The Next Leap in AMM Perpetual Structures: Honeypot Finance's Layered Risk Control and Procedural Fairness

The golden era of CEX shaped the scale of the market, while also creating the greatest risk of single-point trust.

Author: Honeypot

Lede

Over the past decade, the vast majority of global crypto market trading has remained in the hands of centralized exchanges: user funds are held in custody; matching and clearing logic is invisible; forced liquidation mechanisms during volatility are incomprehensible; black swan events always lurk around the corner (Mt.Gox, FTX, Bitzlato…). The golden age of CEXs shaped the scale of the market, but also created the greatest risk of single-point trust.

More and more professional traders and capital are realizing: transparency is not optional, it is a fundamental right of finance. The only way to achieve this is to truly move derivatives trading on-chain. Thus, we have seen a batch of outstanding on-chain perp DEXs—dydx, Hyperliquid, Aster, GMX.

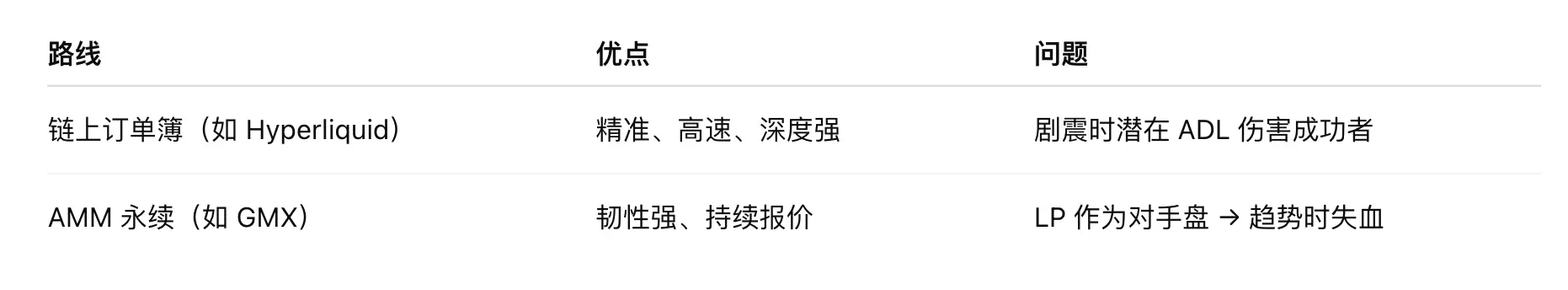

Broadly, these on-chain perp DEXs are divided into two mainstream solutions: Orderbook Perp DEX and AMM Perp DEX. Currently, orderbook perp DEXs dominate the market. In our view, both solutions have their pros and cons.

The two paths will converge in the future. The on-chain perpetual market is currently in a technological tug-of-war between two routes:

They represent: “performance and precision” vs. “resilience and sustainability.” The endgame will be a market order that combines both. Recently, Honeypot Finance, an integrated omnipotent liquidity hub, secured a 35 millions valuation from renowned investors such as Mask Network, filling a critical gap in the market.

What Honeypot wants to do is simple: not to chase fancy derivative designs, but to use three modules to complete the missing piece of AMM perpetuals—a controllable, predictable market that can execute trades even in storms.

I. The Fundamental Problem of Order Books: Most Fragile at the Most Critical Moments

The Fragility of Order Books: When You Need Them Most, They Vanish

Most likely to fail at critical moments

The core of order book (LOB) liquidity is not algorithmic guarantees, but market maker willingness. When the market is stable—market maker risk is controllable, spreads are extremely tight, and depth is sufficient—it appears perfect. But once the market enters a high volatility phase:

1️⃣ Willingness-based liquidity collapses

Volatility increases → risk rises nonlinearly

Market makers collectively withdraw orders or significantly widen spreads, resulting in: no real orders outside the bandwidth range, creating a “liquidity void.” 📌 Prices do not slide, but gap. 📌 Liquidation orders are executed in a vacuum. 📌 Trading and risk reference prices are severely distorted.

2️⃣ On-chain latency and ordering rights → “exploitable markets”

Market maker orders are exposed to: block delays, MEV frontrunning, latency arbitrage. The result is systematic predation of orders: every time they are sniped → next time, they quote shallower, less, and wider, continuously weakening effective depth, with depth quality reflexively deteriorating. Effective depth structurally worsens.

3️⃣ Inventory risk cannot be hedged in time

During market shocks: external hedging costs soar, execution paths are blocked, and market maker positions become increasingly skewed. Risk spillover mode: market makers survive → costs are transferred to traders and liquidators, maximizing impact at liquidation points.

This is precisely where AMMs matter: 📌 When order books fail, AMMs continue to operate, continuously quoting + guaranteeing minimum execution, ensuring the market can function normally.

II. Why Have AMM Perpetuals Still Not Grown?

Why AMM Perpetuals Still Lag Behind

AMMs should be “always open stalls,” theoretically able to withstand volatility, but in reality, there are three structural problems:

1️⃣ LPs and traders are zero-sum opponents: LPs are the counterparty, and when the market trends one way, the pool is drained.

2️⃣ Quoting lag → arbitrageurs’ feast: AMM prices depend on the ratio of assets in the pool. When external markets move, AMMs don’t know until a trade occurs. Arbitrageurs spot the price difference and act immediately, “correcting the price” for the AMM while extracting LP value.

3️⃣ Capital tier confusion: Conservative LPs and yield-seeking LPs are in the same pool, with no clarity on who bears losses first. As a result, conservative funds dare not stay long, and TVL bleeds.

III. The Two Kings of the Industry: Hyperliquid and GMX

The Two Kings: Hyperliquid and GMX

Hyperliquid: The Limits of Speed and the Cost of ADL

Hyperliquid is currently the benchmark for on-chain order books. It has built its own Layer1 “HyperCore,” enabling high-frequency matching and low latency. The trading experience is nearly centralized, with ample depth and extremely fast speed. But speed is not free. Its liquidation mechanism has three layers: Market Liquidation: forcibly closing losing positions on the order book; Vault Intervention (HLP Intervention): when liquidity is insufficient, the vault takes over positions; ADL (Auto-Deleveraging): when the vault can’t hold, the system forcibly reduces the leverage of profitable positions. This makes Hyperliquid almost impossible to bankrupt, but the cost is: even if you are a winner, you may be passively deleveraged. The recent “1011” incident fully exposed Hyperliquid’s design flaw of sacrificing individual fairness for system fairness.

GMX: The Robust AMM Perpetual

GMX is a pioneer in the AMM perpetual field and currently the king of AMM Perp DEXs. The true era of AMM perpetuals began with GMX. It is not a follower, but a trailblazer—the GOAT 🐐 of this track.

GMX V2 brought decisive structural innovation: Isolated GM Pools: BTC risk belongs only to BTC, ETH risk only to ETH, meme volatility won’t drag down mainstream markets → AMM perpetuals say goodbye to “one loss, all lose” in the past;

Oracle-Mark pricing mechanism: no longer blindly trusting pool prices, but directly pegging to the real external market → arbitrageurs can no longer freely plunder LPs;

Continuous online liquidity: when order books go dark, AMMs become the “last line of execution.” GMX gave AMM perpetuals their value and place, proving they can be true market infrastructure—not a backup, but the mainstay.

But the current GMX design still faces two structural challenges we believe need to be addressed:

1️⃣ LP = market counterparty, trending markets → LPs continuously bleed, and TVL shrinks when the market needs it most. The market cannot rely on “luck” to survive cycles.

2️⃣ Risks are not tiered, conservative and high-risk funds bear the same loss priority. Institutions will only ask: “Why must I bear all market behavior risk?” → Unable to convince regulated funds and large-scale liquidity to participate → AMM perpetuals struggle to truly expand. Next comes the era of structural upgrades, which is where Honeypot Finance stands, and why we firmly believe the next leap in solutions is coming.

IV. Honeypot’s Innovation: Structurally Repairing the Fragility of AMM Perpetuals

When designing and breaking through existing AMM models, we focus on three things: risk must be tiered; trading and liquidation must be predictable; shocks must be isolated. To this end, we have introduced a complete structural upgrade:

1: LPs do not face the AMM directly. LPs deposit funds into ERC-4626 vaults of their chosen risk tier (junior, senior): Senior vault: fee priority, last to bear losses (institutional/conservative funds). Junior vault: first to bear losses, in exchange for higher returns (crypto-native style).

2: Vaults provide liquidity for the AMM’s “oracle-anchored price bands” (senior focuses on near bands, junior on far bands).

3: Traders execute against vault liquidity; large orders cross more bands → slippage and order size are linearly predictable, centered on the oracle mark price.

4: Funding rates and utilization are fine-tuned by the minute, so the crowded side pays more fees, and positions self-rebalance.

5: Market isolation: each trading pair has its own independent AMM, vault, limits, and liquidation logic, preventing cross-asset chain reactions.

We also solved the fairness issue present in Hyperliquid’s liquidation process. When events like 1011 occur—large volatility + concentrated liquidations + tight liquidity—Hyperliquid’s liquidation design ensures system safety, but winners have their positions cut at their most successful, sacrificing individual fairness and profit.

Our liquidation sequence: Honeypot liquidation sequence (Process Fairness)

1️⃣ Partial position reduction → lowering leverage instead of direct liquidation

2️⃣ Small-scale auctions → market-based risk transfer

3️⃣ Junior vault bears losses first → risk is voluntarily assumed

4️⃣ Insurance pool as backstop → avoids systemic shocks

5️⃣ ADL executed in small batches → truly a last resort

We first protect the system, and at the same time protect successful individuals. This is a combination of system fairness + process fairness. In Honeypot’s system: risk is voluntary, and victory can be retained. Our design first uses structure to safeguard the system, then protects successful individuals.

V. Horizontal Comparison of the Three Systems: Speed, Resilience, Trust

VI: Honeypot Finance Allows Every Market Participant to Perfectly Balance Return and Risk

In Honeypot Finance’s design, every role truly has its own place.

Crypto-native yield players: Junior Vault = using volatility as a source of return, risk is no longer hidden.

Institutions and compliant capital: clear drawdown boundaries, auditable ERC-4626 assets, can participate with peace of mind.

Traders: stable markets → CEX-level experience; volatile markets → predictable slippage and liquidation logic, profits will not be suddenly stripped away.

VII, Conclusion: Speed Represents Performance, Predictability Represents Trust

Hyperliquid → performance limits

GMX → structural pioneer

Honeypot → new baseline for resilience and trust

We do not pursue greater speed, we pursue non-collapse. When the market truly cares not about who has the lowest spread, but: when everything is falling, can you still execute trades? On that day, the new baseline for AMM perpetuals will be rewritten in Honeypot’s way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreBitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low

Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)