China and U.S. Reach Tentative Agreement in Trade Negotiations as Tariff Deadline Approaches

On October 26, Chinese and American trade representatives wrapped up economic and trade discussions in Kuala Lumpur, reaching an initial agreement to carefully tackle major concerns such as tariffs, export restrictions, and fentanyl oversight, according to Chinese Vice Premier He Lifeng and chief negotiator

These talks followed several months of rising friction, including U.S. tariffs on Chinese imports climbing to 155% and China’s countermeasures restricting vital minerals, according to a

These negotiations come as the 90-day pause on tariffs—agreed upon after a September 19 phone conversation between President Trump and President Xi Jinping—approaches its November 10 expiration,

Despite the ongoing tensions, American business executives remain guardedly hopeful about China’s 15th Five-Year Plan (2026–2030), which focuses on advanced development and modernizing industry, as highlighted in a

The discussions also covered wider geopolitical concerns, such as U.S. restrictions on advanced chip exports and China’s controls on gallium and germanium, which are vital for American defense and technology industries. Analysts have raised concerns about the potential market effects of these policies. Li Chenggang emphasized that China’s export rules “do not ban exports” and that applications meeting the requirements are approved, as reported by the

Experts warn that mutual trust is still fragile. Wang Wen of Renmin University pointed out that inconsistent U.S. policies—such as backtracking on earlier agreements—hinder progress, a point noted in China Daily’s coverage. Nevertheless, both countries seem intent on preventing a full-blown trade conflict, with Li stating that a stable economic partnership is beneficial “for both nations and the global community,” as reported by the Business Times.

The initial agreement now awaits approval within both governments. With Trump’s November 1 tariff deadline approaching, analysts predict continued volatility in commodity markets and supply chains. The results of the late October Trump-Xi summit and the U.S. reaction to China’s rare-earth policies will be crucial, according to China Daily.

At present, the Kuala Lumpur negotiations have provided a temporary pause, but significant obstacles remain on the path to a lasting solution.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pardon or Payment? Trump's Cryptocurrency Decision Ignites Discussion on the Influence of Lobbying

- Trump pardons Binance founder CZ after $740K lobbying, sparking scrutiny over crypto policy influence. - CZ’s 2024 prison sentence for AML violations led to a $4.3B settlement, now reversed by executive clemency. - Critics call it a "favor for crypto criminals," while analysts see relaxed U.S. crypto oversight boosting market confidence. - Trump’s pro-crypto stance includes disbanding enforcement teams, signaling regulatory shifts. - Binance’s $1M+ 2025 lobbying reflects ongoing efforts to rebuild trust

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

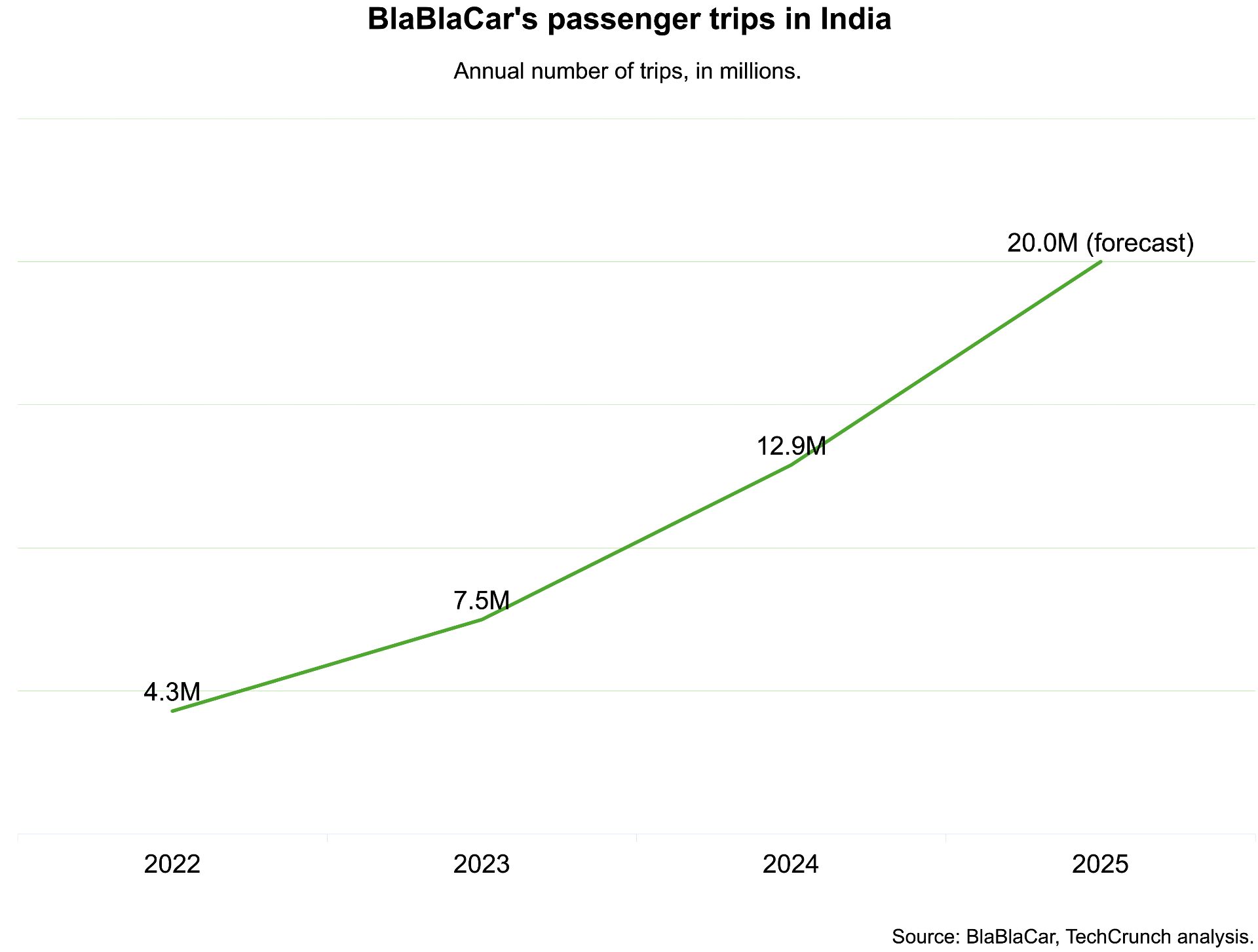

India, which BlaBlaCar previously exited, has now become its largest market