Ethereum Updates Today: Major Crypto Holder's ETH Withdrawal Ignites Discussion—Market Decline Ahead or Tactical Portfolio Adjustment?

- Crypto whale "0xc2a" reduced 14,400 ETH longs, signaling potential market sentiment shift amid broader crypto recalibration. - Whale's $496.8M BTC/ETH holdings and flawless track record draw attention as macro factors like Fed rate cuts boost institutional crypto inflows. - Analysts debate ETH exit as profit-taking or strategic rebalancing, with price consolidation near $3,875 and $931M Bitcoin inflows highlighting mixed retail/institutional dynamics. - Fed's October 29 policy decision looms as critical

A prominent crypto whale, renowned for an unbroken streak of successful trades, has trimmed its long exposure to

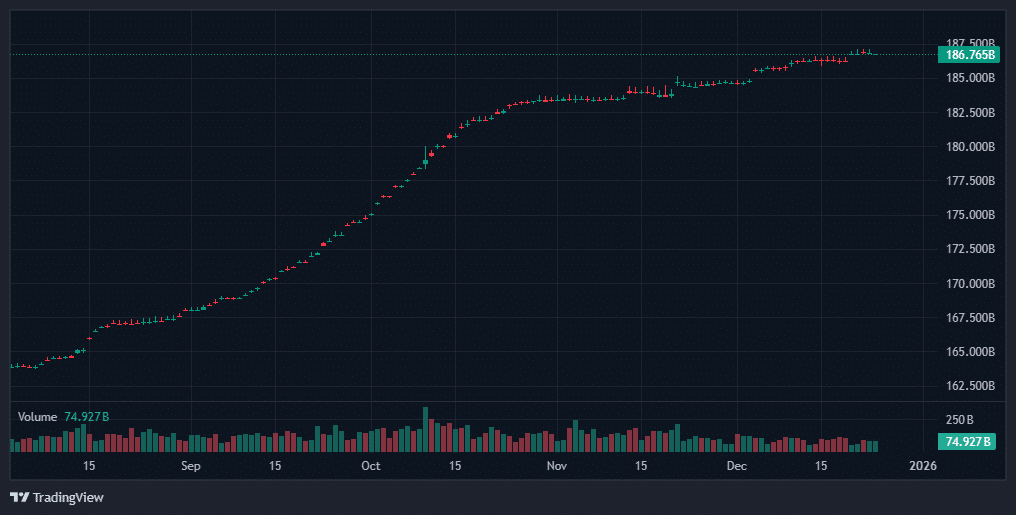

This whale’s trading approach has captured the attention of both analysts and market participants, especially after skillfully navigating a turbulent October that saw over $20 billion in leveraged positions wiped out. During that downturn, 0xc2a accumulated both Bitcoin and Ethereum, which later climbed by 4% and 2%, respectively. Currently, the trader holds 1,483

Ethereum’s price continues to trade sideways, staying close to $3,875 after falling 3.7% over the past week. Blockchain data shows that whales accumulated $660 million worth of ETH between October 21 and 23, with large holders acquiring 170,000 ETH. Despite this, short-term investors have kept selling, forming a “wall of doubt” that has kept ETH locked in consolidation, as highlighted in a

Wider cryptocurrency markets are also being shaped by macroeconomic developments. With the Federal Reserve anticipated to lower interest rates by 25 basis points at its October 29 meeting, increased liquidity could fuel gains for Bitcoin and Ethereum. Derivatives markets currently suggest a 98.3% chance of a rate cut, a scenario that has historically benefited risk assets like crypto, according to a

The whale’s recent ETH sell-off has sparked discussion about its significance. Some interpret it as profit-taking or a hedge against near-term volatility, while others consider it a calculated move ahead of possible ETF approvals or clearer macroeconomic signals. “Whale activity often sets the tone for market direction,” one analyst observed, emphasizing the outsized influence large holders can have on sentiment.

With the Fed’s decision approaching, traders remain on alert. A larger, 50-basis-point cut—though unlikely—could accelerate risk-taking, while an unexpected pause might prompt sharp declines. For now, 0xc2a’s impeccable history and Ethereum’s technical setup point to a cautious stance, with $3,989 and $4,137 identified as key resistance levels to watch.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US ETF Market Hits Triple Crown While BTC Bleeds and XRP Soars

Altcoin Market Cap Breaks 90-Day Downtrend: 5 Crypto Coins Worth Risking as TOTAL Eyes an 80% Upside Move

Bitcoin Price Trading Near 'Fair Value,' Says On-Chain Model

Stablecoins hit $310B ATH, but macro and regulatory questions arise