraging AI features and community governance. - Cardano partners with Wirex to launch ADA-branded crypto payment cards, aiming to bridge blockchain and traditional finance. - NFT and memecoin markets show 12-11% weekly gains, while Ethereum and TRON compete with MoonBull for 2025 growth narrative. - Regulatory risks and macroeconomic pressures persist, challenging projects like JFrog and Bumble amid crypto market volatility.