BlackRock Holds the Line as Bitcoin ETFs Reveal Fragile Foundations | US Crypto News

Bitcoin ETFs have drawn $26.9B in inflows this year — but $28.1B came from BlackRock alone, raising concerns over the sector’s dependence on one giant.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to read how institutional flows tell a story of dominance, dependency, and deep accumulation. At the center stands BlackRock, propping up a fragile ETF ecosystem that may not stand so tall without it.

Crypto News of the Day: IBIT’s Outsized Impact and Concentration Risk

BlackRock’s IBIT contributed $28.1 billion in year-to-date net inflows to US Bitcoin ETFs, surpassing sector gains and revealing a fragile foundation for institutional crypto adoption. Outside IBIT, Bitcoin ETFs faced negative flows, raising concerns over broader market confidence.

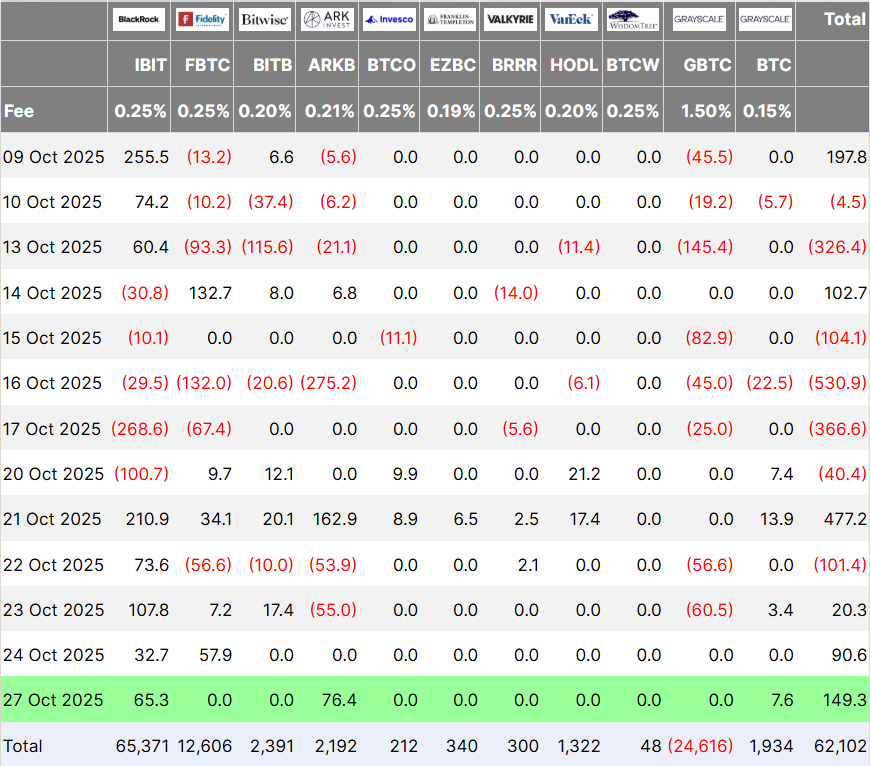

On October 27, US Bitcoin ETFs saw inflows of 1,300 BTC (about $149.3 million), equal to three days’ worth of new Bitcoin. This demonstrates lasting institutional demand, yet nearly all of it goes through IBIT. Competitors continue to face challenges, even as interest in digital assets grows.

Bitcoin ETF Flows. Source:

Farside Investors

Bitcoin ETF Flows. Source:

Farside Investors

Recent figures show a stark pattern. BlackRock’s IBIT has driven the net positive flows for US Bitcoin ETFs, outpacing rivals.

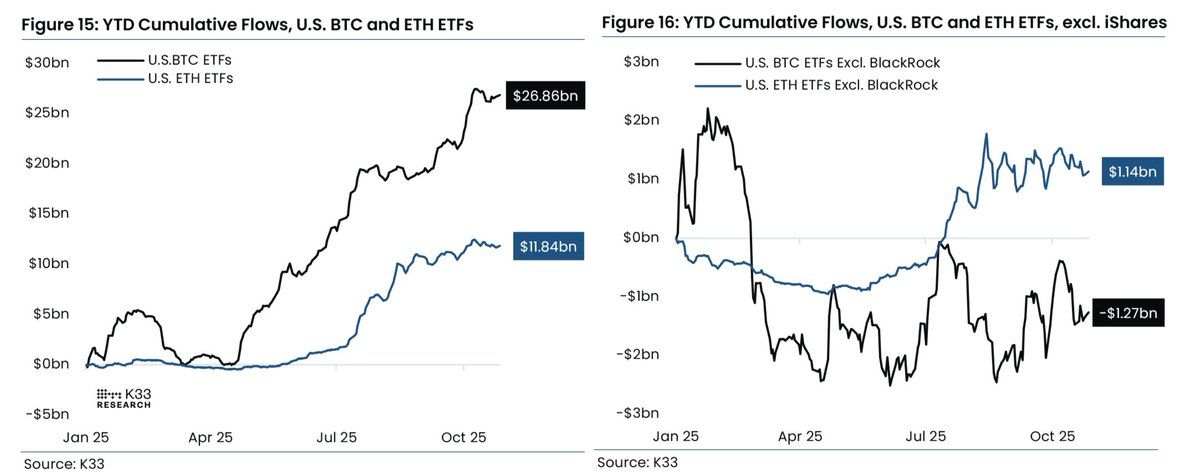

According to Farside Investors, US Bitcoin ETFs reported $26.9 billion in net inflows this year, but $28.1 billion came from IBIT. Without IBIT, flows in other ETFs, such as Fidelity’s FBTC and Bitwise’s BITB, were flat or negative.

“No BlackRock, no party? BTC ETFs are up $26.9bn YTD, yet $28.1bn stems from BlackRock’s IBIT. Ex-IBIT, flows are negative. BlackRock is absent from the imminent altcoin ETF wave. Opportunity for competitors to secure strong flows, but on net, likely limiting for overall flows,” wrote Velte Lunde, head of research at K33 Research.

ETF flow chart from K33 Research. Source:

Head of Research Vetle Lunde

ETF flow chart from K33 Research. Source:

Head of Research Vetle Lunde

This reliance on one fund signals a critical vulnerability. If BlackRock scales back, institutional inflows could fade quickly. Such concentration can shape the perception of ongoing institutional confidence in global finance.

On the same day as notable Bitcoin inflows, US Ethereum ETFs added 32,220 ETH, worth $133.9 million according to Farside.

While significant, no Ethereum ETF has achieved IBIT’s dominance. This indicates growing yet more distributed interest from institutions exploring beyond Bitcoin.

Institutions Treat Crypto As Core Part of Finance

Meanwhile, Bitwise data shows that banks, asset managers, and payment companies treat crypto as a core part of finance. Transitioning from niche to mainstream, large firms are deepening exposure through custody, tokenization, and ETF products. This kind of change would have been unlikely just a few years ago.

Institutional adoption visual. Source: Bitwise via

Kyle Doops

Institutional adoption visual. Source: Bitwise via

Kyle Doops

“Institutions are quietly going all in. Banks, funds, and payment giants keep adding exposure every week. Crypto’s no longer a side bet – it’s becoming part of the system,” wrote analyst Kyle Doops.

Research by CoinShares confirms this trend. Bitcoin investment products drew $931 million in inflows for the week ending October 24, 2025, bringing the annual total to $30.2 billion.

Yet, a sharp outflow the previous week highlights ongoing volatility and shifting sentiment that still affect the crypto markets.

Chart of the Day

BlackRock iShares Bitcoin Trust (IBIT). Source:

SoSoValue

BlackRock iShares Bitcoin Trust (IBIT). Source:

SoSoValue

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Crypto treasury firms stare down leverage crisis as NAV discounts force risky moves.

- Bank of Korea mulls gold purchases after 12-year pause.

- Solana price eyes 10% gains amid SOL ETF launch buzz, but sellers are lurking.

- The ICO wave is back: Why 2025’s token boom looks familiar and dangerous.

- Ethereum sellers halt breakout — But one group still hopes for a price bounce.

- Around 300 million XRP leave Binance — What does it mean for the price?

- Coinbase says DAT buying remains frozen post-crash.

- Litecoin is at a major turning point as ETF and privacy narratives converge.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 27 | Pre-Market Overview |

| Strategy (MSTR) | $295.63 | $295.05 (-0.21%) |

| Coinbase (COIN) | $361.43 | $361.06 (-0.10%) |

| Galaxy Digital Holdings (GLXY) | $40.55 | $36.55 (-9.77%) |

| MARA Holdings (MARA) | $19.56 | $19.54 (-0.10%) |

| Riot Platforms (RIOT) | $23.00 | $22.68 (-1.39%) |

| Core Scientific (CORZ) | $19.87 | $20.18 (+1.56%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interview with Bittensor Founder Jacob: Applying Mining to AI, Top 3 Subnets Built by Chinese Teams

Bittensor is migrating Bitcoin-style mining to AI through "incentivized computation," building an open multi-subnet marketplace powered by TAO, where inference, training, and computing power providers are rewarded based on performance. Jacob visited China for the first time, discussing his experience leaving Google, ecosystem expansion in Asia, TAO halving, protocol revenue, and his five-year vision.

Why is a crypto treasury a better solution compared to spot ETFs?

DAT's corporate structure possesses unique advantages that ETFs cannot match, which is precisely why it commands a premium over its book value.

x402 goes viral, AI Agent trading volume surges 100x—How does AEON become the crypto settlement engine in the era of AI autonomous payments?

x402 ignites the AI payment revolution as AEON takes the lead in bringing it to global commerce.