Bitcoin Reclaims $115,000 as US–China Trade Hopes Lift Markets

Bitcoin and the broader crypto market surged over the weekend, fueled by potential de-escalation in the U.S.-China trade war.

Bitcoin gained 3.5% on Sunday, rising from $110,960 to $115,400, before cooling slightly. The asset is currently trading at $115,235, per CoinGecko data. Bitcoin is still down about 6.5% from its October 6 all-time high $126,000.

The renewed rally comes amid easing trade tensions between the world’s two largest economies.

The U.S. and Chinese officials met in Malaysia over the weekend, resulting in a preliminary framework agreement described by both sides as a constructive step toward cooling the trade war.

“Bitcoin’s weekend rally underscores how macro sentiment continues to steer digital assets,” Daniel Liu, CEO of Republic Technologies, told Decrypt. “The renewed optimism around U.S.-China trade talks has temporarily lifted risk appetite across markets, and Bitcoin, increasingly viewed as a high-beta macro asset, followed suit.”

The reaction reveals more about liquidity psychology than trade fundamentals, Liu highlighted, suggesting there is no direct link between tariff negotiations and crypto demand.

“What we’re really seeing is a reflexive move of traders pricing in a softer macro environment and looser financial conditions, not a structural shift in the U.S.–China dynamic,” Liu added.

Users on the prediction platform Myriad, owned by Decrypt’s parent company Dastan, leaned toward market greed on Sunday, with sentiment spiking to 60% earlier in the day before easing to 57.4% versus 42.6% for fear.

“Trump's renewed U.S.-China dialogue has positively influenced Bitcoin alongside other risk assets,” Daniel Kim, CEO of Tiger Research, told Decrypt. “This week's APEC summit will likely add to short-term volatility.”

Although the U.S.-China trade war has lifted sentiment, on-chain metrics revealed vulnerability with key indicators like transaction count and active users not yet confirming the price rebound, leaving the near-term trajectory uncertain, according to Tiger Research’s Thursday report.

Still, the report maintained a bullish view for the fourth quarter, with Tiger Research analysts forecasting a $200,000 target for Bitcoin, driven by global liquidity expansion, continued institutional inflows, and the Fed's rate-cutting stance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

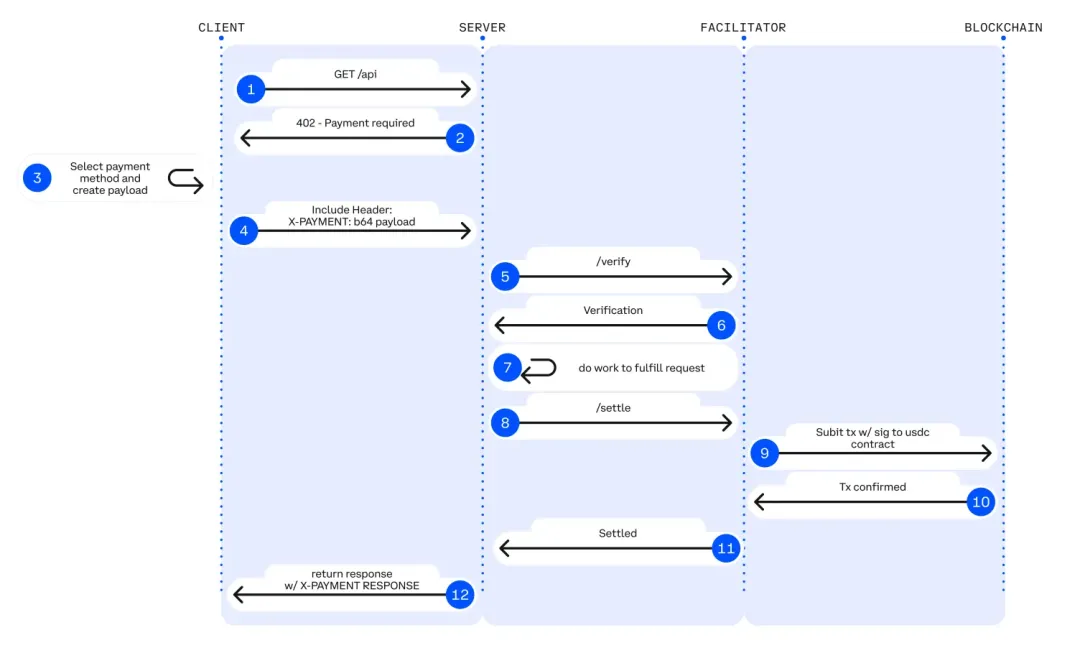

IOSG Weekly Brief|x402 - A New Standard for Crypto Payments by Digital Agents

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Exclusive Interview with Aptos Founder Avery Ching: Not a General-Purpose L1, Focusing on a Global Transaction Engine

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.

Pharos adopts Chainlink CCIP as cross-chain infrastructure and utilizes Data Streams to empower the tokenized RWA market

Pharos Network, a programmable open finance Layer-1 blockchain, announced the adoption of Chainlink CCIP as its cross-chain infrastructure and the use of Chainlink Data Streams to provide sub-second low-latency market data. Together, they aim to build a high-performance, enterprise-grade tokenized RWA solution to drive the large-scale development of institutional asset tokenization.

XRP Holds Strong Above $2.60 as Buyers Maintain Upward Momentum