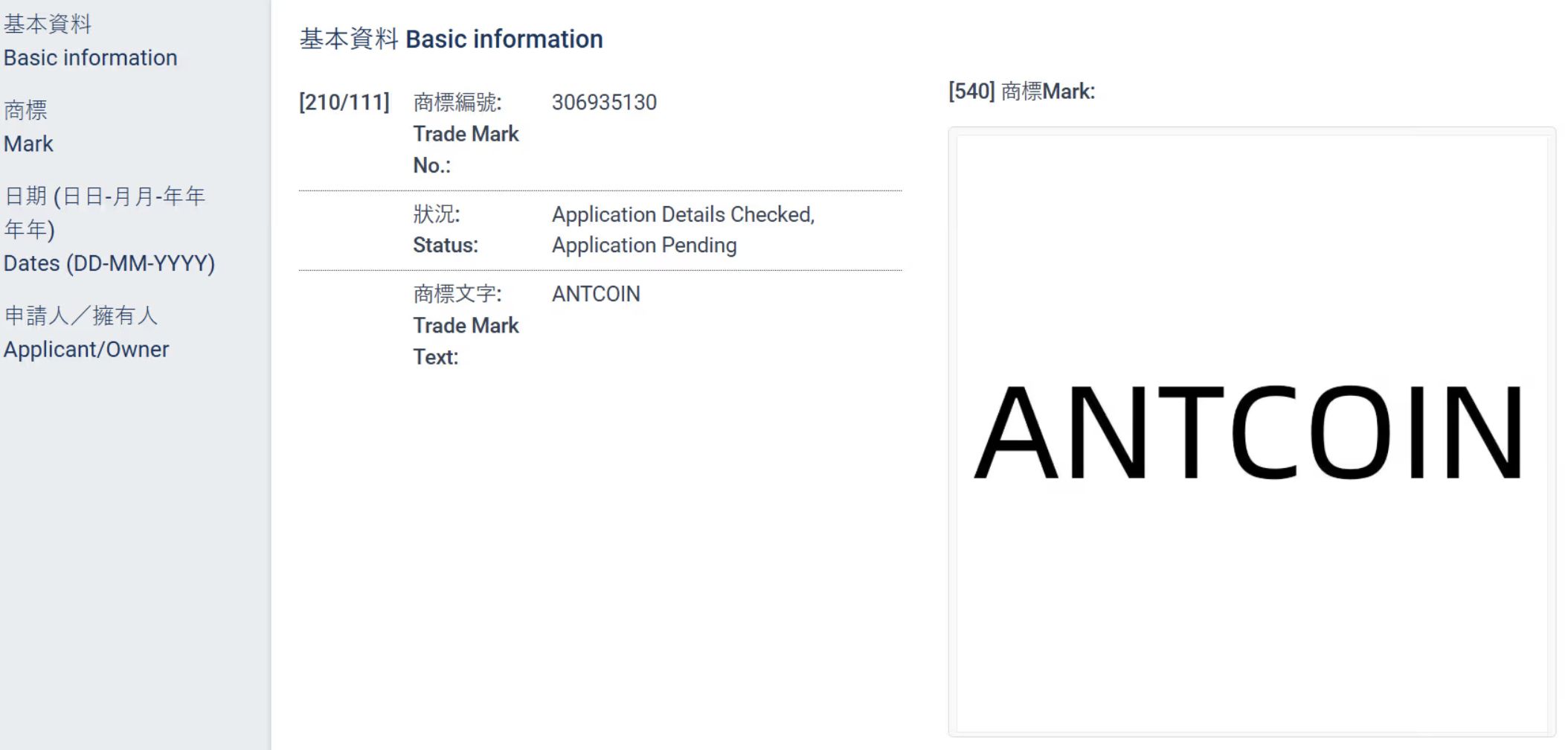

Ant Group, a financial technology giant and Alibaba affiliate, has applied for a trademark in Hong Kong for AntCoin. This application, made in June, suggests the group’s potential focus on blockchain-based financial services and stablecoin initiatives. The development comes just before Ant Group Chairman Eric Jing is set to speak at the upcoming Hong Kong FinTech Week event.

Strategic Timing Before Hong Kong FinTech Week

Ant Group’s AntCoin trademark application underscores the company’s ambition to bridge traditional finance with the Web3 economy. The application covers a wide range of services from banking to foreign exchange, crypto custody, and blockchain-based payment systems. This indicates Ant Group’s readiness to transform its Alipay ecosystem according to global regulatory standards.

Developments in Hong Kong are seen as a significant milestone in the region’s approach to cryptocurrencies. Besides Jing, speakers at the FinTech Week event will include Hong Kong Financial Services Secretary Christopher Hui and Primavera Capital founder Fred Hu. With a strong emphasis on crypto and digital assets, Ant Group’s strategic move appears to be deliberately timed.

AntCoin Could Align with Stablecoin Regulations

Previously, Ant Group announced its examination of Hong Kong’s new stablecoin licensing regime. Effective from August, these regulations mandate that companies involved in cryptocurrency issuance obtain a license to operate. Given that the AntCoin trademark encompasses activities like stablecoin issuance, crypto payments, custody, and rewards programs, it is speculated that Ant Group is developing new products to fit within this framework.

The company reinforces its position as a key player in the digital transformation of the Asian financial ecosystem. Alipay’s existing infrastructure is considered suitable for supporting blockchain-based solutions in both consumer and corporate financial transactions. The AntCoin brand is perceived as a tangible indicator of this transformation.

This strategic endeavor is expected to pave the way for Ant Group to be at the forefront of digital financial innovation, particularly in the Asian market. Additionally, as broader regulatory compliance measures are met, Ant Group’s move could signify a pivotal step in integrating traditional finance with emerging digital technologies.

Such initiatives highlight Ant Group’s proactive approach to regulatory conformity, aligning with potentially global standards for digital financial products. As a result, Ant Group aims to expand its footprint in the evolving landscape of financial technology and blockchain adoption.