UiPath Leads in AI Automation While C3.ai Faces Challenges in Recovery

- UiPath (PATH) leads AI automation with 14% YoY revenue growth ($362M) and 11% ARR increase ($1.72B), driven by generative AI integration and 108% net retention. - C3.ai (AI) struggles post-leadership change, reporting $70.3M revenue (vs. $87.2M prior year), with analysts forecasting widening 2026 losses under new CEO Stephen Ehikian. - BigBear.ai (BBAI) surges 158.9% in six months via defense contracts and edge-computing partnerships, leveraging $170B homeland security funding. - Divergent strategies eme

UiPath, Inc. (PATH) remains a frontrunner in the AI automation industry, posting a 14% year-over-year jump in revenue to $362 million and an 11% increase in annual recurring revenue (ARR), reaching $1.72 billion, as noted in

Yet, the AI sector faces its share of volatility. C3.ai (AI), another significant contender, has encountered challenges following a change in leadership and a disappointing first-quarter earnings report, with revenue dropping to $70.3 million from $87.2 million a year earlier, according to

The differences among these companies reveal distinct approaches within the AI industry. UiPath’s comprehensive automation platform, which merges robotic process automation with artificial intelligence, delivers an all-encompassing solution for enterprise productivity, as previously highlighted. On the other hand, C3.ai’s focus on sector-specific AI tools and collaborations, such as its partnership with Microsoft, has not yet led to steady revenue expansion, as discussed in

These trends are mirrored in investor attitudes. UiPath’s shares are valued at a forward P/E of 21.42, below the sector average of 37.83, while BigBear.ai’s forward P/S of 19.17 represents a premium compared to rivals like C3.ai (7.93). However, C3.ai’s recent setbacks have widened the valuation gap, with its stock falling 49% year-to-date, in contrast to BigBear.ai’s 48.5% rise. Experts warn that both firms must prove their ability to deliver consistent results to support their valuations, especially as AI adoption gains momentum across industries.

The Ironman analogy for CEOs—equating AI ROI to a grueling race—emphasizes the importance of endurance. Just as athletes must blend strategy with persistence, organizations need to approach AI’s challenges with a long-term mindset. UiPath’s share buyback initiative and dedication to innovation embody this philosophy, while C3.ai’s restructuring efforts and BigBear.ai’s focus on defense contracts show the diverse strategies for AI-powered expansion. As the industry progresses, those who combine vision with unwavering execution—much like seasoned Ironman athletes—are poised to lead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pardon or Payment? Trump's Cryptocurrency Decision Ignites Discussion on the Influence of Lobbying

- Trump pardons Binance founder CZ after $740K lobbying, sparking scrutiny over crypto policy influence. - CZ’s 2024 prison sentence for AML violations led to a $4.3B settlement, now reversed by executive clemency. - Critics call it a "favor for crypto criminals," while analysts see relaxed U.S. crypto oversight boosting market confidence. - Trump’s pro-crypto stance includes disbanding enforcement teams, signaling regulatory shifts. - Binance’s $1M+ 2025 lobbying reflects ongoing efforts to rebuild trust

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

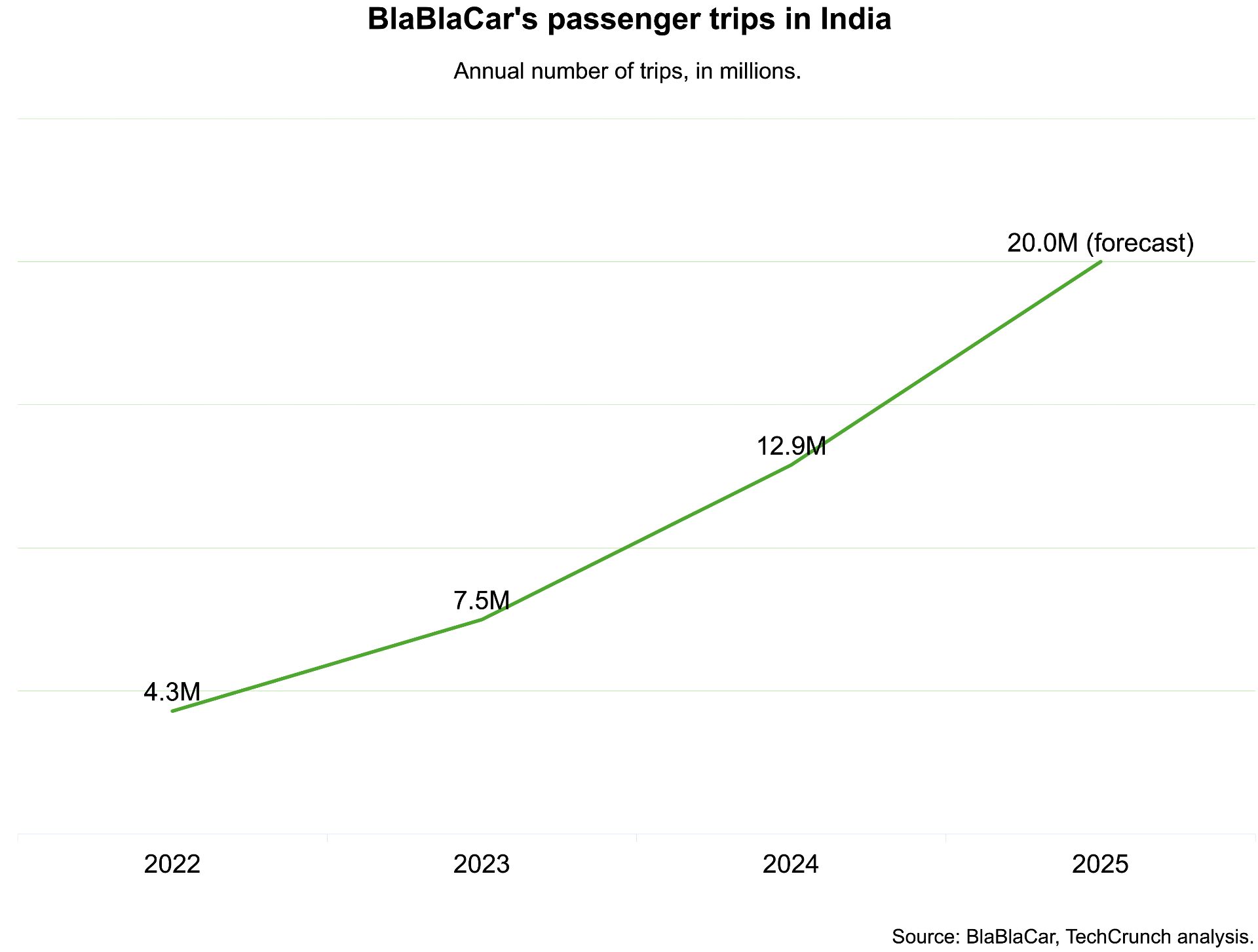

India, which BlaBlaCar previously exited, has now become its largest market