Nicolet’s Quarter-Century Commitment to Community Shows That Profit and Purpose Can Go Hand in Hand

- Nicolet Bankshares reported $42M Q3 2025 net income, up from $36M prior quarter and $33M in 2024, with 3.86% net interest margin and $223M core deposit growth. - CEO Mike Daniels emphasized community-focused banking philosophy, linking 25-year success to relationship-driven growth and shared value creation with stakeholders. - Analysts rank Nicolet in top decile of U.S. banks for returns, though "hold" rating reflects challenges like rising costs and evolving customer expectations. - Strategic share repu

Nicolet Bankshares, Inc. (NYSE: NIC) reported another record-setting quarter, posting net earnings of $42 million for Q3 2025. This marks an increase from $36 million in the previous quarter and $33 million in the third quarter of 2024, according to a

Mike Daniels, who serves as Chairman, President, and CEO of

The company’s financial performance underscores deliberate efforts to enhance its capital base and streamline operations. The Q3 2025 share repurchases lowered the number of shares outstanding, while the improved net interest margin highlights adept handling of interest rate trends. Industry experts observe that Nicolet’s return on average assets and return on average tangible common equity rank it among the top 10% of U.S. banks. Analysts continue to rate Nicolet’s stock as “hold,” with a median 12-month price target of $146, representing an 11.4% premium over its October 21 closing value.

Although Nicolet has achieved notable growth, it still contends with sector-wide issues such as increasing operational expenses and shifting customer demands. Nevertheless, Daniels’ focus on organic expansion and relationship-centric banking is seen as a key advantage in overcoming these obstacles. “We never aimed to go against the grain—we simply chose to stay true to ourselves,” he remarked, reaffirming the company’s dedication to its original mission.

The strong third-quarter results continue a trend of robust performance throughout the year. For Q3 2025, diluted earnings per share reached $2.73, up from $2.34 in Q2 and $2.10 in Q3 2024. Nicolet’s ability to combine profitability with investments in its communities has earned recognition from both investors and regulators, with its 25th anniversary highlighting its purpose-driven strategy.

As the banking sector undergoes ongoing changes, Nicolet’s commitment to its foundational principles and operational strength could provide a model for other banks seeking to balance financial success with social responsibility. Looking ahead, the company is expected to sustain its growth while adapting to broader economic shifts, a strategy that has already set it apart in a crowded marketplace.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pardon or Payment? Trump's Cryptocurrency Decision Ignites Discussion on the Influence of Lobbying

- Trump pardons Binance founder CZ after $740K lobbying, sparking scrutiny over crypto policy influence. - CZ’s 2024 prison sentence for AML violations led to a $4.3B settlement, now reversed by executive clemency. - Critics call it a "favor for crypto criminals," while analysts see relaxed U.S. crypto oversight boosting market confidence. - Trump’s pro-crypto stance includes disbanding enforcement teams, signaling regulatory shifts. - Binance’s $1M+ 2025 lobbying reflects ongoing efforts to rebuild trust

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

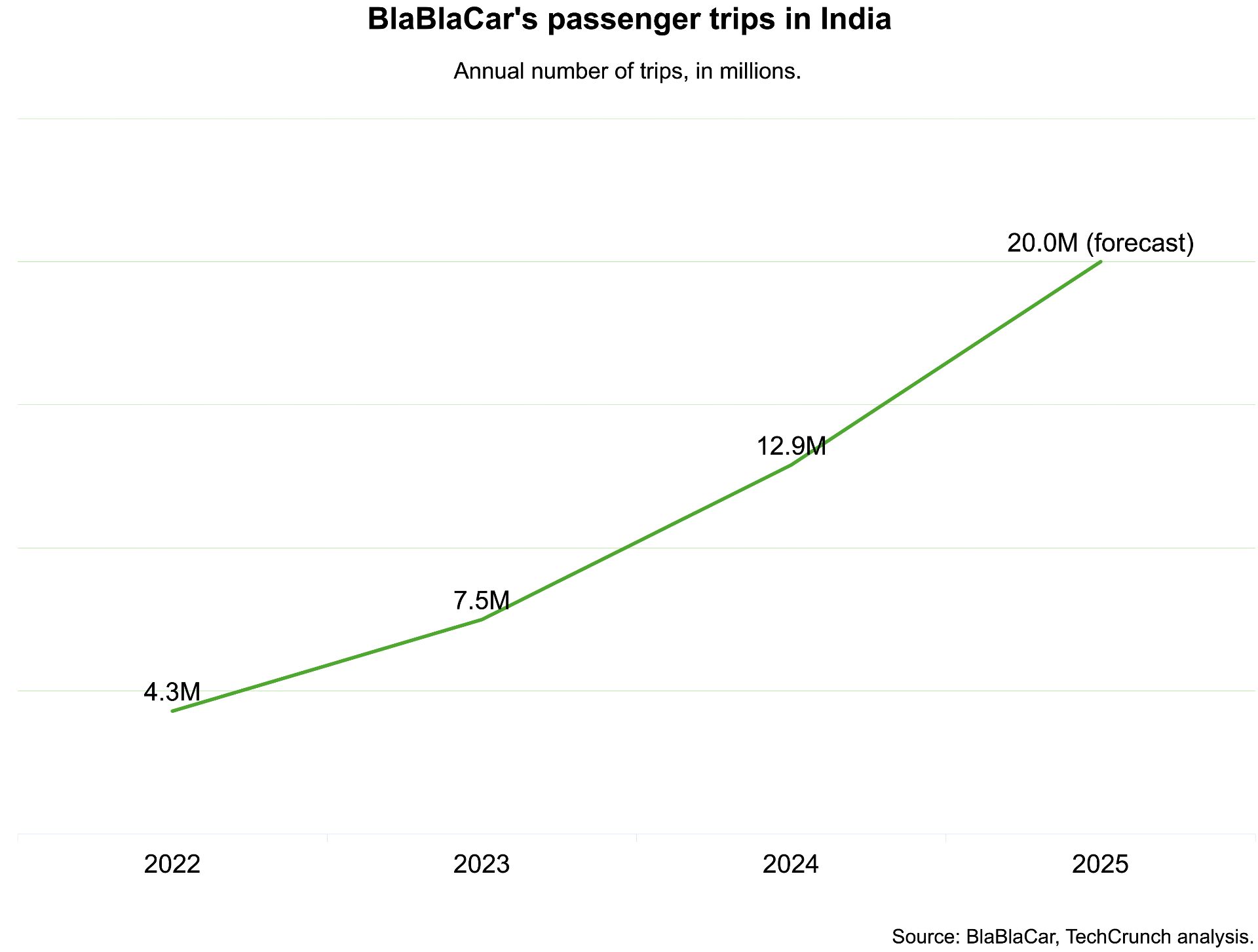

India, which BlaBlaCar previously exited, has now become its largest market